A Show Cause Notice (SCN) is the foundation of any adjudication process under the Goods and Services Tax (GST). It is the very first step where the department alleges short-payment, non-payment, wrongful availment of Input Tax Credit (ITC), or other violations, and calls upon the taxpayer to explain why tax, interest, or penalty should not be levied.

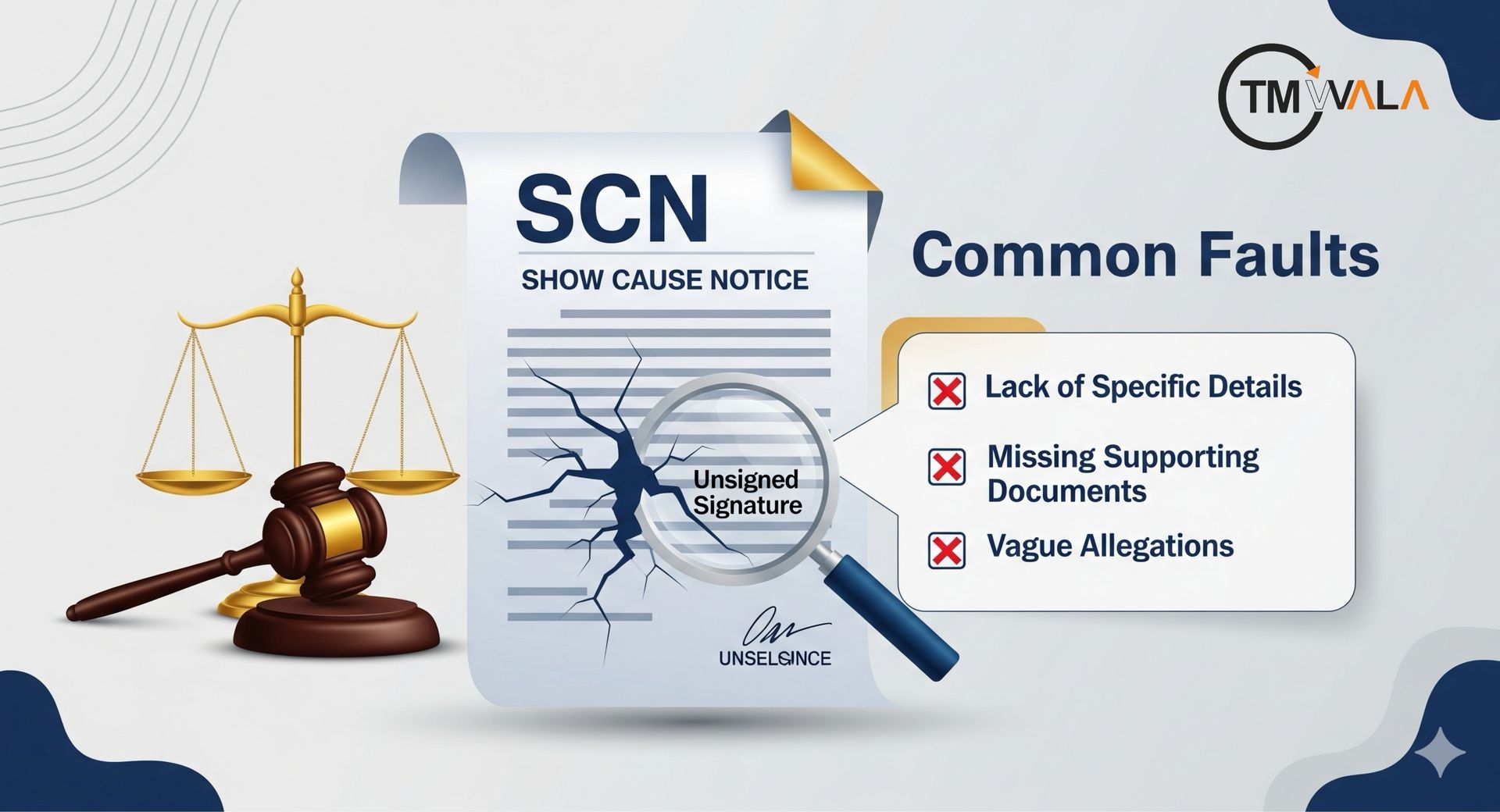

On paper, this seems straightforward: issue a notice, provide reasons, and allow the taxpayer to reply. However, in practice, many SCNs fall short of legal standards. They may be vague, unsigned, unsupported by evidence, or issued without following the mandatory procedure. Courts across India have consistently held that such defects are not “technicalities” and they go to the very root of jurisdiction and render the proceedings void.

One of the most common faults in SCNs is the absence of fundamental details. A notice alleging non-compliance, without spelling out the specific facts, the quantification of demand, or the evidence relied upon, does not give the taxpayer a fair chance to defend themselves.

The Hon’ble Gujarat High Court in Arcelormittal Nippon Steel India Ltd. v. Assistant Commissioner [2021-VIL-840-GUJ] held that a SCN lacking fundamental details violates the principles of natural justice, because here the assessee is deprived of an opportunity to defend themselves. The Hon’ble Apex Court in METAL FORGINGS VERSUS UNION OF INDIA – 2002 (11) TMI 90 – SUPREME COURT, wherein the Hon’ble Apex Court made the following observations in the judgement: “Issuance of a show cause notice in a particular format is a mandatory requirement of law.

The law requires the said notice to be issued under a specific provision of law and not as a correspondence or part of an order.”Thus, any notice or order lacking specific, disclosed evidence is procedurally flawed and cannot sustain demand proceedings.

The Supreme Court in CCE v. Brindavan Beverages (P) Ltd. [2007 (213) ELT 487 (SC)] reiterated that an SCN must adhere strictly to statutory requirements. An informal letter or vague communication cannot substitute a valid notice.

Takeaway: An SCN should be clear and independent, providing the taxpayer with an adequate opportunity to respond.

The format of an SCN is not optional. Circular No. 1053/02/2017-CX lays down a prescribed format comprising the legal provisions cited, factual scenario, documents relied upon, quantification of demand, and rationale. Departure from this format has been rejected in several cases. For instance, in Amrit Foods v. CCE [2005 (190) ELT 433 (SC)] and Royal Oil Field Pvt. Ltd. v. UOI [2006 (194) ELT 385 (Bom.)], the courts held that a defective SCN cannot sustain proceedings.

Takeaway: A properly structured SCN is a statutory necessity, not a departmental formality.

Another common issue is when SCNs merely reproduce the text of the law without explaining how it applies to the taxpayer’s case.

The Gujarat High Court in Aggarwal Dyeing and Printing Works v. State of Gujarat [(2022) 4 TMI 864] observed that an SCN without reasons amounts to a denial of opportunity and cannot be sustained.

Similarly, the Telangana HC in Nice Enterprises v. Deputy Commissioner ST and M/s Rayees Metals v. Dy. STO [2024] held that a vague SCN, without facts or evidence, violates natural justice.

The courts also relied on Canara Bank v. Debasis Das [(2003) 4 SCC 557] and Rajesh Kumar v. CIT [287 ITR 91 (SC)], emphasizing that copy-pasting provisions of law is not enough.

Takeaway: Allegations in an SCN must be backed by facts and evidence, not just bare sections of the Act.

An SCN must be authenticated with a proper digital signature. Courts have repeatedly quashed unsigned or unauthenticated notices.

The Bombay HC in Ramani Suchit Malushte v. Union of India (W.P. 9331/2022) held that an unsigned order is invalid and unenforceable. Likewise, in Marg ERP Ltd. v. Commissioner of DGST and Railsys Engineers Pvt. Ltd. v. CGST, unsigned notices were struck down.

Takeaway: The unsigned SCN is not just some curable flaw, but it is void ab initio.

The Supreme Court in Pradeep Goyal v. UOI [TS-396-SC-2022-GST] reiterated that all communication under tax administration should bear a Document Identification Number (DIN) to maintain transparency and traceability. An SCN, if devoid of an effective DIN or RFN, is defective and likely to be quashed.

Takeaway: Always make sure your SCN bears either a valid DIN/RFN, because its absence makes it invalid.

Section 75(4) of the CGST Act requires the adjudicating authority to offer a personal hearing if it is asked for, or where a negative order is being contemplated.

In M/s Haarine Associates v. Assistant Commissioner (ST) (2024), the Madras HC quashed an order in which the department disregarded a taxpayer’s hearing request. The court held this to be a flagrant denial of natural justice.

This doctrine follows from the historic ruling in Maneka Gandhi v. UOI [(1978) 1 SCC 248], in which the Supreme Court has stated that withholding of the opportunity to be heard renders proceedings invalid

Takeaway: A personal hearing is not a courtesy, but it is a statutory right.

If the department relies on documents (invoices, statements, reports, etc.), copies must be furnished to the taxpayer.

The Karnataka HC in UOI v. Lampo Computers Pvt. Ltd. [2014 (305) ELT 215 (Kar.)] held that failure to share relied-upon documents is a clear violation of natural justice.

Similarly, the Andhra Pradesh HC in M.R. Metals v. Deputy Commissioner quashed an order where documents forming the basis of the demand were withheld.

Takeaway: Without disclosure of evidence, the taxpayer cannot defend themselves, thus making the SCN unsustainable.

The GST scheme envisages early resolution through pre-notice intimations such as ASMT-10 and DRC-01A if the said matter calls for it. However, many officers bypass this stage and directly issue SCNs. Courts have observed that this deprives taxpayers of an opportunity to clarify or settle issues before escalation.

Some may dismiss these issues as “technical defects.” But courts have been clear: defects in SCNs strike at the very jurisdiction of the authority. A defective SCN cannot be cured by later proceedings because the very foundation is flawed.

Ultimately, these safeguards are not for the department; they exist to protect taxpayers. They ensure that no one is penalized without being told exactly what they are accused of, on what evidence, and given a fair chance to respond.

The practical effect for taxpayers is evident. Each SCN is subject to close examination. If it is not clear, if it is not signed, if it does not contain the DIN, if it does not include relied-upon documents, or if it refuses a hearing, these are not technical omissions but bases upon which the notice itself can be questioned. An invalid SCN is no SCN at all, and proceedings based on a notice of such invalidity have no legal force. Being aware of these rules empowers the taxpayers to safeguard their rights and to demand due process before any liability is attached to them.

Thus, to be valid, an SCN must:

From Arcelormittal Nippon Steel (2021) to Haarine Associates (2024), courts have consistently quashed vague, unsigned, or procedurally defective SCNs as violations of natural justice. For taxpayers, the message is clear: scrutinize every SCN. If it suffers from these defects, challenge it because a defective SCN is no SCN at all.

Author Details– Apoorva Lamba (3rd Year Student, Madhav Mahavidyalya, Jiwaji University, Gwalior)

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

"*" indicates required fields

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy