₹2,000.00 Original price was: ₹2,000.00.₹599.00Current price is: ₹599.00.

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Starting a business is always an exciting journey, but it also comes with plenty of challenges. One big hurdle for any startup is gaining credibility and access to resources, especially when competing with established players. That’s where Udyam Registration comes into play. If you’re new to this term, don’t worry – it’s simply an official certification process that classifies your business as a registered Micro, Small, or Medium Enterprise (MSME) in India. This registration isn’t just a formality; it can be a game-changer for startups. Let’s dive into why Udyam Registration matters for startups and how it can be a launchpad for your business growth.

One of the major struggles for startups is building trust, especially when you’re just starting out. Getting Udyam Registration can help with this by showing that your business meets government standards for a small or medium enterprise. It essentially adds a stamp of legitimacy to your company, which can go a long way in establishing credibility.

Think about it – potential customers, partners, or even investors are more likely to trust a registered entity over an unregistered one. With Udyam Registration, you can display your MSME certificate, adding an extra layer of professionalism. You might even find that customers are more comfortable doing business with you when they see that you’re officially registered. For startups, this simple badge of trust can open doors to new opportunities, partnerships, and clients.

Funding is the lifeline of any startup, but getting loans or grants can be a challenge without a track record. That’s another reason why Udyam Registration matters for startups. Once registered, your startup becomes eligible for various financial schemes, subsidies, and loan benefits that are otherwise reserved for MSMEs.

For instance, registered startups often have access to priority loans through government schemes, often at lower interest rates. These loans can help you get the funding you need to expand, develop new products, or manage your day-to-day operations. Additionally, registered MSMEs are eligible for credit guarantees, which reduce the risk for banks and make it easier for you to secure funding. When you’re bootstrapping or seeking financial backing, these perks are incredibly valuable.

Saving on taxes is always a plus, especially for startups trying to make every penny count. Udyam Registration can unlock a range of tax exemptions that are only available to MSMEs. For example, many startups find that they’re able to get a rebate on the income tax they would otherwise pay. While these rebates vary based on specific criteria, they’re often a fantastic way to reduce costs and improve your cash flow.

Moreover, with Udyam Registration, startups can also benefit from exemptions on certain taxes and fees when they bid on government contracts. This can be a big help if you’re planning to work with public sector clients or secure government projects. Not only can these rebates and exemptions provide a financial cushion, but they also allow you to redirect funds back into your business for growth initiatives. Who doesn’t want a bit more breathing room in their budget?

Government contracts can be highly lucrative, but they’re usually challenging for small businesses to win, especially when up against larger companies. However, with Udyam Registration, startups can get priority access to government tenders and contracts. This special status is granted to MSMEs to encourage small businesses to take part in public sector projects.

For startups, this is a golden opportunity. Not only does it increase your chances of landing big projects, but it also gives you a chance to grow your portfolio with reputable clients. Imagine being able to showcase a successful government project early on – it’s a fantastic trust builder and can make a big difference in how potential clients and partners view your startup. With a little bit of government support, your startup could land significant deals that fuel growth and establish a strong market presence.

For startups that want to stay competitive, keeping up with the latest technology and skills is essential. Luckily, Udyam Registration can give you access to several government programs that support technological upgrades, skill development, and infrastructure improvement. These programs are designed to help MSMEs adopt the latest tools and best practices, so you’re not left behind.

For example, there are specific programs that provide grants or subsidies for purchasing new equipment, upgrading systems, or training your workforce in the latest technology. These benefits can be especially helpful for tech-oriented startups or those in fields like manufacturing where equipment costs are high. When you’re just starting out, being able to access resources like these can save you a lot of upfront expenses, enabling you to focus on other core areas of growth.

Thinking of applying for Udyam Registration but unsure if your business qualifies? You’re in the right place! Udyam Registration is designed specifically to support India’s Micro, Small, and Medium Enterprises (MSMEs). But before you dive in, it’s essential to understand the eligibility criteria. This guide will walk you through who can apply, what’s needed, and why this matter for your business. With a little clarity, you’ll see how easy it can be to determine if Udyam Registration is a good fit for you.

The first thing to know is that Udyam Registration is open exclusively to MSMEs. But what exactly qualifies as a “Micro,” “Small,” or “Medium” enterprise? The answer lies in two key factors: your business’s investment in plant and machinery or equipment, and its annual turnover.

Micro Enterprises are the smallest category, perfect for tiny businesses and startups just getting off the ground. To qualify as a Micro Enterprise, your business should have an investment of up to ₹1 crore in equipment or machinery and an annual turnover of up to ₹5 crore. If your business fits this bill, you’re set to register as a Micro Enterprise!

Small Enterprises are a step up, designed for growing businesses with a bit more capital and income. Small businesses can have an investment of up to ₹10 crore and a turnover of up to ₹50 crore. If you’re expanding and seeing more revenue, you might qualify as a Small Enterprise.

Medium Enterprises are the largest eligible category for Udyam Registration. These businesses can have an investment of up to ₹50 crore and a turnover of up to ₹250 crore. If your business is thriving but still falls under these limits, you’re eligible for registration as a Medium Enterprise.

Knowing where your business fits in can help simplify your application. Just check your investment and turnover figures, and you’ll have a good idea of which category to choose!

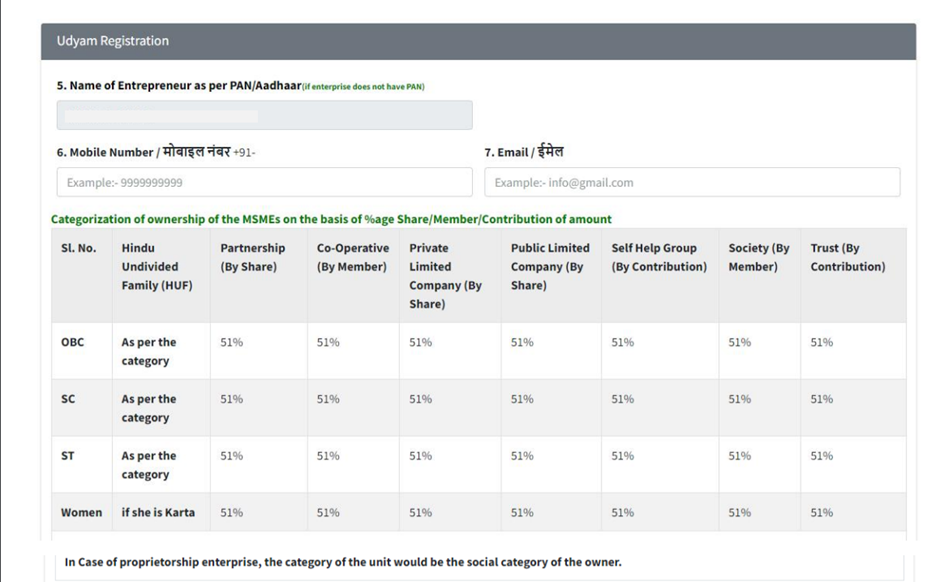

One of the great things about Udyam Registration is that it’s open to many types of business structures. So, whether you’re a sole proprietor, running a partnership firm, or operating as a private limited company, you can apply. Udyam Registration recognizes that businesses come in all shapes and sizes, so it’s designed to accommodate different setups.

Sole proprietors are individuals who own and run their business alone. If you’re a solo entrepreneur, Udyam Registration is a great fit and can help you gain some of the perks typically available to larger companies.

Partnerships are also eligible, allowing small teams of co-founders or partners to access MSME benefits. If you and a few others have pooled your resources and created a small business, you’re on the right track with Udyam.

Private limited companies and limited liability partnerships (LLPs) can also apply for Udyam Registration if they meet the MSME criteria. Even if your business has a more complex structure, Udyam is inclusive enough to support your application. This flexibility means that as long as your business meets the investment and turnover thresholds, your company’s legal structure won’t hold you back.

If you’ve decided that your business qualifies based on the eligibility criteria, it’s time to gather the right documents. Fortunately, the Udyam Registration process is pretty straightforward and doesn’t require a mountain of paperwork. Here’s a quick checklist of what you’ll need:

Make sure you have these documents ready and accessible. With everything in place, you can go through the registration process smoothly and without delays.

Thinking about registering your business under Udyam but feeling overwhelmed? Don’t worry – registering for Udyam is easier than you might think. This step-by-step walkthrough is here to make the whole process simple and stress-free. In a few straightforward steps, you’ll go from preparing your documents to being officially registered as an MSME (Micro, Small, or Medium Enterprise) in India. So grab a cup of coffee, get comfortable, and let’s walk through the Udyam Registration process together!

Before you jump into the registration, take a few minutes to gather the necessary documents. Starting with everything in hand will make the process much smoother!

To register on the Udyam portal, you’ll need your Aadhaar number if you’re a sole proprietor, or a PAN card if your business is a partnership or company. Your Aadhaar or PAN acts as your main identification, linking your application to your business. It’s also recommended to have your GST Number (if applicable) and bank account details ready, as these make it easier to complete your registration and access benefits later on.

Once you have these documents ready, you’re already halfway there! Think of this as packing for a short trip – it’s always smoother when you know what you need beforehand.

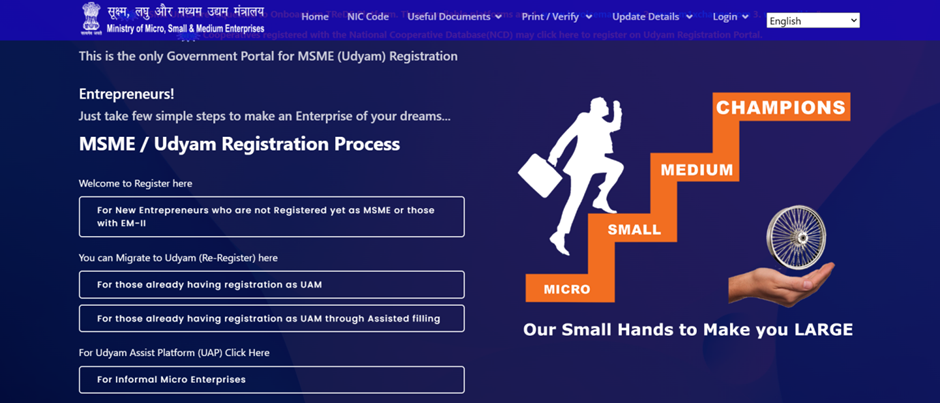

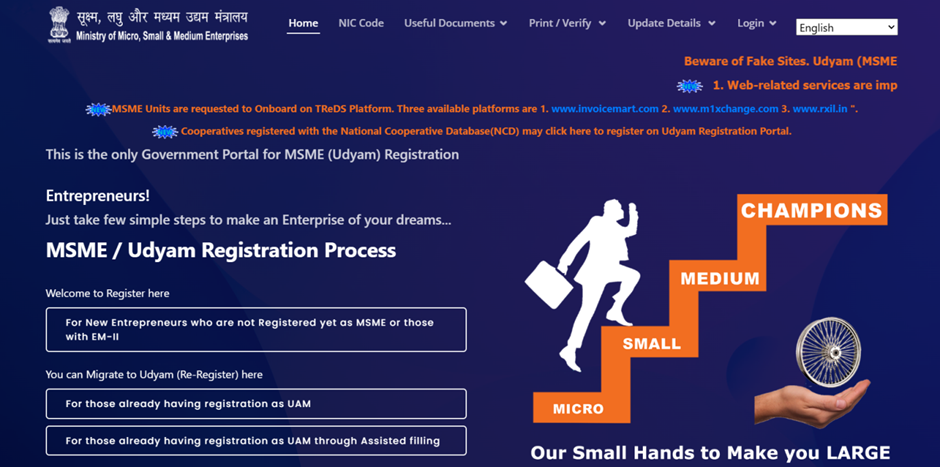

Now that you’re armed with your documents, it’s time to head over to the official Udyam Registration Portal udyamregistration.gov.in. The portal is the only place to register, so be cautious of any other websites offering to do it for you. Many third-party sites might charge you for services that are entirely free on the official portal.

Once you’re on the portal, you’ll see options for new MSME registration and registration for existing enterprises. Since this is likely your first time registering, go ahead and click on the “For New Entrepreneurs” section. The site’s design is straightforward, so you won’t need to worry about getting lost. This section will guide you to a page where you can enter your details and start the official registration process.

On the homepage, click the option ‘For new entrepreneurs who are not registered yet as MSME or those with EM-II.

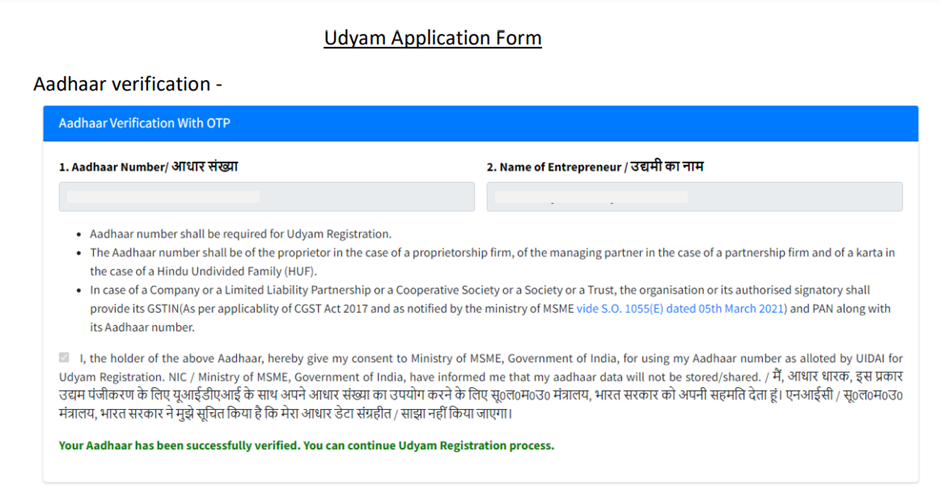

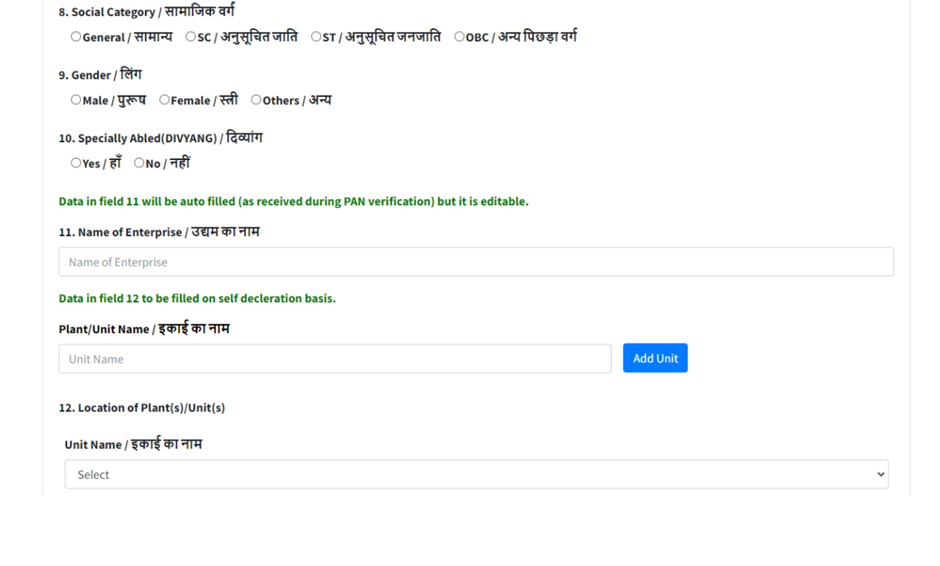

This step is where you’ll really start filling out the application form. If you’re a sole proprietor, simply enter your Aadhaar number and business name as prompted. If your business is a partnership or company, you’ll need the PAN of the organization and details of one of the authorized signatories.

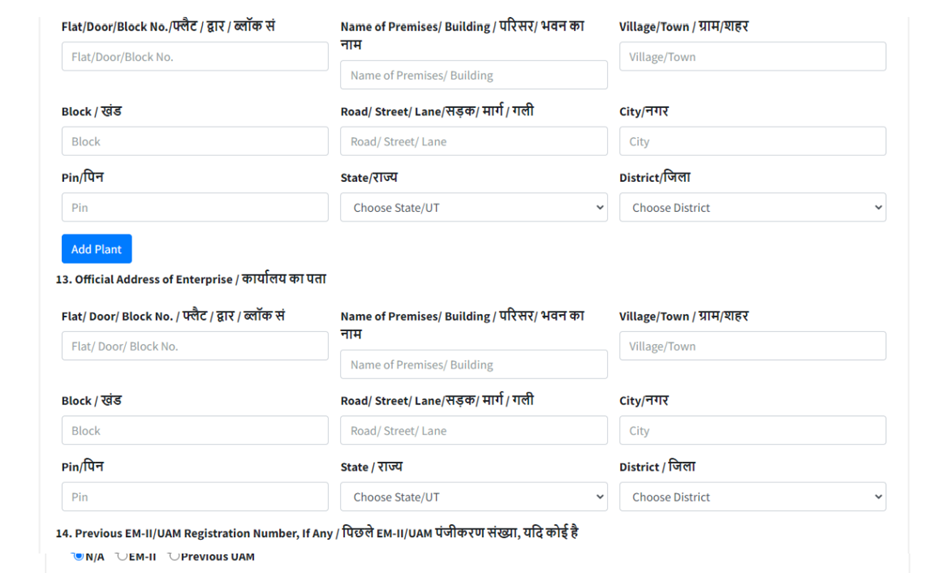

After entering these, the portal will prompt you to fill out your business details, including your business location, type of organization, and industry sector. Take a few moments to check each entry – a small typo here can lead to delays or complications later. There’s no need to rush; the portal autosaves, so you have some flexibility to double-check your information.

If you’re unsure about any of the fields, the Udyam portal provides helpful tips next to each box. Think of it as having a virtual assistant guiding you along. Simply click on the question mark icons to get short explanations of what each field requires.

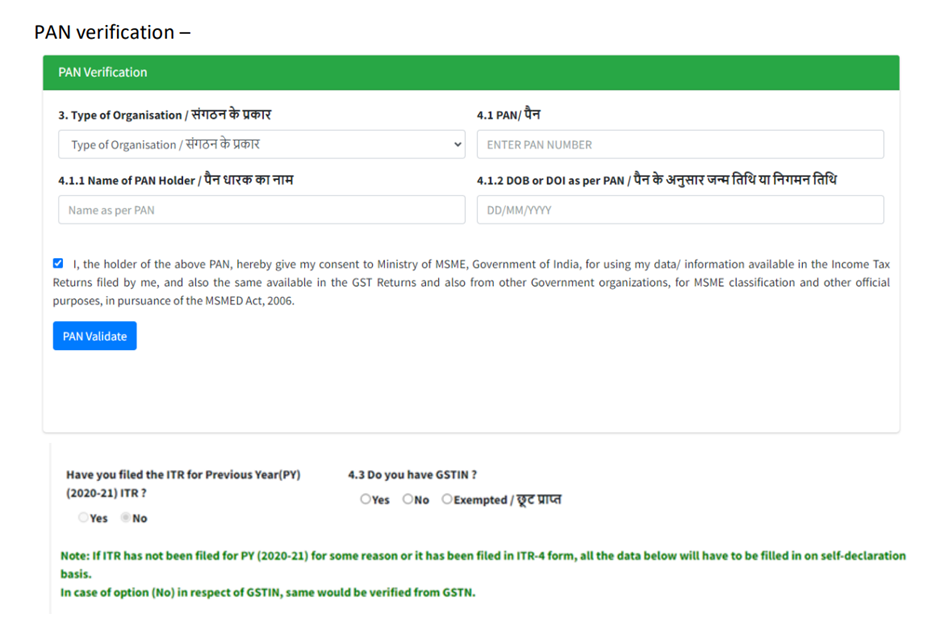

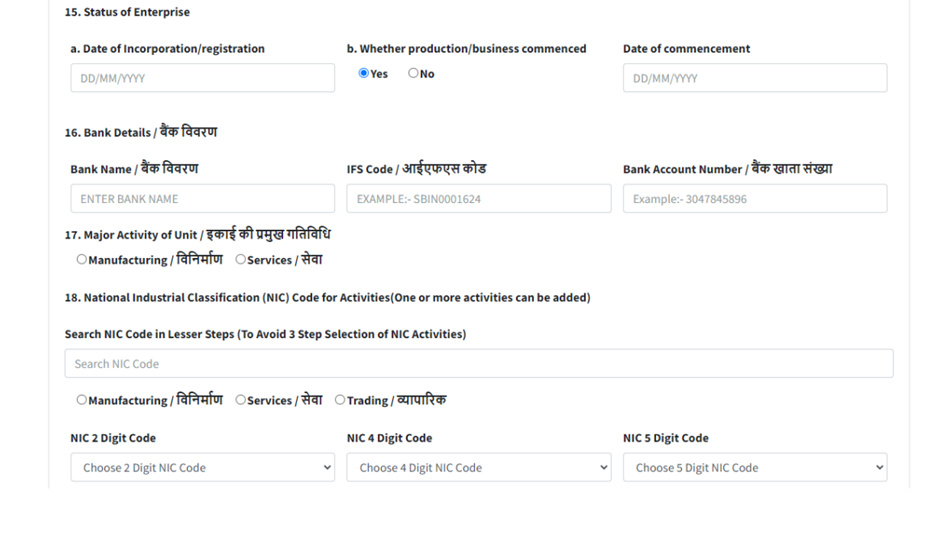

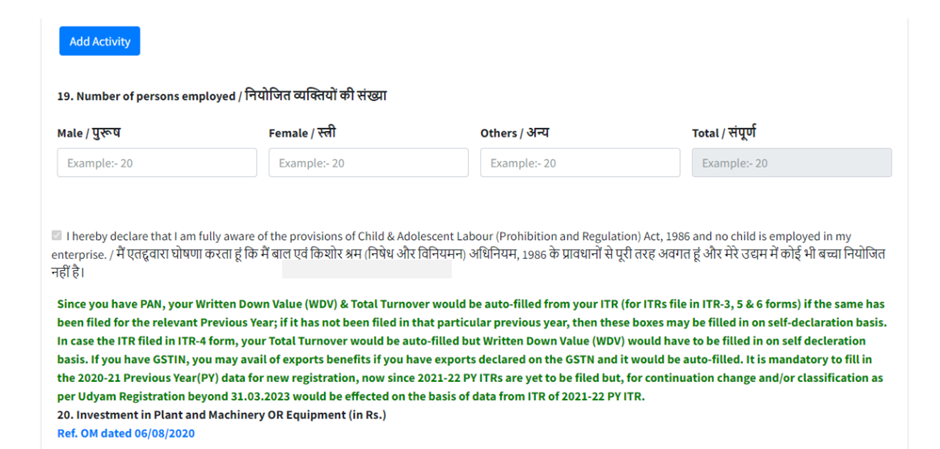

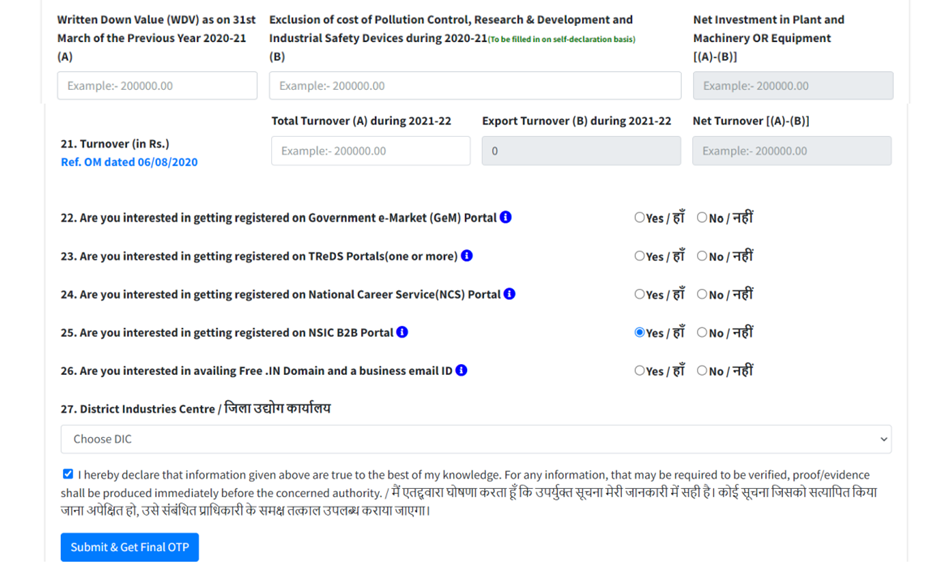

In this section, you’ll need to enter your investment in equipment or machinery and annual turnover. These numbers are essential, as they help determine whether your business qualifies as a Micro, Small, or Medium Enterprise. Be sure to use accurate figures based on your financial records.

If you’re unsure about your business’s exact numbers, don’t worry – a rough estimate usually works as long as it’s within the ballpark. Remember, these figures are used to assess the scale of your business, so the government knows what support you qualify for. Having realistic numbers will also help you benefit from the appropriate schemes.

Once you’ve filled in every field, it’s time to review everything. Think of this as the final check before hitting “submit.” Make sure all details, such as your Aadhaar number, PAN, and business information, are accurate. Small mistakes, like a misspelled name or wrong business address, can cause delays in your application.

After the final check, go ahead and click Submit! Once submitted, you’ll receive a reference number, which confirms that your application is in progress. Keep this reference number handy; it’s like a receipt for your registration. If there are any updates or issues, this number will help you track down your application.

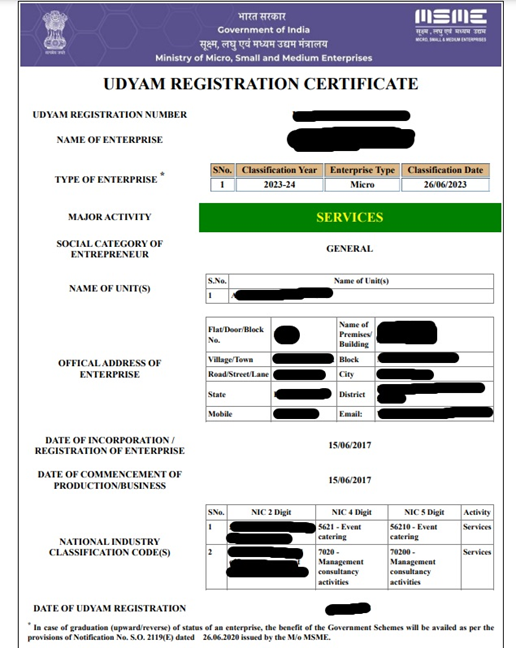

Once you submit your application, the waiting game begins – but don’t worry, it’s typically a short wait! Your application will be reviewed, and, if everything checks out, you’ll receive your Udyam Registration Certificate directly by email. This certificate is the official document confirming that your business is now recognized as an MSME under Udyam Registration.

The certificate will include your unique Udyam Registration Number (URN), which is essential for accessing the benefits and schemes available to registered MSMEs. Keep it safe! This document is your ticket to government programs, financial assistance, tax rebates, and other perks designed to support small businesses.

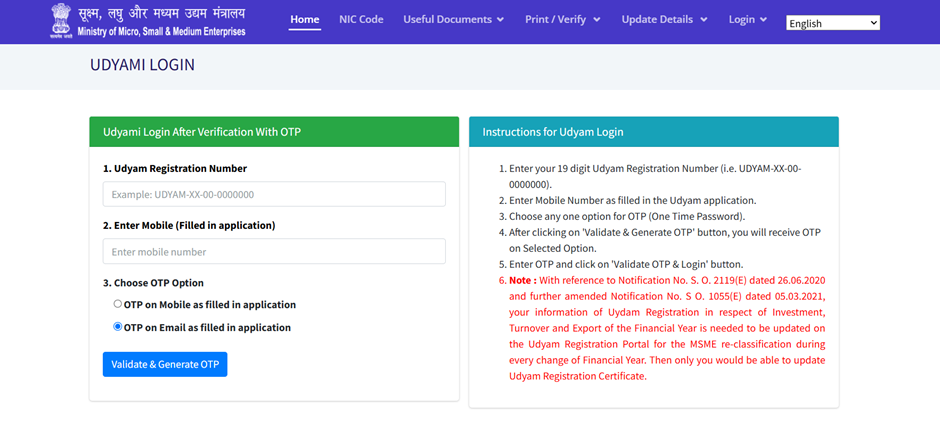

For Udyam Registration certificate download, follow these steps:

Step-1 Visit the Udyam Registration Portal: Go to the official Udyam Registration website.

Step-2 Access the Udyog Aadhar Download Section: On the homepage, locate the “Print/Verify” section, then select “Print Udyog Aadhar.”

Step-3 Enter Udyog Aadhar Number and Mobile Number: Provide your unique Udyog Aadhar number and the registered mobile number associated with it.

Step-4 Generate OTP: An OTP (One-Time Password) will be sent to your registered mobile number. Enter the OTP in the designated field.

Step-5 Download the Certificate: Once verified, you can view and complete your Udyog Aadhar download certificate in PDF format.

For more information click here to visit TMWala’s Udyam Registration Page.

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

"*" indicates required fields

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy