Have you ever wanted to set aside property for a specific purpose, like your children’s education, a charitable cause, or simply to protect family assets, but weren’t sure how to legally secure it? You’re not alone. In India, the legal tool for this is often a Deed of Trust.

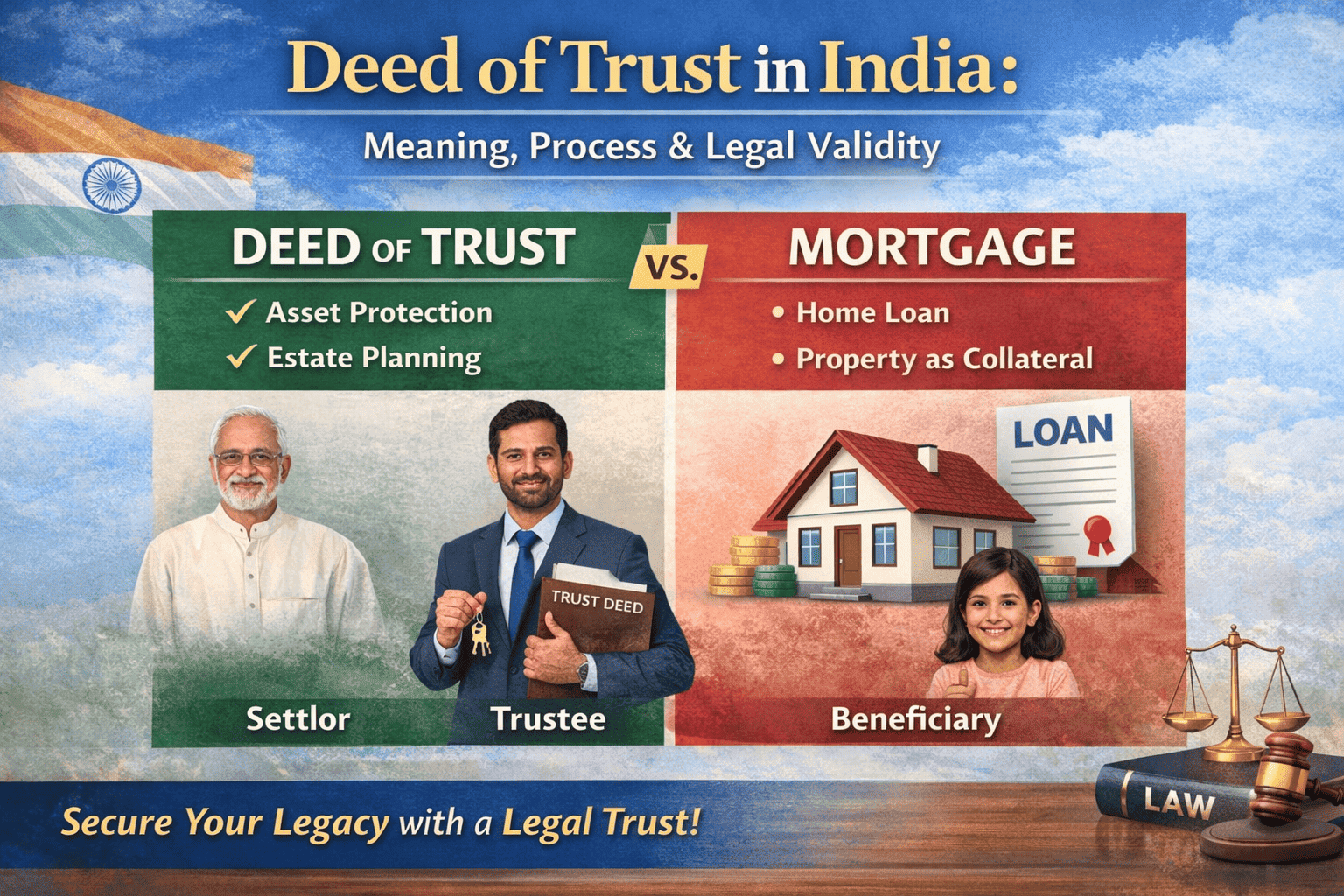

While the term “Deed of Trust” is frequently heard in real estate and financial discussions, it can be confusing because it means different things in different countries. In the US, it’s a way to secure a home loan. But here in India, under the Indian Trusts Act, 1882, it primarily refers to the document that establishes a “trust,” a powerful vehicle for asset protection and succession planning.

