₹2,000.00 Original price was: ₹2,000.00.₹1,599.00Current price is: ₹1,599.00.

If you’re a business owner looking to expand globally, you’ve probably come across the term Import Export Code (IEC). This seemingly small yet powerful code opens up a world of opportunities for your business by allowing you to legally engage in cross-border trade. But what exactly is IEC, and why should it matter to you? Let’s dive into the basics of IEC and uncover why it’s such an essential part of your business’s growth strategy.

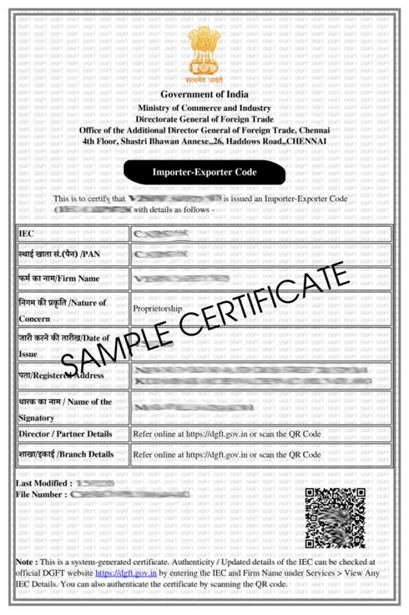

The Import Export Code, or IEC, is a unique 10-digit code issued by the Directorate General of Foreign Trade (DGFT) in India. Think of it as your business’s passport to international trade. Without an IEC, businesses in India cannot legally import or export goods or services. This simple code is your ticket to accessing new markets, connecting with international customers, and, ultimately, scaling your business beyond domestic borders.

Why a unique code, you might ask? The purpose is to identify your business in the global trade landscape. When you register for an IEC, your business is officially recognized as an entity in import-export operations. It’s like being given a pass to join a global trade community, filled with countless growth opportunities. And while the term IEC registration might sound complicated, it’s actually quite straightforward once you know the basics.

IEC isn’t just for large corporations; it’s also a fantastic tool for small businesses looking to grow. For small and medium enterprises (SMEs), the international market is filled with potential. But entering it without proper registration can lead to penalties, fines, or simply being denied trade opportunities. That’s where IEC comes in. By registering for an IEC, even small businesses can stand shoulder-to-shoulder with industry giants, exporting and importing goods legally and with confidence.

Many small businesses find that IEC registration opens the door to various government schemes and incentives, which can be a big help in reducing operational costs. For instance, with IEC, you might be eligible for tax exemptions or even subsidies, which means more money saved and more resources to grow your business. These benefits can make a big difference, especially for businesses operating on tight budgets.

The Import Export Code (IEC) is often seen as something only big businesses need. But if you’re a small business owner, don’t overlook the powerful benefits of having an IEC. This unique code can open up doors to global trade, boost your credibility, and even save you money! Let’s dive into the essentials of why IEC is so valuable for small businesses and why you should consider getting one today.

Simply put, if you want to do business internationally, IEC is a must-have. Without it, you miss out on incredible opportunities to grow your brand and increase your revenue by reaching customers across the world. Imagine your products being available not just in your home country but in cities and towns around the globe—that’s the magic IEC can bring to your business.

Having an IEC isn’t just a requirement; it’s a badge of credibility. When you engage in international trade with an IEC, suppliers, customers, and partners will see your business as legitimate and trustworthy. This sense of trust can make it easier to establish connections and negotiate favorable terms with international clients and suppliers. And since compliance is a major concern in international trade, having an IEC shows that your business follows all necessary rules and regulations.

One of the biggest benefits of IEC is that it gives small businesses a chance to sell internationally. Imagine your products being available to customers across the globe! With an IEC, you can legally export your products to other countries, expanding your reach far beyond your local market. This means a larger customer base, more sales opportunities, and ultimately, more revenue.

Whether you’re selling handmade crafts, clothing, or tech gadgets, there’s a global market waiting for your products. And while the idea of selling internationally might sound daunting, having an IEC is the first step that makes the process legitimate and smooth. Plus, with the rise of online marketplaces, it’s easier than ever to reach buyers worldwide. An IEC helps you tap into these markets and grow your business in ways you might not have thought possible.

Another incredible perk of getting an IEC is the potential tax benefits that come along with it. For small businesses, these savings can make a big difference. Many governments offer tax exemptions or reductions on certain imports and exports, and an IEC is often required to claim these benefits. In some cases, you might even be eligible for government incentives designed specifically to support export activities.

For example, under certain government schemes, businesses that export goods may be exempt from paying GST on their exports. This can add up to significant savings, allowing you to keep more profit in your pocket. With these benefits, small businesses can operate more efficiently and use their resources to scale up or improve their operations. When every penny counts, the tax savings from an IEC can be a major advantage.

An IEC is more than just a code—it’s a sign that your business is legitimate and trustworthy. When you’re dealing with customers or suppliers from another country, having an IEC assures them that your business is compliant with government regulations. This can make them feel more comfortable working with you, which is especially important if you’re new to the international scene.

Building credibility is key to growing any business, and this is even more true in global trade. With an IEC, your business becomes more attractive to international clients who might otherwise hesitate to engage with a small or new business. It shows that you’re serious, professional, and prepared to handle cross-border transactions. So, while it may seem like a simple code, IEC goes a long way in building trust and establishing strong partnerships.

The government often offers support to businesses that are involved in exporting goods, and having an IEC can give you access to these programs. These schemes are designed to encourage small businesses to engage in international trade, making it easier and more affordable. Some common incentives include subsidies, export promotion schemes, and reduced tariffs on imported goods.

By registering for an IEC, you may become eligible for these incentives, which can provide financial relief and help your business compete internationally. Whether it’s a rebate on certain goods or a loan with lower interest rates, these incentives can boost your business’s profitability. In some cases, the financial support can be the nudge that enables a small business to take its first steps into the global market.

Here’s another reason why IEC is essential: it’s surprisingly easy to obtain, and once you have it, it’s valid for a lifetime! Unlike some other registrations that require regular renewals and maintenance, an IEC doesn’t need to be renewed every few years. This means that once you go through the simple application process, you’re set for the foreseeable future.

The application process for an IEC is now mostly online, making it accessible to everyone, even small business owners with limited resources. All you need are some basic documents—like a PAN card, bank details, and a proof of address—and you’re on your way to getting your IEC. With no need for renewals, you can enjoy the benefits of global trade without worrying about constant paperwork.

For many small business owners, scaling up can be a real challenge. Local markets can only take you so far, especially if there’s a lot of competition. But with an IEC, the possibilities are virtually endless. You’re no longer limited to the local economy; you can explore markets in other countries where demand might be even higher.

Small businesses that take the leap into international trade often find that their growth accelerates. Exporting goods can also bring new insights, as you’ll get a better understanding of customer needs in different regions. This can help you refine your product, improve your processes, and ultimately build a more successful business.

As a small business with an IEC, you can benefit from favorable trade policies between countries. Many nations have trade agreements that reduce tariffs or offer other benefits for importing and exporting goods. With an IEC, you’re in a position to take advantage of these policies, which can reduce costs and increase your profit margins.

For example, certain countries have trade agreements that offer reduced tariffs or import duties on specific products. If you’re exporting a product covered under such agreements, your IEC can help you access these benefits. Over time, these cost savings can be reinvested back into your business, helping you grow and compete more effectively.

In short, Understanding the Basics: Benefits of IEC for Small Businesses, and why it’s essential? reveals that IEC is more than just a requirement for large corporations. It’s a powerful tool that helps small businesses reach new markets, save money, and build trust with global clients. If you’re serious about expanding your business, gaining an IEC could be one of the smartest moves you make.

With the potential to boost revenue, build credibility, and access special incentives, IEC brings valuable benefits that can transform a small business. So, if you’ve been thinking about taking your business to the next level, consider the possibilities that an Import Export Code can offer. You might just find that the world is ready for your products, and an IEC is the key to getting them there.

When it comes to Import Export Code (IEC) registration, a lot of myths and misconceptions can make it seem more complicated than it really is. Many business owners shy away from getting an IEC because of common misunderstandings, missing out on the benefits it offers. In reality, IEC registration is simpler, more affordable, and more beneficial than you might think! Let’s bust some myths and uncover the truth about IEC registration.

One of the biggest misconceptions is that IEC registration is only for large corporations or well-established companies. But that couldn’t be further from the truth! Small and medium-sized businesses can benefit significantly from having an IEC, especially if they’re looking to expand into international markets. Whether you’re a small business owner, a freelancer offering services abroad, or an artisan selling on international platforms, an IEC opens up doors to global opportunities.

In fact, many small businesses find that IEC registration helps them stand out in a competitive market by adding credibility. So, don’t let the idea that IEC is only for big players hold you back. If you have dreams of taking your business global, IEC registration could be the game-changer you’ve been looking for.

Another common misconception around IEC registration is that it’s a long, complicated, and paperwork-heavy process. While it’s true that some government registrations can be daunting, IEC registration isn’t one of them! The Directorate General of Foreign Trade (DGFT) has simplified the process, and most of it is now online.

In just a few clicks, you can start your application and submit the required documents. Typically, all you need is your business PAN card, bank details, and proof of address. Once your documents are uploaded and verified, you’ll get your IEC within a few days. With the modernized online system, IEC registration is faster and easier than most people expect. So, if the fear of paperwork has been stopping you, rest assured—the process is pretty smooth!

Many small business owners think that IEC registration is an expensive affair, but this isn’t true. While there is a fee for registration, it’s usually quite reasonable and affordable, even for small businesses. The benefits you gain from IEC far outweigh the registration cost, especially if you’re planning to explore international markets.

Think about it this way: by registering for an IEC, you’re investing in the future growth of your business. The potential revenue from reaching new customers abroad can easily cover the registration cost and more. Plus, IEC is valid for a lifetime, so there are no recurring fees. Once you’re registered, you’re set for good!

This myth might be true for some businesses, but if there’s even a small chance you’ll expand internationally, an IEC is valuable. The reality is that having an IEC can allow you to take advantage of opportunities that might arise, such as international sales inquiries, export grants, or even participation in global trade fairs.

Many businesses start with a local focus and later decide to expand abroad as they grow. Having an IEC already in place can save you time and help you seize opportunities quickly when you’re ready to explore global markets. Even if you’re not sure about international trade yet, having an IEC gives you the flexibility to make that leap when the time is right.

The word “registration” can sometimes make people worry about extra taxes or difficult compliance rules. However, IEC registration doesn’t automatically bring new taxes or hidden costs. The primary purpose of IEC is to allow businesses to legally import and export goods or services, not to increase tax burdens. In fact, IEC holders might benefit from tax exemptions on exports, depending on local regulations.

With IEC, you can actually save on some taxes and take advantage of certain export benefits or schemes. The compliance aspect is also straightforward, as there are minimal requirements for maintaining your IEC. The only thing you need to remember is to update it if there’s a major change in your business details. So, rest assured, IEC won’t complicate your tax life!

A common myth around IEC registration is that it requires frequent renewals or maintenance, which can feel like extra hassle. The truth? IEC registration is valid for a lifetime and doesn’t need regular renewal! This means that once you’ve registered, you don’t have to worry about renewing or updating it unless there’s a major change in your business information.

This aspect of IEC registration makes it a “register once, benefit forever” situation. For small business owners, that’s one less thing to worry about in an already busy schedule. So, if the thought of renewals has been holding you back, know that IEC registration is a one-time commitment with lasting benefits.

Another myth is that IEC registration is only for formal businesses, not freelancers or sole proprietors. However, even individuals can register for an IEC if they want to offer services internationally or import goods. For example, freelance consultants, designers, and even influencers sometimes need an IEC when engaging in global projects.

If you’re a freelancer or sole proprietor considering international work, IEC registration can help you take your career further. It signals professionalism and can make it easier to work with clients from other countries. In short, IEC isn’t limited to traditional businesses; it’s open to individuals too!

Thinking about expanding your business internationally? One of the first things you’ll need is an Import Export Code (IEC), a simple code that opens doors to the world of international trade. But before diving in, it’s essential to know if your business qualifies for an IEC. Fortunately, the eligibility requirements are straightforward and open to a wide range of business types, from established companies to individual entrepreneurs. Let’s break down who qualifies for an IEC and what makes your business eligible to go global!

One of the best things about IEC eligibility is that it’s inclusive. Almost any type of business entity can apply for an IEC, whether it’s a small sole proprietorship, a partnership, or a larger corporation. If you’re an individual running a small business on your own, don’t worry—you don’t need to have a massive company to qualify for an IEC.

Here’s a quick breakdown of who can apply:

Sole Proprietors: You’re eligible as long as you have a PAN card. IEC is an excellent way for freelancers, artists, or small-scale sellers to reach international customers.

Partnership Firms and LLPs: Partnerships can also apply for an IEC, making it ideal for small groups of entrepreneurs working together.

Companies: Private limited and public companies can apply, regardless of their size. Big or small, as long as you meet the basic requirements, you qualify!

So, whether you’re just starting or already have an established business, chances are you’re eligible. Think of it as a ticket to new possibilities!

It’s a common misconception that IEC is only for registered businesses. In reality, individual entrepreneurs and freelancers can also apply! If you’re offering services to clients in other countries or thinking of exporting your handmade crafts, you’re eligible to get an IEC.

To apply as an individual, all you need is your PAN card and a bank account. The process is the same as for companies and partnerships, and it doesn’t involve any complex paperwork. Having an IEC gives you the freedom to explore international clients without the restrictions that often come with local-only businesses.

Plus, an IEC can help you grow your reputation as a global service provider, even if you’re a solo freelancer. So, if you’ve been hesitant to apply because you thought IEC was only for big businesses, it’s time to change that mindset!

Government bodies and specific charitable institutions are also eligible for IECs but typically apply under slightly different conditions. While the standard requirements remain the same, these entities might have different rules or exemptions based on the nature of their work.

For example:

Government Bodies: Government departments or organizations can apply for an IEC if they’re involved in trading or importing/exporting goods or services.

Charitable and Non-profit Organizations: Certain charities may qualify if they need an IEC to facilitate international donations or goods movement for their operations.

The DGFT (Directorate General of Foreign Trade) often grants special consideration for these cases, making it easier for them to fulfill the international needs.

Foreign nationals and NRIs often wonder if they’re eligible to apply for an IEC for their businesses in India. The good news is that they can, provided they meet some additional requirements. For instance, NRIs or foreign nationals may need a registered business entity within India and a PAN card for that business.

If you’re an NRI or a foreigner with a business in India, the IEC can help you connect with global customers or source goods internationally. Just ensure you meet the local regulations, as IEC eligibility may have additional rules for foreign business owners.

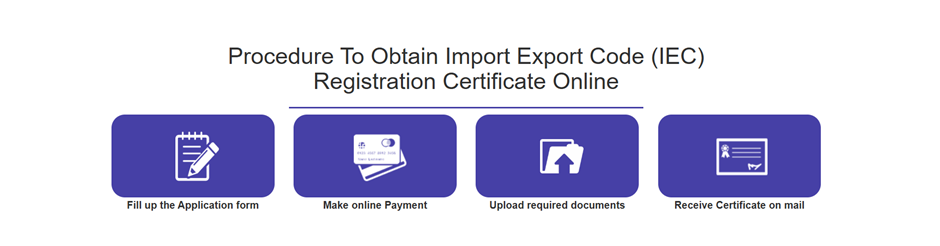

Thinking about taking your business global? Whether you’re eyeing international customers or sourcing unique products from abroad, obtaining an Import Export Code (IEC) is the first essential step. Don’t worry if the process sounds complicated. With a little guidance, getting your IEC is simple, straightforward, and mostly online! Here’s a friendly, step-by-step guide to help you obtain your IEC so you can start exploring new markets without the fuss.

Before jumping into the application, you’ll need a few key documents. Think of it as gathering your ingredients before starting a recipe—it makes the process smoother! Here’s what you’ll need:

PAN Card: Your business PAN card (or personal PAN card if you’re a sole proprietor).

Address Proof: Any document that proves your business’s address, such as an electricity bill or bank statement.

Bank Details: A copy of a canceled cheque or a bank certificate to confirm your account.

These documents are like your entry ticket into the world of import-export, so double-check to make sure they’re all up-to-date and correctly filled out. Once you’ve got everything ready, you’re set for the next step!

To get your IEC, you’ll need to apply through the official website of the Directorate General of Foreign Trade (DGFT). The DGFT’s online portal click here: IEC Registration to know that is where all IEC applications happen, making it easy for you to manage the entire process from your own computer.

If you’re visiting the IEC Registration website for the first time

Go to the IEC Registration website and look for the “New IEC Code” option.

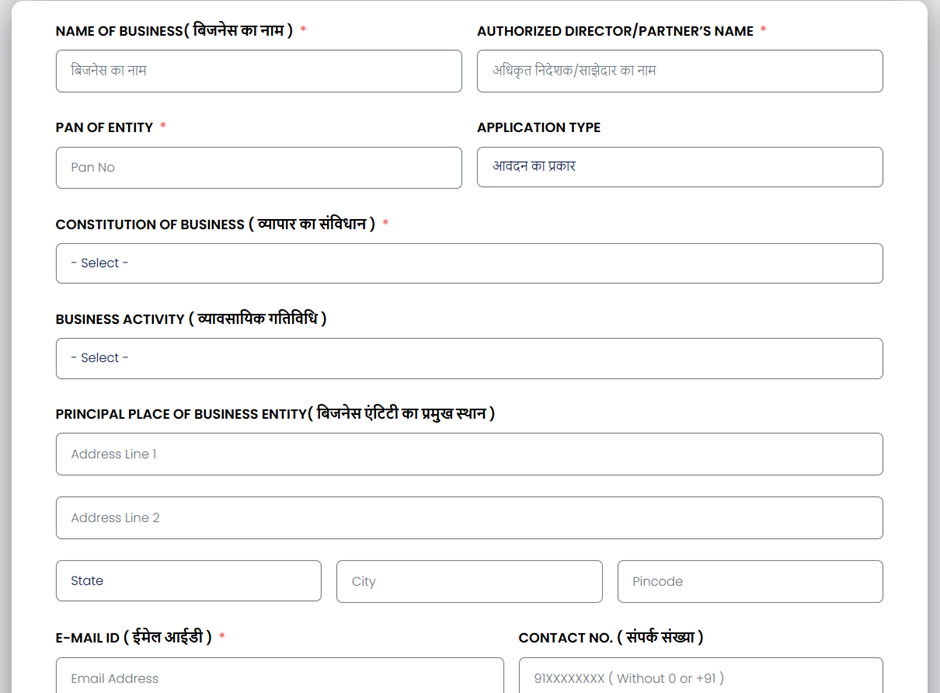

Now that you’re logged in, it’s time to fill out the IEC application form. This form will ask for basic information about your business and yourself if you’re a sole proprietor. Here’s a breakdown of what you’ll typically need to enter:

Personal Details:

1. Name of Business Entity: Fill the name of the Business / Enterprise which will get printed on IEC Certificate.

2. Authorized Director/Partner’s Name: Name of the person who will be authorized to apply IEC Code.

3. PAN of Entity: Fill in the Correct PAN Number of the Business Entity.

4. Select Type Of Application: You Want New IEC Code, IEC Renewal, IEC Modification.

5. Constitution of Business: Select the type of firm, the applicant must be applied for the IEC Code.

6. Business Activity: Select the main Business Activity to be conducted.

7. Address of Entity: Fill Complete Address which will get printed on IEC Certificate.

8. E-Mail ID: Fill in the Correct Mail ID of the Applicant.

9. Mobile No: Fill in the Correct Mobile Number of the Applicant.

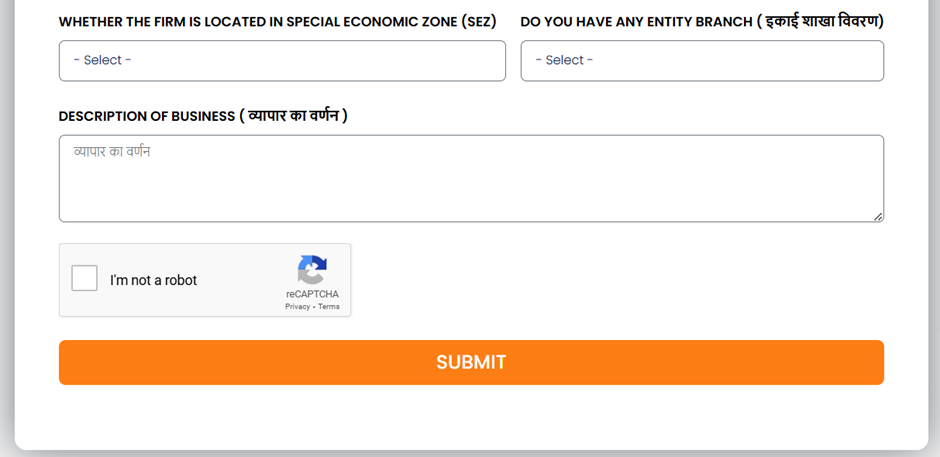

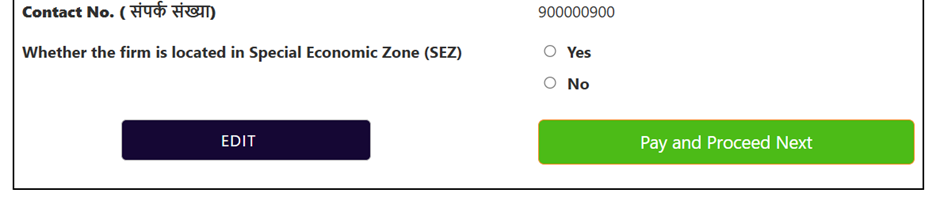

10. Whether the firm is located in Special Economic Zone (SEZ): Select Yes or No.

11. Entity Branch Details: Do You Have Any Entity Branch Select Yes or No

Once the form is complete, you’ll need to upload your supporting documents, including the PAN card, Aadhar Card, Address proof, and bank details. Make sure your scanned copies are clear and readable to avoid any issues with verification. Most common file formats, like PDF or JPEG, work just fine for the upload.

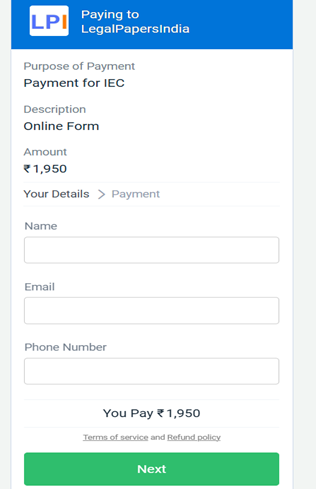

After uploading, click “Submit” to send your application to the DGFT. It’s a bit like sending a message into the world of trade, sign that your business is ready to go global! Once submitted, you’ll be asked to pay a small application fee online, which is generally affordable and easy to process.

Upload scanned copies of the required documents along with the application form.

The IEC application does come with a nominal fee, but don’t worry, it’s not a huge expense. The DGFT portal supports online payments, so you can use a credit card, debit card, or even net banking to pay quickly and securely.

Once your payment is processed, you’ll receive a confirmation receipt, which is worth saving for your records. With the fee paid, your application is officially on its way! This step is quick and easy, so you’re already nearly at the finish line.

After submitting your application and paying the fee, it’s time to sit back and let the DGFT do their work. In most cases, the processing time for an IEC application is a few days. You can even track the status of your application through the DGFT portal, which can be helpful if you’re eager to start trading internationally.

Once your IEC is issued, it will be sent to you digitally. There’s no physical card to wait for, so you can start using your IEC right away. Having your IEC in hand means your business is now officially part of the global trade community!

Congratulations, you’re officially equipped to take your business beyond borders! With your IEC, you now have the legal clearance to engage in import-export activities. Think of it as a ticket to a world of possibilities. You can start exploring new markets, sourcing materials internationally, or selling your products to overseas customers. The opportunities are endless!

Before you jump into global trade, consider doing a little research on the markets or regions you’re interested in. A bit of planning goes a long way, especially when it comes to things like pricing, shipping, and local regulations in foreign markets. But with your IEC in hand, you’re already on the right track.

In short, Getting Started: Step-by-Step Guide to Obtaining an IEC makes the process of getting an IEC simple and achievable for any business. If you’ve dreamed of expanding internationally, an IEC is the perfect starting point. From gathering documents to receiving your code, the steps are clear, affordable, and manageable.

So don’t let myths or confusion keep you from entering the world of global trade! With this guide, you’re ready to get started, break down those borders, and see what the world has to offer for your business. Good luck, and here’s to your international success!

In summary, understanding the eligibility requirements for obtaining an Import Export Code (IEC) opens doors to countless international opportunities. Whether you’re a small business owner, a freelancer, or part of a larger organization, IEC registration can transform the way you connect with the world. With eligibility spanning sole proprietors, partnerships, companies, and even certain individuals, the process is accessible, straightforward, and surprisingly inclusive.

If you’ve been considering taking your business to new markets, there’s no better time to get started. An IEC is more than just a registration—it’s a key to growth, new relationships, and expansion. With your IEC in hand, you’re ready to tap into the global economy and explore everything the international market has to offer. So, why wait? Start your global journey today and see where your IEC can take you!

Learn more about Import Export Codes by clicking here Import Export Code tmwala.com

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

"*" indicates required fields

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy