Starting a one-person company is exciting, but before you dive into the fun stuff—like naming your business or designing a logo—you’ll need to handle the legal side of things. While it may sound a bit dry, getting your company registration and business structure right is crucial to your success. Don’t worry, though! We’re going to break it down in a way that’s simple, easy to understand, and even a little bit fun.

Let’s explore how to register your one-person company and figure out which business structure will suit you best. Spoiler: It’s easier than it sounds!

A One Person Company (OPC) is a unique type of business structure designed for solo entrepreneurs who want to operate a business with the legal benefits of a company, without the need for partners or shareholders.

As the name suggests, an OPC is owned and run by a single individual, who acts as both the shareholder and the director. This gives the owner full control over business decisions, like a sole proprietorship.

One of the main advantages of an OPC is limited liability, meaning the owner’s personal assets are protected. The owner’s liability is limited to the amount they have invested in the business, so personal wealth is not at risk if the company faces debts or lawsuits.

An OPC has its own legal identity, separate from its owner. This allows the company to own property, enter contracts, and sue or be sued in its own name, offering more legal security than a sole proprietorship.

An OPC must appoint a nominee director at the time of registration. The nominee director steps in to manage the company if the original owner becomes incapacitated or is unable to continue running the business. This is a unique requirement specific to OPCs.

There is no minimum capital requirement for forming an OPC. You can start the business with any amount of capital, allowing flexibility for small-scale operations.

OPCs enjoy simplified legal and financial compliance compared to other company types. There are fewer regulatory filings and paperwork requirements, which makes managing an OPC more straightforward for single business owners.

Even though the company is run by a single person, it benefits from perpetual succession, meaning the company can continue to exist independently of the owner’s involvement, illness, or death, as long as it is passed on to the nominee director.

The administrative and regulatory requirements for OPCs are generally lighter compared to larger companies. For instance, an OPC is not required to hold annual general meetings (AGMs), which are mandatory for other types of companies.

An OPC is taxed as a private limited company, which can offer some tax advantages over a sole proprietorship. Additionally, the company can claim deductions on various business expenses, reducing taxable income.

An OPC can easily be converted into a private or public limited company once it exceeds certain thresholds, such as higher annual turnover or an increase in paid-up share capital. This flexibility allows the business to grow and evolve.

One limitation is that an OPC cannot engage in non-banking financial activities, including investing in securities or lending. The business activities of an OPC are somewhat restricted in certain industries.

An individual can only register one OPC at a time and cannot be a nominee for more than one OPC. This ensures that OPCs remain small, focused enterprises.

Before registering a One Person Company (OPC), it is crucial to understand the eligibility criteria and constraints associated with its incorporation. The Companies Act lays down specific requirements that must be met to ensure the promoter is eligible to register an OPC.

1) Natural Person and Indian Citizen: Only a natural person who is an Indian citizen can incorporate an OPC. Legal entities like companies or LLPs cannot establish an OPC.

2) Resident in India: The promoter must be a resident in India, which means they should have resided in India for a minimum of 182 days during the previous calendar year.

3) Minimum Authorized Capital: The OPC must have a minimum authorized capital of Rs 1, 00,000. It is the amount mentioned in the company’s capital clause during registration.

4) Nominee Appointment: During the incorporation of the OPC, the promoter must appoint a nominee. The nominee will become a member of the OPC in the event of the promoter’s death or incapacity.

5) Restrictions on Certain Businesses: Businesses engaged in financial activities such as banking, insurance, or investment cannot be incorporated as an OPC.

6) Conversion to Private Limited Company: If the OPC’s paid-up share capital exceeds 50 lakhs or its average annual turnover exceeds 2 Crores, it must be converted into a private limited company. This conversion ensures compliance with the regulatory requirements for larger companies.

Once you’ve decided on your business structure, it’s time to officially register your company. Don’t let the paperwork intimidate you—this process is straightforward. Here’s how it usually works:

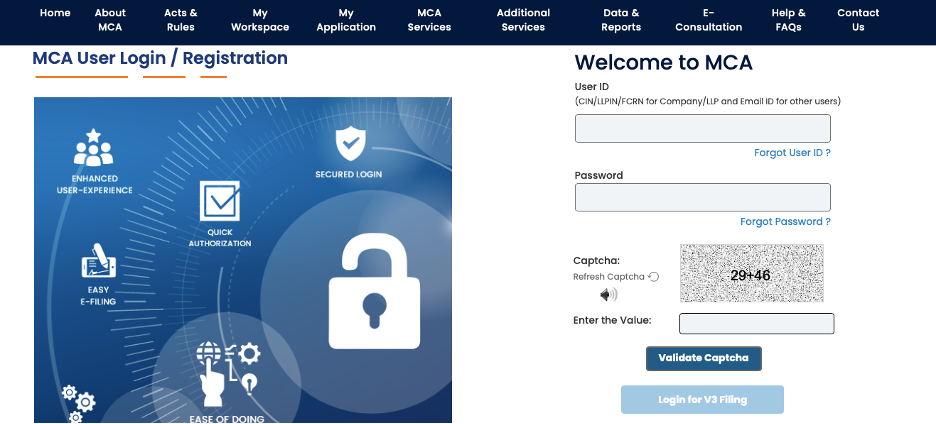

STEP 1: For registration of One person company a person is needed to visit the site of ministry of corporate affairs https://www.mca.gov.in/content/mca/global/en/home.html

STEP 2: Login to MCA portal with valid credentials

STEP 3: Select “MCA services” and further select “Company Services”

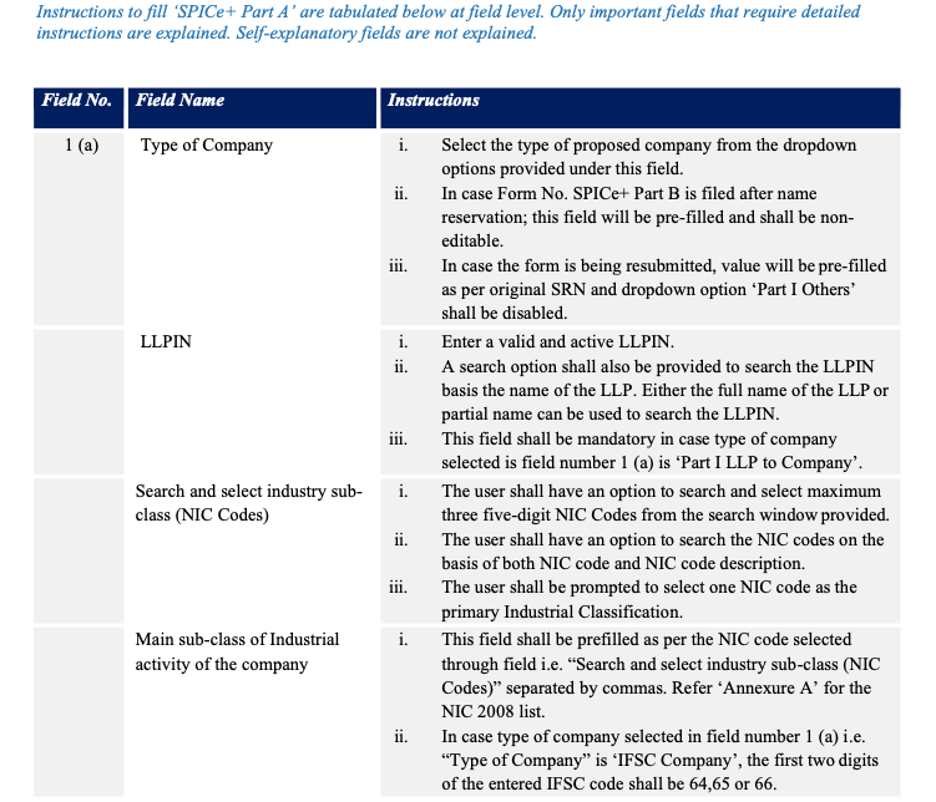

STEP 4: Access “SPICe + Part A”

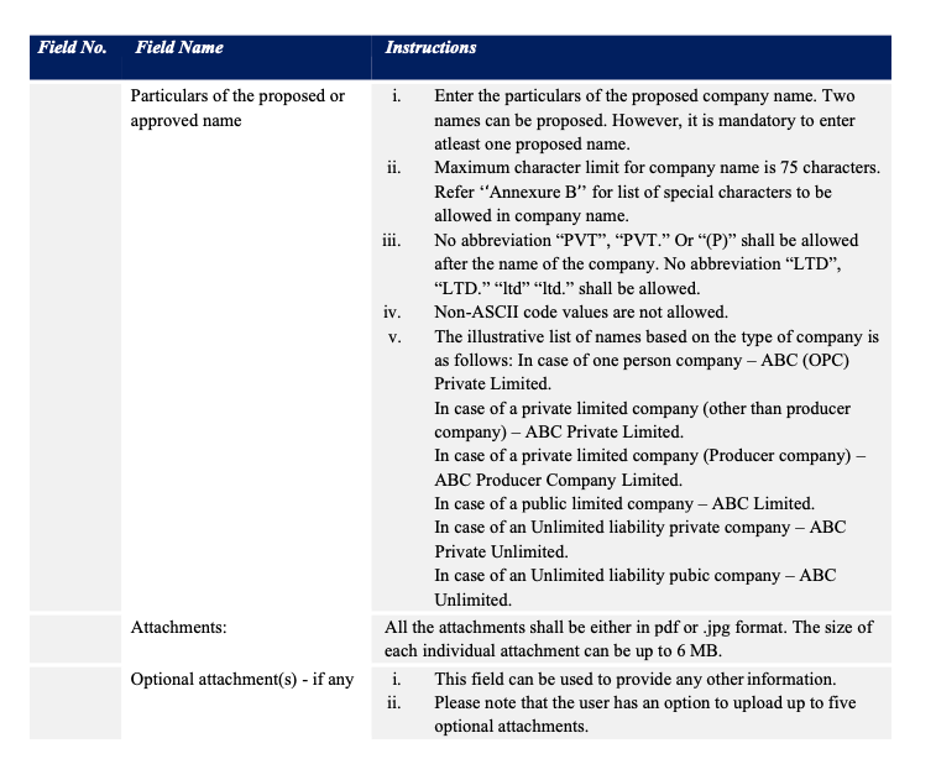

STEP 5: Fill up the application

STEP 6: Perform Auto Check

STEP 7: Submit the webform

STEP 8: SRN is generated upon submission of webform (The SRN can be used by the user for any future correspondence with MCA)

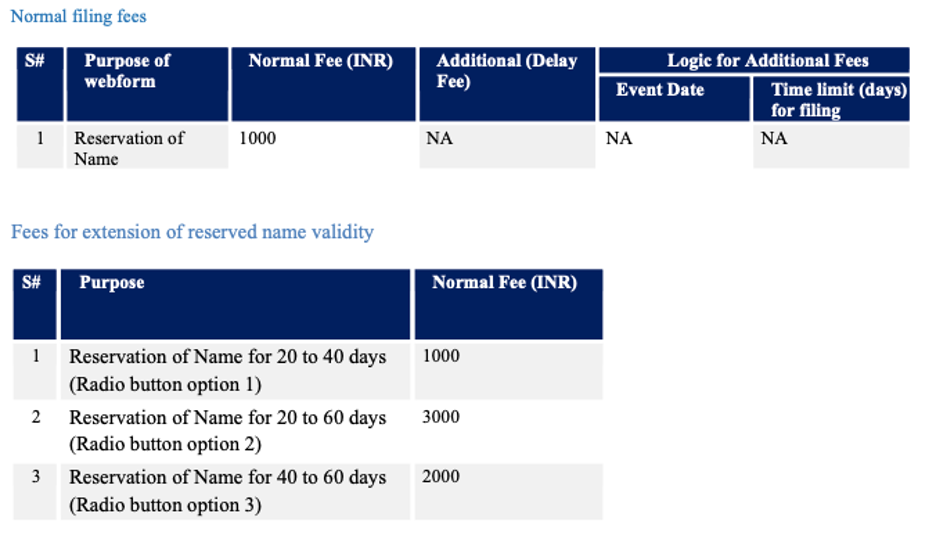

STEP 9: Pay Fees (In case the user does not complete the payment within 7 days of SRN generation, the SRN will be cancelled)

STEP 10: Acknowledgement email is generated

STEP 11: Once the form is processed an approval/rejection letter is sent to the registered Email ID of the user.

STEP 12: Click on the link provided in the notification email sent (received for resubmission)

STEP 13: Login to MCA portal with valid credentials .Access ‘SPICe +’ application from the application history in the user dashboard .Fill up the application.

STEP 14: Submit the webform

STEP 15: Access and file the linked forms2

STEP 16: Affixing of DSC

STEP 17: Upload the DSC affixed pdf document(s) on MCA portal Error! Bookmark not defined.