At TMWala, we believe in simplifying legal complexities so you can make informed decisions with peace of mind. Let’s break down exactly what a Deed of Trust is, how to register one, and why it’s not the same as a mortgage in India.

A Trust deed is a legal document that evidences the creation of a trust. It outlines the rules, rights, and obligations of all parties involved. View it just like the “blueprint” or guideline for your estate.

When you create a trust, you are essentially transferring your property to a trusted third party to manage for the benefit of someone else. The Deed of Trust puts this arrangement in writing to ensure it is legally binding.

Based on the Indian Trusts Act, 1882, a trust is a “duty attached to the possession of assets.”

This means the trustee is the legal owner of the property, but they cannot use it for themselves. They are legally obligated to use it solely for the benefit of the beneficiaries as per the instructions in the Deed of Trust. Without a written deed, there is no clear evidence of these obligations, which can lead to disputes later.

That remains one of the most frequent queries we receive. If you’ve been reading international finance blogs, you might think a Deed of Trust is a loan document. Let’s clarify the difference between a Trust deed and a mortgage.

| Feature | Deed of Trust (India) | Mortgage (India) |

| Primary Purpose | To set up a trust for estate planning, charity, or asset protection. | To secure a loan (like a home loan) using property as collateral. |

| Parties Involved | 3 Parties: Settlor, Trustee, and Beneficiary. | 2 Parties: Mortgagor (Borrower) and Mortgagee (Lender). |

| Ownership | Legal ownership transfers to the trustee. | Ownership remains with the borrower; the lender gets a “lien” or charge. |

| Governing Law | Indian Trusts Act, 1882. | Transfer of Property Act, 1882. |

Note: In corporate finance, you might hear of a “Debenture Trust Deed.” This is a specific type of deed used by companies to secure debts owed to many investors (debenture holders), where a trustee holds the security. However, for most individuals, a Deed of Trust refers to family or charitable trusts.

A well-drafted Deed of Trust acts as a safety net, preventing future confusion. While you can find a Deed of Trust example online, every trust is unique. Here are the essential clauses your deed must cover:

For a Deed of Trust for property (immovable property like land or a house) to be legally valid in India, registration is mandatory. Here is the step-by-step process:

A registered Deed of Trust is a public record. It provides:

1. What acts as the core objective of a Trust Deed?

It legally secures assets, outlines management rules, and ensures property is used strictly for beneficiaries like family or charity.

2. Is it mandatory to register a Trust deed in India?

Yes, for trusts involving immovable property (land/house), registration with the local sub-registrar is mandatory for legal validity.

3. What is the difference between a will and a trust?

A will distributes assets only after death; a Trust allows you to transfer and manage assets during your lifetime and after death.

4. Can a Trust deed be cancelled or revoked?

Yes, if the deed explicitly includes a revocation clause. Otherwise, it is generally irrevocable unless all beneficiaries consent.

5. How much does it cost to register a Trust deed?

Costs vary by state. You generally pay stamp duty based on the value of the property and a standard registration fee to the sub-registrar.

6. Who is eligible to be a trustee in India?

Any individual over 18 who is of sound mind and capable of holding property can be a trustee. Corporate bodies can also serve as trustees.

7. Can a trustee also be a beneficiary?

Yes, a trustee can be a beneficiary, provided they are not the sole trustee and the sole beneficiary of the same trust.

8. Can an NRI be appointed as a trustee?

Yes, an NRI can be a trustee. However, the trust’s operations must comply with FEMA regulations if foreign funds or assets are involved.

9. What happens if a trustee dies?

The Trust Deed should name a successor. If not, surviving trustees or a court can appoint a new trustee to ensure the trust continues.

10. Does a private family trust save taxes in India?

Not always. Private trusts are taxed at the maximum marginal rate unless specific conditions are met. Consult a CA for tax planning.

Creating a Deed of Trust is a powerful way to manage your assets and ensure your wishes are honored long into the future. Whether you are looking to secure your family’s financial future or start a charitable initiative, getting the paperwork right is the first step.

Don’t leave your legacy to chance. Drafting a watertight Deed of Trust requires precise legal language. At TMWala, we specialize in simplifying business and legal compliance.

Need help drafting or registering your Deed of Trust?

Reach out to our experts at TMWala.com for a consultation. We’re here to make legal processes fast, transparent, and hassle-free for you.

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

"*" indicates required fields

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy