Your customer pays ₹500 via UPI. The money gets into your account. Simple. But then you open your payment gateway dashboard at the end of the month and find a line item asking, “Is there GST on UPI payment?” You were told UPI is free. So what exactly are you paying? This confusion trips up […]

When a business decides to discontinue operations and cancel its GST registration, the compliance journey does not end with cancellation. One of the most critical post-cancellation obligations is filing the GSTR-10 return, commonly referred to as the GSTR-10 final return. This return formally concludes the taxpayer’s responsibilities under GST and ensures that all outstanding liabilities […]

The concept of place of supply under GST is the backbone of India’s Goods and Services Tax framework. Since GST is a destination-based tax, revenue accrues to the state where goods or services are actually consumed, not where they originate. This makes determining the correct place of supply essential for identifying the nature of the […]

Commission and brokerage arrangements are an integral part of modern trade and commerce in India. From real estate brokers and insurance agents to export facilitators and marketing representatives, intermediaries play a crucial role in connecting buyers and sellers and enabling smooth business transactions. However, with the implementation of the Goods and Services Tax (GST) regime, […]

The Goods and Services Tax (GST) transformed India’s indirect taxation system by replacing multiple state and central taxes with a unified structure. While the GST framework is broadly consistent across the country, its implementation varies in Union Territories due to their distinct administrative setup. This is where UTGST (Union Territory Goods and Services Tax) plays […]

Under the GST regime, businesses are generally required to issue a tax invoice when supplying taxable goods or services. However, there are specific situations where a tax invoice cannot be issued. Instead, the seller must issue a bill of supply under GST. This document serves as proof of a tax-free transaction and is particularly relevant […]

What is a GST number? Why does it matter for every business operating in India? Under the Goods and Services Tax (GST) regime, a GST Registration Number, commonly known as GSTIN, acts as the official identity of a registered taxpayer. Whether you are a startup, freelancer, MSME, or a large enterprise, knowing the GST number […]

The introduction of Goods and Services Tax (GST) significantly transformed India’s indirect tax system by bringing uniformity and transparency. One of the key compliance mechanisms introduced specifically for the digital economy is TCS under GST. With the rapid growth of online marketplaces and digital platforms, the government needed a way to track transactions carried out […]

The implementation of the Goods and Services Tax (GST) has brought uniformity to indirect taxation in India, while also introducing a structured compliance framework for taxpayers. One of the most important obligations under this framework is the GSTR-3B return. This return acts as a summary declaration of a taxpayer’s GST liability and input tax credit […]

The Goods and Services Tax (GST) framework in India relies heavily on digital processes to ensure transparency, efficiency, and accountability. One of the most important identifiers generated within this system is the ARN number in GST. Whether you are applying for GST registration, submitting an amendment, or responding to a departmental notice, this number acts […]

Running a business is never static. Addresses change, partners are added, contact details are updated, and sometimes even the structure of the business evolves. Since GST registration acts as the official identity of a business under Indian tax law, all details reflected on the GST portal must remain accurate and current. The Government of India […]

The Reverse Charge Mechanism under GST is a key feature of India’s Goods and Services Tax system. Unlike the normal GST process, where the supplier pays tax, RCM under GST shifts the tax payment responsibility to the recipient (buyer). This system is vital for capturing tax from unorganized sectors and ensuring proper taxation of specific […]

Starting a business in India comes with several legal and regulatory responsibilities, and one of the most critical steps for any new entrepreneur is GST registration for a new business. The Goods and Services Tax (GST) is a comprehensive tax system that replaced multiple indirect taxes in India, simplifying tax compliance and ensuring smoother business […]

Mobile phones have become indispensable in modern life, supporting communication, digital payments, education, remote work, and business operations. With smartphones now acting as productivity tools rather than mere communication devices, understanding their tax treatment under GST is crucial for individuals, businesses, retailers, and importers alike. Following the GST 2.0 reforms, the Indian government simplified the […]

The diamond and jewellery industry is one of India’s most valuable export-driven sectors, contributing significantly to employment, foreign exchange earnings, and global trade leadership. Given the high value and intricate supply chain involved in diamonds from mining and import to cutting, polishing, and retail taxation, this sector demands clarity and precision. The introduction of the […]

The introduction of electronic invoicing has marked a significant milestone in India’s indirect tax framework. The GST e-invoice system has been implemented to enhance transparency, ensure standardization, and reduce tax evasion. At the core of this system lies the Invoice Reference Number, commonly referred to as IRN. Understanding the concept, generation, and applicability of IRN […]

Navigating indirect taxes on technology products can feel complex, especially when rules evolve and classifications change. In India, laptops are essential tools for education, work, and business operations, which makes understanding their tax treatment extremely important. With the introduction of GST 2.0 reforms effective from 22 September 2025, the government streamlined the GST structure into […]

Shipping goods across India? Dealing with logistics can feel complicated, but getting your documentation right doesn’t have to be. If you are moving goods, the E-Way Bill is your digital passport for smooth transit. It ensures your consignments move without highway hiccups, penalties, or delays. Whether you are a business owner, transporter, or tax professional, […]

Televisions remain one of the most commonly purchased electronic items in India, both for household and commercial use. While buyers often focus on features such as display quality, size, and smart functionality, taxation plays a crucial role in determining the final price. Under India’s Goods and Services Tax framework, televisions are taxed at a uniform […]

Understanding the GST rate for food items is essential for households, retailers, manufacturers, restaurants, and food service businesses in India. Food is a daily necessity, and even a small change in tax rates directly impacts consumer prices and business margins. With the introduction of GST 2.0 reforms effective from September 22, 2025, the Goods and […]

If there’s one thing Indians never stop discussing, it’s food, where to eat, what to order, and how much it costs. And a big part of that cost is the GST on restaurant bill, something most people notice only when the final total looks a little higher than expected. With the GST Council’s 56th meeting […]

The introduction of the Goods and Services Tax (GST) stands as one of the most significant indirect tax reforms in India, aiming to unify the nation under a simplified, transparent, and efficient tax structure. This reform changed how the country perceived and administered indirect taxation, replacing a complex web of central and state taxes. To […]

The GST framework in India has undergone a significant transformation, effective from 22 September 2025. One of the most notable changes concerns the GST Compensation Cess, a levy originally introduced to protect state revenues during the transition to the Goods and Services Tax regime. With the latest policy updates, the cess has been removed for […]

In the Goods and Services Tax (GST) system, accurate reporting and consistency are crucial for efficient tax administration. UQC full form in GST is one of the important tools that facilitate this is the Unique Quantity Code (UQC). UQC is a measuring quantity under the GST system for standard use by all taxpayers. Its application […]

Since the rollout of the Goods and Services Tax (GST), the tax structure for the construction sector has undergone substantial restructuring. Previously, construction activities attracted multiple taxes such as VAT, excise duty, and service tax. With GST in place, these fragmented levies have been consolidated, resulting in a more uniform and transparent framework. However, despite […]

Beginning November 1, 2025, India will introduce a major improvement to the GST enrolment framework as part of the wider GST 2.0 reforms. A new GST registration auto-approval system will allow most applicants to receive their registration within three working days, significantly reducing the usual waiting period. This initiative, endorsed by the GST Council, aims […]

INTRODUCTION India’s commitment to a transparent, digital-first taxation ecosystem took a significant leap forward in April 2025 with the official rollout of the Invoice Management System GST. Months into its implementation, the IMS is already redefining how businesses across sectors manage GST invoices, claim Input Tax Credit (ITC), and ensure real-time compliance. Designed as a […]

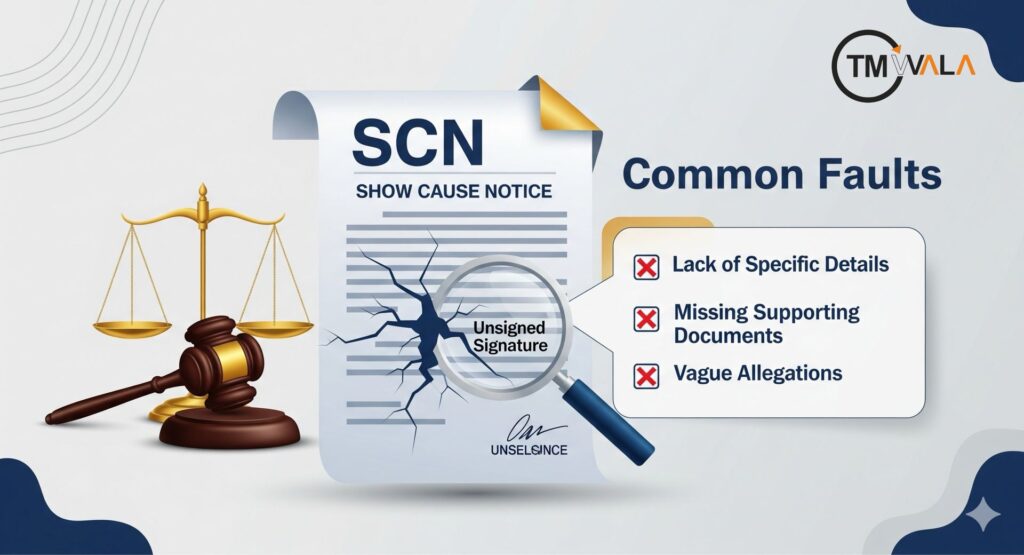

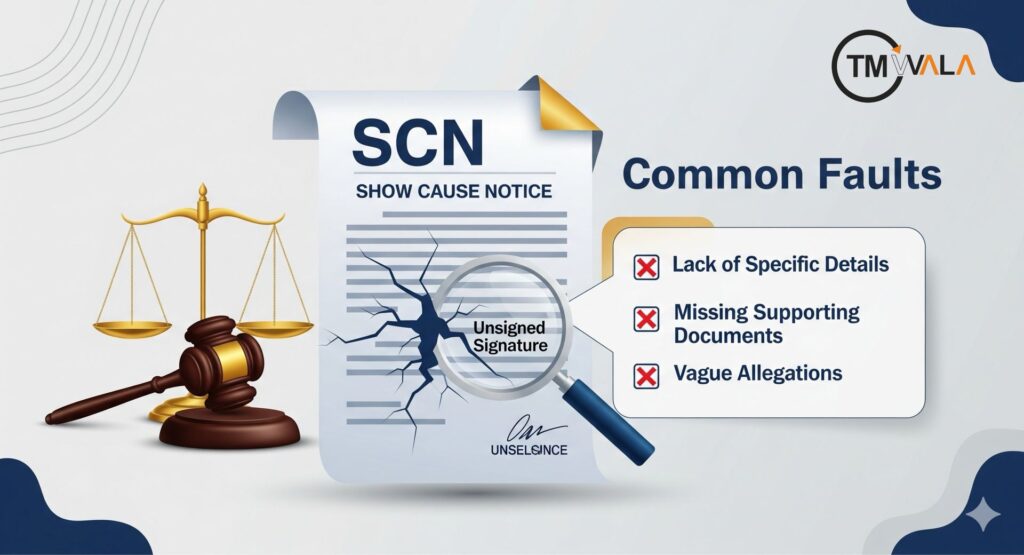

A Show Cause Notice (SCN) is the foundation of any adjudication process under the Goods and Services Tax (GST). It is the very first step where the department alleges short-payment, non-payment, wrongful availment of Input Tax Credit (ITC), or other violations, and calls upon the taxpayer to explain why tax, interest, or penalty should not […]

INTRODUCTION In a major step toward simplifying India’s taxation landscape, the GST Council, under the leadership of Finance Minister Nirmala Sitharaman, has introduced a revamped structure of the Goods and Services Tax, popularly termed GST 2.0. Effective September 22, this overhaul significantly rationalises tax slabs and aims to strike a delicate balance between economic stimulation […]

One of the biggest promises of the GST regime from 2017 in India was the concept of “seamless flow of input tax credit” (ITC). It simply means that businesses could claim credit for the taxes they already paid on their purchases or inputs, and use that credit to offset the tax payable on their sales […]

Navigating the Goods and Services Tax (GST) system can be intimidating, particularly when you receive an impending Show Cause Notice (SCN) on your portal. So, understandably, the right to a personal hearing is one of your most significant rights as a taxpayer during this process. Personal hearings are more than just formalities; they are your […]

INTRODUCTION Goods and Services Tax (GST) compliance is a critical aspect of running a business in India. While it aims to streamline the taxation system, its practical implementation has posed challenges for businesses of all sizes. Multiple monthly filings, complex return structures, and system-driven validations often result in errors, especially for small and medium enterprises […]

INTRODUCTION GSTR 9C is a crucial compliance form under the Goods and Services Tax (GST) regime in India. It is a reconciliation statement filed annually by taxpayers whose turnover exceeds a specified limit. This form reconciles the details declared in GSTR-9 (Annual Return) with the audited financial statements of the taxpayer for the relevant financial […]

INTRODUCTION The GST Compensation Cess is crucial as it helps ensure fair revenue distribution among Indian states after the launch of GST. It is a special kind of tax imposed on specific goods and services, especially those related to luxury. The amount collected is used to compensate states for any revenue loss caused by GST […]

INTRODUCTION The GST return filing rule changes from July 2025 bring significant shifts in compliance requirements for businesses across India. Major updates include the GSTR-3B Auto-lock, strict 3-year GST return filing limit, late GST return penalty 2025and classification of time-barred GST returns. The introduction of e-way bill 2.0 ensures smoother logistics, while broader GST return […]

Introduction Form GSTR-9 is the annual return under GST law that must be filed by registered taxpayers who operate as regular taxpayers, including SEZ units and SEZ developers. It consolidates the details of outward and inward supplies, input tax credit, tax paid, and other related activities for a financial year. This return acts as a […]

“From the treasury comes the power of the government, and the Earth, whose ornament is the treasury, is acquired by means of the Treasury and Army.” -Kautilya (Arthasastra) INTRODUCTION TO GST 1.1 Background and Evolution of Indirect Taxes in India Prior to the advent of the Goods and Services Tax (GST), India’s indirect tax regime […]

In India, GST registration for a Private Limited Company is important if its revenue surpasses ₹40 lakhs for goods and ₹20 lakhs for services, or if it does e-commerce or interstate transactions. The Aadhaar and PAN cards of each director, corporate photos, the Certificate of Incorporation, the Letter of Authorization, and evidence of the primary […]

INTRODUCTION The GST Amnesty Scheme 2024 introduced as an opportunity for the businesses and taxpayers as it will help in regulating their tax filling without the risk of penalties and interest. It helps in GST late fee waiver and work as GST interest waiver scheme. The scheme has been introduced under section 128 of the […]

INTRODUCTION With the implementation of the Goods and Services Tax (GST) in India, the taxation system has become more streamlined, impacting various sectors, including the stationery industry. GST on stationery items has introduced transparency and uniformity, but frequent rate revisions require businesses and consumers to stay informed. The GST rate for stationery items varies based […]

INTRODUCTION GST has completely changed the way businesses in India function. It endeavours to streamline the system of taxation, but several businessmen still find it confusing to decode and adhere to its various precepts correctly. Keeping up-to-date with the latest GST Laws is vital for every business owner in 2025. Failure to maintain GST practice management can result […]

INTRODUCTION The Goods and Services Tax (GST), which took effect in India from 2017, has swept away huge structural changes to the landscape of indirect taxation. GST adjudication lifecycle consists of various stages, starting from detection of anomalies to investigations, to the issuance of SCNs adjudication and appeals. There are legal processes that manage each stage to guarantee […]

Abstract: In this article, we will discuss the impact of Goods and Services Tax (GST) on gold in India, GST rates on gold, GST on old gold exchanges, GST on sovereign gold bonds, etc. As gold holds a significant place in Indian culture and investment portfolios, it becomes crucial to know how GST affects its pricing and […]

Securing appropriate Business Registrations in India is extremely important for all businesses whether big or small in order to stay compliant with laws, take advantage of benefits offered by government and to avoid future legal penalties. Two such important Business Registrations in India are GST Registration and Udyam Registration, commonly referred to as MSME (Micro, […]

The Goods and Services Tax (GST) 2017, has ushered in substantial changes to the Indian real estate industry today. These changes are impacting land transactions as whole, but also sale of developed plots, completed houses, and townships. Comprehending these implications is important for all developers, investors, and buyers. In order to comply with taxation and […]

The rollout Goods and Services Tax (GST) has shaken up how the pharmaceutical industry in India handles taxes. When GST kicked off on July 1, 2017, and it took the place of several indirect taxes like VAT, Excise Duty, and CST setting up a single tax system under the government’s vision of One Nation, One […]

With the rollout of the Goods and Services Tax (GST) in 2017, various Indian industries have experienced significant shifts in the way they are taxed. The essential food products, including atta (wheat flour) and other grains, have experienced these said shifts as well. Although the government has left the essential food staples out of GST, […]

In the ever-evolving landscape of the Indian business world, the taxation policies and intellectual property rights often intersect at varied points impacting the way businesses manage their assets. One such critical intersection is between the GST and Financial Year and trademark registration. While GST affects some very integral aspects of business operations, its impact on […]

Unlock the power of Input Tax Credit (ITC) to reduce your GST liability and boost cash flow efficiency for your business. Learn how ITC works, the steps to claim it, and common pitfalls to avoid, ensuring compliance with GST regulations while maximizing financial benefits

Discover how GST affects hospitality, banquet, and catering services this wedding season. Learn about GST rates on hotel bookings, banquet halls, and catering services, including tips on managing costs, avoiding tax surprises, and understanding Input Tax Credit (ITC). Stay informed about the GST rates for weddings and ensure your special day stays within budget.

Learn the basics every entrepreneur should know about GST and GST Returns (GSTR). This guide covers the different types of GST (CGST, SGST, IGST), key forms like GSTR-1, GSTR-3B, and GSTR-9, and practical tips to stay compliant. Understand how GST impacts cash flow, Input Tax Credit (ITC) claims, and legal consequences of non-compliance, helping you manage your business tax obligations effectively.

Discover the Reverse Charge Mechanism (RCM) under GST law with our comprehensive beginner’s guide. Learn how RCM shifts tax responsibility from suppliers to recipients, its application on goods and services, compliance tips, and ways to maximize your Input Tax Credit (ITC). Simplify your GST understanding today!

GST registration is essential for businesses to comply with Indian tax laws. This article offers a comprehensive guide to the Goods and Services Tax (GST) registration process, its benefits, and the penalties for non-compliance. Learn how to register your business, the necessary documents, and step-by-step instructions for completing the application. Whether you are a small business, startup, or established company, understanding GST registration is crucial for claiming input tax credits, staying tax compliant, and avoiding hefty fines. Discover common mistakes to avoid during the registration process and answers to frequently asked questions (FAQs). Start your GST registration journey today and unlock the full benefits for your business.

Unlock the full potential of your business with GST Registration! Enjoy simplified tax compliance, massive cost savings through Input Tax Credit, and seamless interstate trade. GST Registration boosts credibility, avoids penalties, and sets your startup up for rapid growth and success. A must-have for any business aiming to scale efficiently!