INTRODUCTION

A key accounting concept that enables companies to spread out the expense of physical assets over their useful lives is depreciation. It shows how assets deteriorate, wear down, or become obsolete over time. The article mentions the depreciation rates for 2024–2025. The depreciation rate as per the Income Tax Act varies based on the kind of asset and is crucial for determining permitted deductions for tax purposes. Businesses can more effectively manage their financial statements and tax obligations by being aware of the several methods of calculating depreciation.

Depreciation can be calculated in a variety of ways, each having unique uses and advantages. The Written Down Value method (WDV method) and the straight-line method are the most widely utilized. By adding a specified percentage to the asset’s book value annually, the WDV method of depreciation causes depreciation expenses to be higher in the early years and lower in the later years. The straight-line approach, on the other hand, uniformly distributes the depreciation over the asset’s useful life.

The way the depreciation expense is allocated over time is the difference between the straight line method and the WDV method. The WDV approach produces a declining charge over time, whereas the straight-line method yields a constant amount of depreciation.

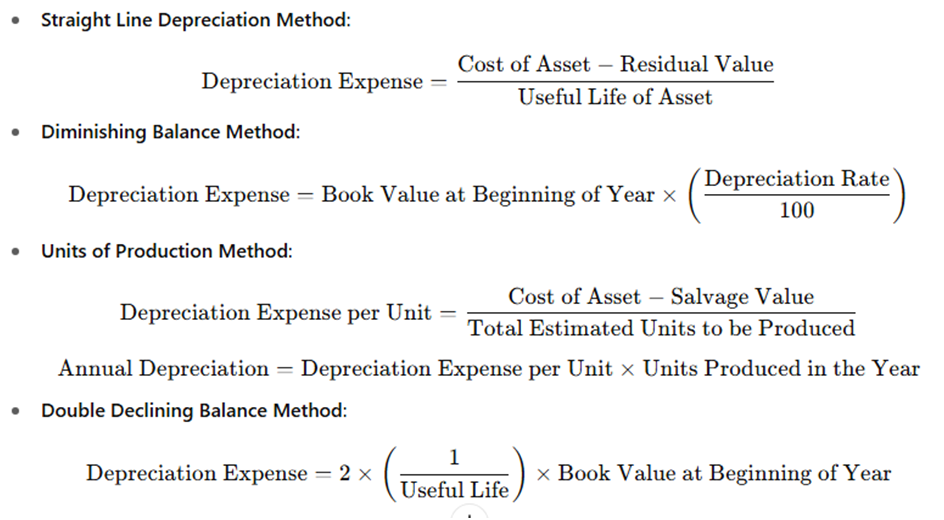

Understanding the formula for calculating depreciation, which typically includes the asset’s cost, residual value, and useful life, is crucial to calculating depreciation under any method. Accurate financial reporting and adherence to accounting and tax laws are further guaranteed by identifying the type of depreciation that applies to a particular asset.

By automating tax computations, streamlining depreciation tracking, and ensuring adherence to the most recent Income Tax Act regulations, TMWala helps businesses save time and lower the possibility of mistakes.

Depreciation, as used in taxation, is the gradual decline in an asset’s value brought on by wear and tear, obsolescence, or use. Businesses can reduce their taxable profits by deducting this value decline as a cost under the Income Tax Act.

Depreciation is a concept that allows companies to allocate the cost of both tangible and intangible assets over the expected course of their useful life. Depreciation is a tax-deductible expense under the Indian Income Tax Act of 1961, which lowers taxable income and, in turn, the tax obligation.

Depreciation under the Income Tax Act:

According to the Income Tax Act, the Income Tax Department classifies assets, each of which has a predetermined rate of depreciation. The rates are summarized as follows:

| ASSET TYPE | DEPRECIATION RATE |

| Residential Buildings | 5% |

| Commercial Buildings | 10% |

| Furniture and Fixtures | 10% |

| Plant and Machinery | 15% |

| Computers (including software) | 40% |

| Motor Vehicles (used for business purposes) | 15%-30% |

TMWala can offer integrated solutions that are suited to the asset structure of your company for the precise and current application of these rates in your accounting system.

The book value of an asset can be determined using various methods and types of depreciation expenses. The most commonly used depreciation methods include:

The amount of depreciation can be calculated using four main formulas. Let’s talk about each of them:

Different assets may have different methods of calculating depreciation and usable lives. For accounting and taxation purposes, depreciation methods may vary based on the industry and the type of asset. The two most commonly used techniques are the Straight-Line Method and the Written Down Value Method.

In addition to differences in depreciation rates, the primary distinction between the methods prescribed under the Companies Act and the Income Tax Act lies in the calculation approach.

Methods of depreciation as per the Companies Act, 1956:

Methods of depreciation as per the Companies Act, 2013:

Methods of depreciation as per the Income Tax Act, 1961:

The Written Down Value Method, or we can say WDV method of depreciation, is one of the most often used techniques for determining depreciation. The amount depreciated for any asset under this system is charged at a predetermined rate, although it is based on the asset’s declining value each year. Depreciation is charged on the negative side of the Profit and Loss A/C as a loss after being subtracted from the written-down value (i.e., cost less depreciation) of an asset. Because the depreciation is applied on the book value rather than the asset’s cost, the relevant asset experiences an uneven annual depreciation.

The difference between the SLM and WDV methods is explained below:

Depreciation is essential to accounting and taxation because it enables companies to lower taxable income and spread out the cost of an item over its useful life. Businesses must comprehend the depreciation rate as per the Income Tax Act to maintain compliance and correct financial reporting. The permitted deductions based on the type of asset are determined in part by the applicable rates, such as those shown for FY 2024–2025.

Depending on the asset’s characteristics and the company’s financial plan, there are several methods of calculating depreciation, and each has a distinct function. Among these, the WDV method of depreciation applies a fixed rate to the asset’s declining balance annually frequently employed under the Income Tax Act. This approach differs from the straight-line approach, which levies a fixed annual fee.

The main distinction between the straight line method and the WDV method is how depreciation is applied, either on the asset’s initial cost or its declining book value, which leads to either increasing or decreasing depreciation charges over time. To choose the approach that best suits their operational and reporting requirements, businesses must be aware of this disparity.

It is crucial to use the correct formula for calculating depreciation, which changes based on the method used, to apply these approaches accurately. Last but not least, choosing the right kind of depreciation guarantees accurate asset assessment and adherence to internal and legal accounting regulations.

Asset management and financial reporting are now more efficient than ever thanks to technologies like TMWala, which allow firms to automate depreciation tracking, maintain tax compliance, and generate reports instantaneously.

Get started instantly

TMWala

Your one stop shop for all your business registration and compliance needs.

Our Services

© Copyright TMWala. All rights reserved

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-