₹2,000.00 Original price was: ₹2,000.00.₹999.00Current price is: ₹999.00.

₹4,000.00 Original price was: ₹4,000.00.₹1,999.00Current price is: ₹1,999.00.

₹2,000.00 Original price was: ₹2,000.00.₹1,599.00Current price is: ₹1,599.00.

₹2,000.00 Original price was: ₹2,000.00.₹599.00Current price is: ₹599.00.

If you’re considering starting a small business in India, you may have heard about the concept of sole proprietorship. This type of business structure is one of the most common choices for new entrepreneurs, and for good reason it’s simple, flexible, and doesn’t require a lot of formalities. But what exactly does it mean to be a sole proprietor? Let’s break down the definition, benefits, and a few limitations to help you understand whether sole proprietorship could be the right fit for your business.

A sole proprietorship is essentially a one-person business, owned and run by a single individual. Unlike other business structures, a sole proprietorship doesn’t require complex registration or corporate procedures. In fact, in most cases, you’re automatically considered a sole proprietor the moment you start conducting business. The business and the owner are legally the same entity, which means that all profits, losses, and legal responsibilities are tied directly to the owner.

For instance, imagine you’re a freelance graphic designer or a small bakery owner. As a sole proprietor, you make all the decisions, keep all the profits, and handle all the paperwork (though there’s not too much of it). In India, the sole proprietorship model appeals to many because it offers full control without the need for a board of directors, shareholders, or complex tax structures. Essentially, it’s you and your business—one and the same.

One of the biggest perks of sole proprietorship is its simplicity. Starting up is straightforward, as you don’t need to register with any special authorities or government bodies in India. You just need a few basic licenses, depending on your business type and location, and you’re good to go. This ease of setup makes it a popular choice for freelancers, small shop owners, consultants, and other self-employed professionals.

Another big benefit? You get to be the boss. As a sole proprietor, you have full control over business decisions. You don’t have to seek approval from partners or shareholders; you’re free to follow your own vision and make changes whenever you see fit. This flexibility is ideal for creatives, innovators, and anyone who wants the freedom to adapt their business quickly.

On top of that, sole proprietorship allows you to keep all the profits. Since there’s no formal division of earnings, all the income generated by your business belongs to you. You can choose to reinvest it, save it, or spend it—whatever works best for your goals. This direct link between hard work and rewards can be incredibly satisfying and motivating.

While sole proprietorship offers many advantages, it does come with a few limitations. One of the most significant drawbacks is unlimited liability. Since you and your business are legally the same, any debts or legal obligations your business incurs also become your personal responsibility. This means that if the business fails, your personal assets, like your savings or property, could be at risk. For businesses with higher risks, this can be a major factor to consider.

Another limitation of sole proprietorship is its limited access to funding. Since the business isn’t a separate legal entity, banks and investors often view it as riskier than, say, a private limited company. Sole proprietors might struggle to raise large amounts of capital, which can slow down growth if you’re looking to expand quickly. While it’s easier to get small loans or lines of credit, attracting significant investment may be a challenge.

Additionally, sole proprietorship can face challenges with succession. Because the business is entirely tied to you, it doesn’t have a built-in mechanism for passing ownership along. This can make it harder to sell or transfer the business if you want to retire or move on to something new. In other business structures, like a partnership or company, there’s more flexibility in transferring ownership.

Ultimately, choosing a sole proprietorship depends on your business needs, goals, and comfort with risk. For smaller businesses and freelancers who prioritize simplicity and independence, this structure can be ideal. It’s an excellent way to start small, build experience, and test your business idea without heavy commitments or costs. You’ll have the freedom to experiment and grow, plus the flexibility to adapt your business on the fly.

However, if you’re envisioning a business that might need substantial funding or has higher risks, it might be worth exploring other business structures. You can always transition to a different entity, like a private limited company, as your business grows. The best part? Starting as a sole proprietor gives you a solid foundation in business management and helps you develop the skills, you’ll need for future growth.

In India, sole proprietorship is a popular choice because it’s easy, affordable, and flexible. If you’re eager to dive in and get started, this structure could be just the thing you need to turn your business dream into reality. But remember, like any decision, it’s essential to weigh the pros and cons carefully, so you know what you’re signing up for. To know more about the sole proprietorship and how it simplifies your journey as a business owner check the Tmwala Blog on Sole Proprietorship

Starting a sole proprietorship in India is one of the simplest ways to get your business rolling. Unlike other business setups, there’s no need for a complicated registration process or lengthy paperwork. With a few essential steps, you can officially kick off your venture and start bringing in business.

A PAN card is essential for all business transactions in India. It serves as your official identification for tax purposes and will be linked to your sole proprietorship. Luckily, applying for a PAN card is straightforward you can do it online via the Income Tax Department’s website. Just fill out the application, upload a few required documents, and you’re good to go.

In most cases, you’ll receive your PAN card within a few weeks. Having it in hand is crucial, as you’ll need this identification number for various registrations and to open your business bank account.

After you have your PAN card, the next step is to open a dedicated bank account for your business. Keeping your personal and business finances separate is essential in a sole proprietorship. Even though you’re the sole owner, having a business account helps you maintain a clean financial record, which makes tax filing easier. Plus, it adds a level of professionalism to your business when clients make payments directly to your business account.

To open a business account, visit your chosen bank with your PAN card, address proof, and business-related documents, such as a business license. Many banks also offer special account options for sole proprietors, which may come with benefits like lower transaction fees or extra support services.

The proprietor needs to obtain the Registration Certificate under the Shops and Establishment Act of the state in which the business is located. For Registration in Madhya Pradesh for the shop and establishment act one must go to the Shram Sewa Portal of Government of Madhya Pradesh Using the link: Registration for the shop and establishment act

To know the in-detail step-by-step guide to register yourself for the shop and establishment act follow the Article on the Tmwala website by clicking here.

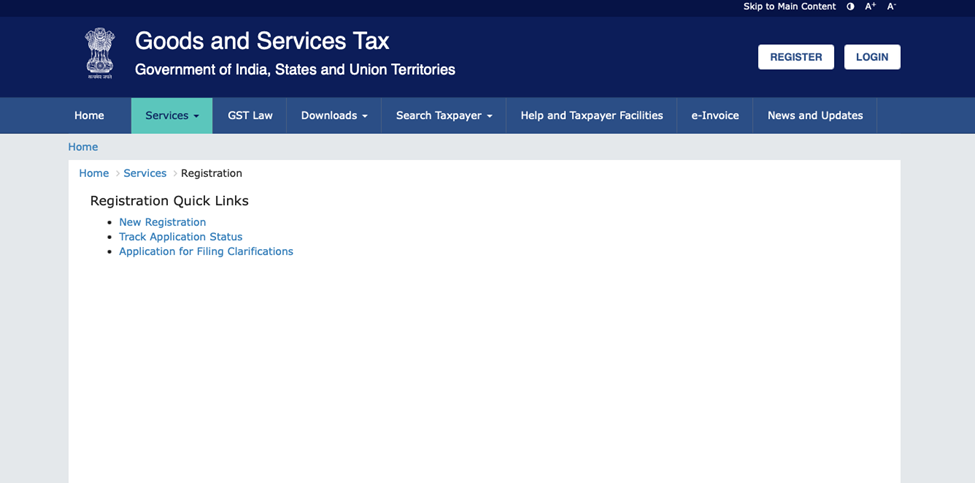

Depending on the nature of your business, you may need to register for GST. In India, GST registration is required for sole proprietors if your annual turnover crosses a specific threshold generally ₹20 lakh for services and ₹40 lakh for goods. Even if you don’t need it right away, GST registration can be helpful as it allows you to claim input tax credit and makes your business appear more credible to clients and suppliers.

Applying for GST is simple and can be done online on the GST portal GST-Registration portal.

To know about the whole process of GST registration in detail follow up the Tmwala blog on GST registration a comprehensive guide https://tmwala.com/blog-gst-registration/

Once registered, you’ll receive a GSTIN (Goods and Services Tax Identification Number) that’s unique to your business. Don’t forget to mark your calendar for regular GST filing deadlines if you’re registered it keeps your business compliant and avoids penalties.

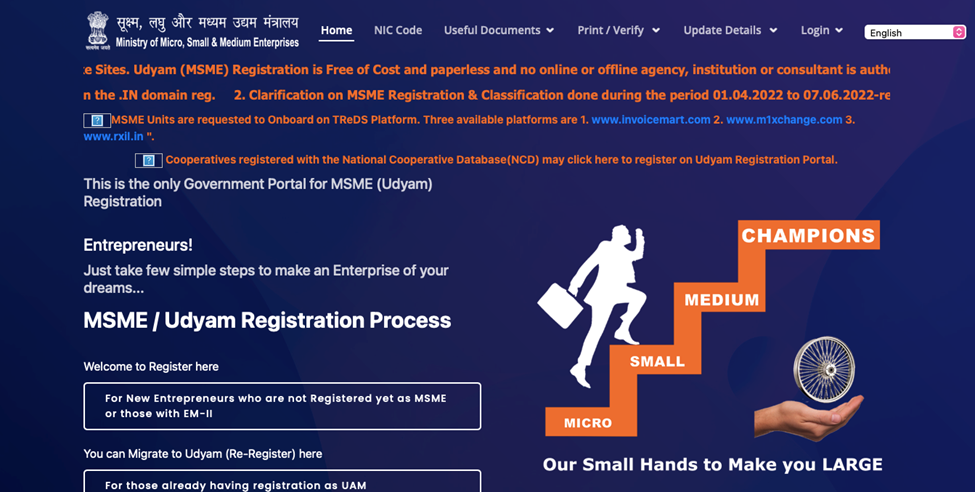

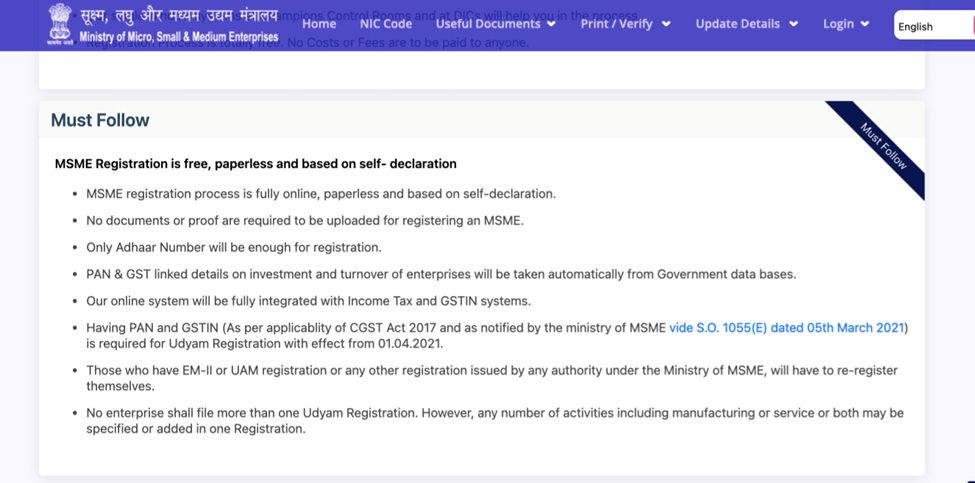

While sole proprietorships don’t require a mandatory registration with the government, registering on the Udyam Portal can offer several benefits. The Udyam registration is specifically for small and medium enterprises (MSMEs) in India, and it provides access to government schemes, subsidies, and easier financing options. The registration process is free and easy simply visit the Udyam Portal and fill in your business details. To register yourself for the MSME you need to register yourself on the Udhyam portal https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

Once registered, you’ll receive a unique Udyam Registration Number (URN) and a certificate. This certificate can be useful for proving your business’s status as a recognized MSME. Plus, it opens the door to financial and technical support from government initiatives, which can be especially helpful as you grow.

Getting your documents together for sole proprietorship registration in India can feel like a big task. Having all your paperwork in order is the key to a smooth, hassle-free process.

| Identity proof: | A passport, Aadhar card, voter ID, or driver’s license of the owner |

| PAN card: | The proprietor must have a PAN card to file tax returns in their name |

| Address proof: | Utility bills or bank statements |

| Proof of registered office: | Ownership of the property, such as an electricity bill or corporation tax receipt, or a rental agreement or No Objection Certificate (NOC) from the owner |

| Aadhar card: | A scanned copy of the proprietor’s Aadhar card |

| Passport-sized photograph: | A recent photograph to confirm the proprietor’s identity on the GST application |

Choosing the right business structure is one of the biggest decisions you’ll make when starting your business. With options like sole proprietorship, LLP (Limited Liability Partnership), and Pvt Ltd (Private Limited Company), it can be tough to know which structure is the best fit. Each one has unique features, benefits, and drawbacks, so understanding how a sole proprietorship compares to LLPs and Pvt Ltd companies will help you make a more informed choice. Let’s break down these differences in an easy, approachable way to help you pick what’s right for your business.

In a sole proprietorship, you’re the boss—no partners or board members to answer to. It’s the simplest business structure, making it perfect for freelancers, small retailers, and consultants who want full control over decision-making. You own 100% of the business and call the shots on everything from finances to operations. On the other hand, LLPs and Pvt Ltd companies require more than one person for their setup. LLPs allow two or more partners to share responsibilities, meaning you have to consult with your partner(s) before making big moves. In a Pvt Ltd, the structure is even more formalized, with directors and shareholders who have roles defined by company law. This setup is better for businesses that expect to grow rapidly or want to attract investors, but it means sharing control and responsibility. If you’re someone who values independence and prefers simplicity, sole proprietorship gives you that freedom without added layers.

One major difference between sole proprietorship and other entities is liability. In a sole proprietorship, there’s no legal separation between you and your business. This means that if your business owes money or faces legal issues, you’re personally liable. Your personal assets, like your savings or property, could be at risk if something goes wrong. For some, this isn’t a big deal—especially if you have a low-risk business. But for others, it’s something to consider carefully. LLPs and Pvt Ltd companies, however, offer limited liability protection, which is a big advantage. In these structures, your personal assets are generally protected, and you’re only liable up to the extent of your investment in the company. For example, in a Pvt Ltd, shareholders only risk losing the money they’ve invested in shares. This feature makes LLPs and Pvt Ltd companies safer options if your business operates in a high-risk industry or you’re dealing with large sums of money. But remember, this added protection comes with extra regulations and paperwork, so you’ll have to weigh the pros and cons.

When it comes to compliance, the simplicity of a sole proprietorship really stands out. Running a sole proprietorship is straightforward because there’s minimal paperwork and fewer regulatory requirements. You won’t have to worry about annual filings or board meetings, and you can focus on running your business without much interference. Taxes are also simpler—you file business income as part of your personal income, which keeps things easy, especially for small businesses. In comparison, both LLPs and Pvt Ltd companies are required to follow more formal regulations. LLPs must file annual returns with the Ministry of Corporate Affairs and maintain certain records. Pvt Ltd companies face even stricter requirements: they must hold annual general meetings, file annual returns, and submit audited financial statements. These formalities add a level of professionalism and transparency that’s appealing to investors, but they can also feel overwhelming for small business owners. If you’re not planning to expand rapidly or seek funding from investors, a sole proprietorship keeps things simple and frees up more time for you to work on your business.

In terms of funding, sole proprietorships have limited options. Since you and the business are one and the same, it’s harder to attract investors who might prefer more formal structures like Pvt Ltd companies. With a sole proprietorship, you’re generally funding the business out of your pocket or taking out loans. While this can limit growth, it also means you retain complete ownership and avoid the complexities of outside investments. For businesses aiming to scale, Pvt Ltd companies are the most appealing to investors. Investors and venture capitalists feel more secure with Pvt Ltd companies because they offer shares, limited liability, and a legal structure that protects their interests. LLPs fall somewhere in between—while they don’t offer shares, they’re still seen as more formal than sole proprietorships, making it easier to bring in partners or get business loans. So, if you’re looking for outside investment, a sole proprietorship might not be the best choice. However, if you’re content to grow organically and stay lean, sole proprietorship lets you retain full ownership and avoid dealing with shareholders.

Taxation is another key area where sole proprietorships differ from LLPs and Pvt Ltd companies. In a sole proprietorship, your business income is considered personal income, which means you’ll pay taxes based on personal income tax rates. This can be a benefit for smaller businesses since it simplifies tax filing. You can also claim certain business expenses as deductions, which can lower your taxable income. However, sole proprietors miss out on certain tax benefits available to companies, like lower corporate tax rates. Pvt Ltd companies, on the other hand, are taxed as separate entities at corporate tax rates, which can sometimes be lower than individual rates. LLPs also enjoy tax benefits that sole proprietorships don’t, such as the ability to share income among partners, potentially reducing tax liabilities. If your business income is high, it’s worth considering these options, as the tax savings might offset the extra regulatory costs. However, for small businesses with moderate income, the simplicity of paying personal income tax as a sole proprietor can be a huge relief.

For businesses looking to grow rapidly, scalability is crucial, and Pvt Ltd companies are structured with growth in mind. Pvt Ltd companies are better equipped for expansion, partnerships, and funding rounds. They also make it easier to bring on additional shareholders or convert into a public company if that’s in your long-term plan. LLPs also offer some flexibility for growth since you can bring on new partners as needed. However, both these structures come with stricter compliance and legal requirements, which can slow down decisions if you’re a small business owner with limited resources. In contrast, a sole proprietorship is all about flexibility. You can make changes, adapt your strategy, and pivot quickly without going through formal approval processes. If your business model is straightforward and not aiming for rapid expansion, a sole proprietorship gives you the freedom to operate with minimal restrictions. However, if you’re aiming for substantial growth and plan to bring in investors or partners, transitioning to a more formal structure down the road could be beneficial.

Choosing between a sole proprietorship, LLP, and Pvt Ltd company depends on your business goals, risk tolerance, and future plans. If you value simplicity and want full control, a sole proprietorship is a great way to get started without a lot of overhead. For those planning to expand, share responsibility, or bring on investors, an LLP or Pvt Ltd company offers more security and growth potential. Take your time, weigh the options, and remember that you can always evolve your business structure as your company grows.

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

"*" indicates required fields