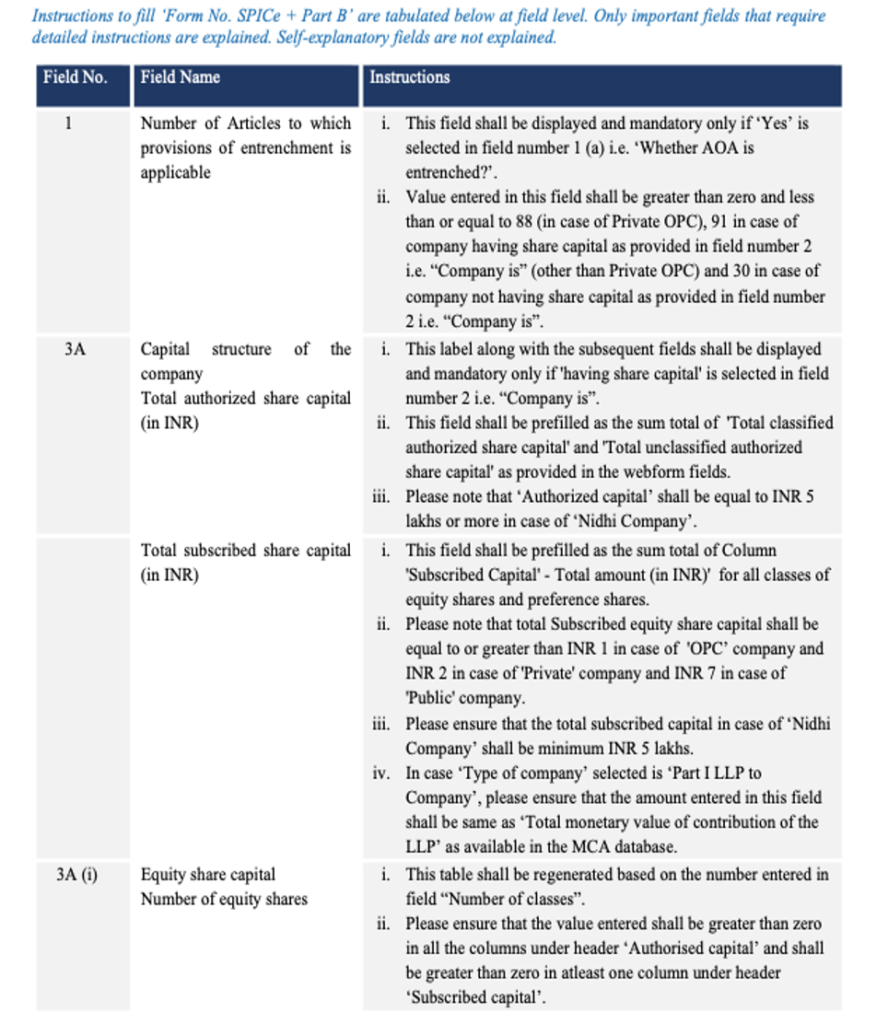

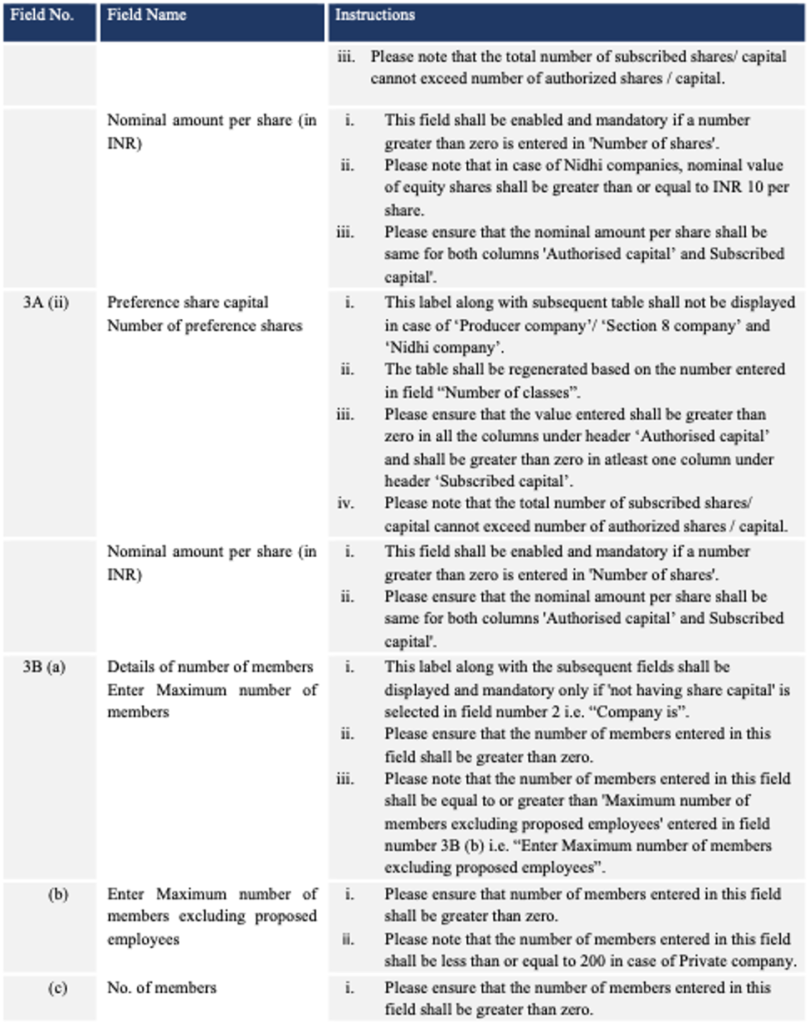

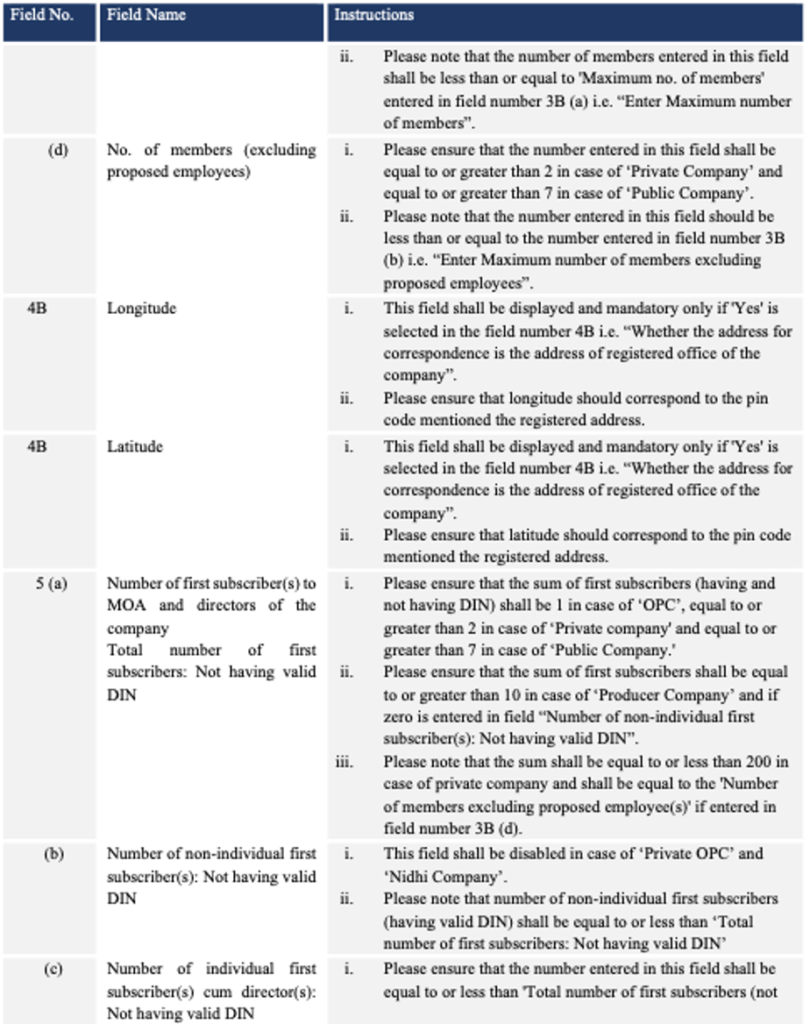

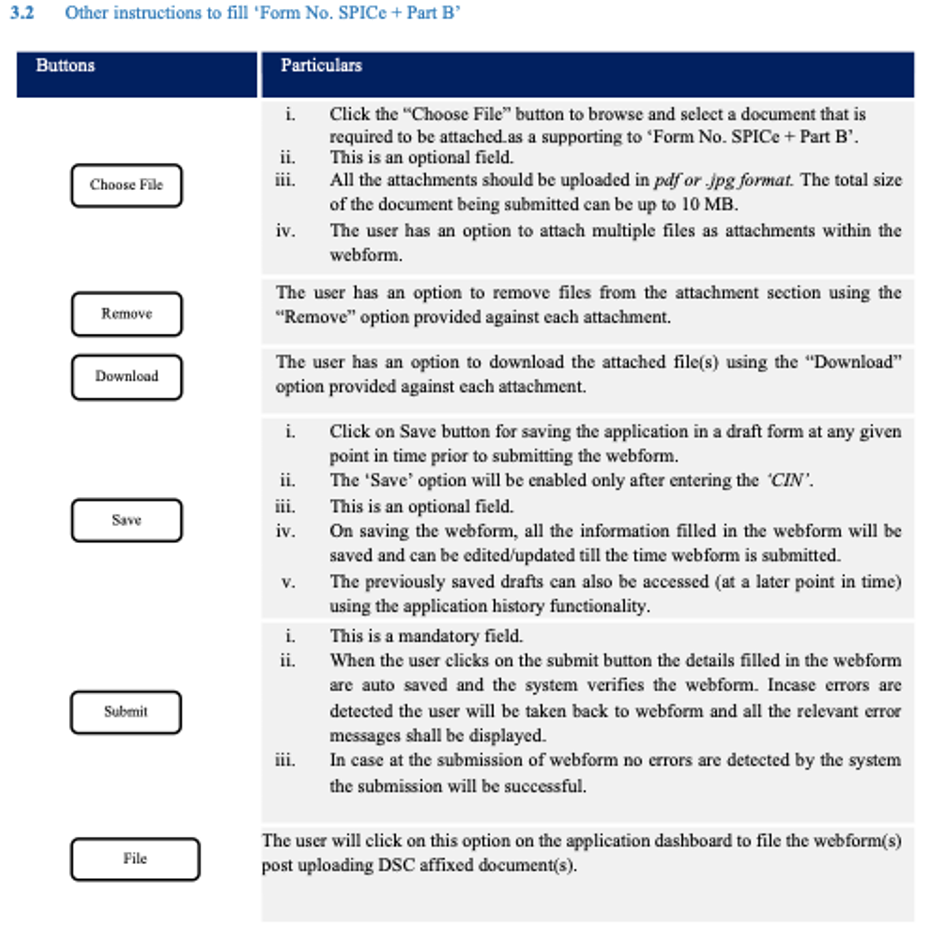

STEP 18: Filing of SPICe + Part B application along with linked webform(s)

STEP 19: Resubmission of webform (In case the user does not complete re-submission of the form and upload the DSC affixed pdf document within 24 hours of the SRN update, a SMS and email reminder will be sent to the user daily for 15 days OR till the time this is submitted, whichever is earlier.

STEP 20: Acknowledgement email is generated

STEP 21: Once the webform is processed, an intimation mail for name reservation along with the Approval

(Certificate of Incorporation) and Section 8 license, if applicable/ Rejection letter is sent to the registered Email ID of the user, PAN/TAN and CIN shall be allocated, an acknowledgement for stamp duty payment of e-MOA and e-AOA shall be generated. Also, DINs will be issued to the proposed directors who do not have a DIN and DIN letter is sent to the registered Email ID of those directors.

Step 22: Certificate of Incorporation: Once the ROC approves your application and verifies the compliance requirements, they will issue a Certificate of Incorporation. This certificate signifies the successful registration of your One Person Company.

When you start a one-person company, having a well-crafted business plan is essential. Think of it as your roadmap; it guides you through the twists and turns of entrepreneurship. A business plan doesn’t have to be a long, complicated document. In fact, the best plans are simple yet effective, providing you with clarity and direction. So, let’s dive into how you can create a straightforward business plan that sets you up for long-term growth.

Once you’ve got your vision and mission nailed down, it’s time to focus on your target audience. Who are you trying to reach with your one-person company? Knowing your audience is crucial because it informs all aspects of your business, from marketing to product development.

Start by creating a simple customer profile. Think about their demographics—age, gender, location, and interests. What problems do they face that your business can solve? Understanding these aspects helps you tailor your offerings to meet their needs. It’s like having a conversation with your ideal customer before you even start selling!

Now that you know who your audience is, it’s time to outline what you’ll offer them. This section of your business plan should be clear and concise. Focus on the unique value your products or services bring to the table.

What makes your offerings stand out? Is it the quality, the price, or the customer service? Make sure to highlight these differentiators in your plan. If you’re launching a product, describe its features and benefits. If you’re offering a service, explain how it improves your client’s life. Remember, clarity is key here; you want anyone reading your plan to understand what you offer instantly.

Your one-person company needs customers, and that’s where your marketing strategy comes in. This section outlines how you’ll attract and retain customers. Start by considering the channels you’ll use to reach your audience.

Will you utilize social media, email marketing, or content marketing? Choose a few channels that align with your audience’s habits. For example, if your audience spends a lot of time on Instagram, it makes sense to prioritize visual content there. Additionally, think about how you’ll create engaging content that speaks directly to your audience’s pain points. The goal is to build a strong brand presence that resonates with potential customers.

Now that you’ve outlined your offerings and marketing strategy, it’s time to dive into the numbers. Setting realistic financial goals is critical for the long-term growth of your one-person company. Start by estimating your startup costs, including materials, marketing expenses, and any necessary software.

Next, project your revenue for the first few years. Be honest and conservative in your estimates; it’s better to under-promise and over-deliver. You can create a simple spreadsheet to track your income and expenses, allowing you to monitor your financial health over time. This way, you’ll have a clear view of when you can expect to break even and start making a profit.

Every business journey comes with its fair share of challenges. Your business plan should include a section on potential obstacles and how you plan to overcome them. This could be anything from increased competition to changing market trends.

Being adaptable is key in today’s fast-paced business environment. Consider what changes you might need to make to your products or marketing strategies based on customer feedback or industry shifts. This flexibility will help you navigate any bumps in the road and keep your one-person company on the path to success.

Starting a one-person company can be an exciting adventure! You’re your own boss, and you have the freedom to pursue your passion. However, navigating this journey isn’t always smooth sailing. Many solo entrepreneurs make common mistakes that can hinder their success. Let’s explore these mistakes and how you can avoid them to set your one-person company on the path to success.

One of the biggest blunders you can make as a one-person company is skipping market research. You might think your idea is brilliant, and while it might be, it’s crucial to know if others think so too! Ignoring this step can lead to offering products or services that people don’t want or need.

To avoid this mistake, take the time to conduct thorough market research. Survey potential customers to understand their needs and preferences. You can also analyze your competitors to see what they’re doing right and where they fall short. This insight will help you tailor your offerings and ensure there’s a demand for what you provide. Remember, knowledge is power, and in business, it can make all the difference!

Another common mistake one-person companies make is neglecting financial planning. It’s easy to get caught up in the excitement of launching your business, but overlooking your finances can lead to trouble down the line. You might find yourself facing unexpected expenses or cash flow issues that could have been avoided with proper planning.

To steer clear of this pitfall, create a simple budget that outlines your expected income and expenses. Track your finances regularly to see where your money is going. Consider using accounting software to simplify the process. Establishing a separate business bank account can also help you keep personal and business finances separate, making it easier to manage your funds.

As a solo entrepreneur, you might feel the urge to do everything yourself. This can lead to overcomplicating your business processes. Trying to juggle too many tasks at once can cause burnout and reduce your overall efficiency. Simplifying your operations can help you stay focused and productive.

To avoid this mistake, identify the core activities that drive your business forward. Prioritize these tasks and streamline processes wherever possible. Use tools and software to automate repetitive tasks, such as email marketing or invoicing. This way, you can free up time to focus on growing your one-person company instead of getting lost in mundane details.

Many one-person companies make the mistake of ignoring customer feedback. You might think you know what your customers want, but their opinions matter more than you realize. Ignoring their feedback can lead to missed opportunities for improvement and growth.

To avoid this mistake, actively seek out customer feedback. Encourage reviews and testimonials, and make it easy for customers to share their thoughts. Take their suggestions seriously and use them to enhance your products or services. Engaging with your audience not only helps improve your offerings but also builds a loyal customer base that feels valued.

Another common error is failing to network and build relationships. Many solo entrepreneurs think they can go it alone, but building connections is vital for growth. Networking can lead to partnerships, mentorships, and new opportunities that can benefit your one-person company.

To avoid this mistake, make a conscious effort to connect with other professionals in your industry. Attend networking events, join online forums, and participate in social media discussions. Building relationships can provide you with support, resources, and valuable insights that can help you navigate the challenges of running a one-person company.

Legal compliance is a crucial aspect that many one-person companies overlook. Neglecting legal requirements can lead to penalties and even the closure of your business. It’s essential to understand the legal obligations related to your one-person company, such as registration, taxes, and permits.

To avoid this mistake, educate yourself about the legal requirements in your area. Consult with a legal professional if needed to ensure that you’re compliant with all regulations. This might seem like a hassle, but staying on the right side of the law can save you from significant headaches in the future.

Starting a one-person company can be an exciting adventure! You’re your own boss, and you have the freedom to pursue your passion. However, navigating this journey isn’t always smooth sailing. Many solo entrepreneurs make common mistakes that can hinder their success. Let’s explore these mistakes and how you can avoid them to set your one-person company on the path to success.

One of the biggest blunders you can make as a one-person company is skipping market research. You might think your idea is brilliant, and while it might be, it’s crucial to know if others think so too! Ignoring this step can lead to offering products or services that people don’t want or need.

To avoid this mistake, take the time to conduct thorough market research. Survey potential customers to understand their needs and preferences. You can also analyze your competitors to see what they’re doing right and where they fall short. This insight will help you tailor your offerings and ensure there’s a demand for what you provide. Remember, knowledge is power, and in business, it can make all the difference!

Another common mistake one-person companies make is neglecting financial planning. It’s easy to get caught up in the excitement of launching your business, but overlooking your finances can lead to trouble down the line. You might find yourself facing unexpected expenses or cash flow issues that could have been avoided with proper planning.

To steer clear of this pitfall, create a simple budget that outlines your expected income and expenses. Track your finances regularly to see where your money is going. Consider using accounting software to simplify the process. Establishing a separate business bank account can also help you keep personal and business finances separate, making it easier to manage your funds.

As a solo entrepreneur, you might feel the urge to do everything yourself. This can lead to overcomplicating your business processes. Trying to juggle too many tasks at once can cause burnout and reduce your overall efficiency. Simplifying your operations can help you stay focused and productive.

To avoid this mistake, identify the core activities that drive your business forward. Prioritize these tasks and streamline processes wherever possible. Use tools and software to automate repetitive tasks, such as email marketing or invoicing. This way, you can free up time to focus on growing your one-person company instead of getting lost in mundane details.

Many one-person companies make the mistake of ignoring customer feedback. You might think you know what your customers want, but their opinions matter more than you realize. Ignoring their feedback can lead to missed opportunities for improvement and growth.

To avoid this mistake, actively seek out customer feedback. Encourage reviews and testimonials, and make it easy for customers to share their thoughts. Take their suggestions seriously and use them to enhance your products or services. Engaging with your audience not only helps improve your offerings but also builds a loyal customer base that feels valued.

Another common error is failing to network and build relationships. Many solo entrepreneurs think they can go it alone, but building connections is vital for growth. Networking can lead to partnerships, mentorships, and new opportunities that can benefit your one-person company.

To avoid this mistake, make a conscious effort to connect with other professionals in your industry. Attend networking events, join online forums, and participate in social media discussions. Building relationships can provide you with support, resources, and valuable insights that can help you navigate the challenges of running a one-person company.

Legal compliance is a crucial aspect that many one-person companies overlook. Neglecting legal requirements can lead to penalties and even the closure of your business. It’s essential to understand the legal obligations related to your one-person company, such as registration, taxes, and permits.

To avoid this mistake, educate yourself about the legal requirements in your area. Consult with a legal professional if needed to ensure that you’re compliant with all regulations. This might seem like a hassle, but staying on the right side of the law can save you from significant headaches in the future.

As a one-person company, it’s normal to make mistakes along the way. The key is to learn from them and adapt. By avoiding common pitfalls like skipping market research, neglecting financial planning, overcomplicating processes, ignoring customer feedback, failing to network, and neglecting legal compliance, you’ll be better equipped to succeed.

Embrace the challenges, stay focused on your goals, and remember that every misstep is an opportunity to learn and grow. With the right approach, your one-person company can thrive and reach new heights!

Wish to read similar articles, click here: https://tmwala.com/blog-cease-and-desist/

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

"*" indicates required fields