If you’re an employer or employee in India, you’ve probably heard about Employee State Insurance (ESI). But what exactly is it, and why should you care? ESI is a social security scheme specifically designed to protect workers from financial strain due to health-related issues. By offering medical care, disability support, and other benefits, ESI aims to support both employers and employees when life throws an unexpected curveball. Let’s dive into the details and see why Employee State Insurance is a must-know for every workplace.

The Employee State Insurance scheme was introduced in India to provide a safety net for employees during times of illness, injury, or disability. Think of it as health insurance with a twist: ESI doesn’t just cover medical expenses—it also provides cash benefits during periods when employees are unable to work. Funded by contributions from both employers and employees, the scheme helps reduce the financial burden on workers while ensuring that employers have a healthier, more secure workforce.

ESI is managed by the Employee State Insurance Corporation (ESIC), which handles everything from registration to claims processing. If you’re an employer, it’s important to note that all businesses with 10 or more employees are legally required to register for ESI. Employees earning a monthly salary of ₹21,000 or less (or ₹25,000 for those with disabilities) are eligible, making ESI accessible to millions of workers across the country.

ESI is primarily geared toward lower and middle-income workers who may find it hard to afford unexpected medical expenses. For employees, the benefits are substantial: ESI covers not only healthcare costs but also provides support if they need time off work due to illness, injury, or maternity. In short, employees can feel more secure knowing they won’t be left struggling financially if they have to take a break due to health issues.

But ESI doesn’t just benefit employees; employers benefit too. A healthy workforce is a productive workforce, and ESI helps ensure that employees get timely medical treatment, recover faster, and return to work ready to perform. By contributing to the ESI fund, employers demonstrate a commitment to their team’s well-being, which can help improve morale and reduce turnover. Plus, offering ESI coverage can make your company more attractive to potential hires, giving you an edge in the talent market.

So, what exactly does ESI cover? One of the most important benefits is medical care. Registered employees and their dependents have access to a network of ESI hospitals and dispensaries across India, where they can receive medical treatments for a range of conditions, including long-term illnesses and surgeries. The best part? The treatment is cashless, which means employees don’t have to worry about upfront costs.

Besides medical care, ESI also offers cash benefits during recovery periods. If an employee is sick or injured, they can receive a percentage of their wages while they’re off work, ensuring they have some income support. There’s also a maternity benefit for female employees, covering time off during pregnancy and postpartum recovery. ESI even offers financial support to family members if an employee passes away due to a work-related injury—proving just how comprehensive the scheme really is.

ESI is not just a legal requirement for many employers; it’s also a valuable tool for fostering a secure and motivated workforce. Unexpected health expenses can throw anyone’s life into chaos, and ESI provides a much-needed safety net. Employees who know they have medical coverage are less likely to feel stressed, which contributes to a healthier work environment overall.

For employers, ESI can play a crucial role in reducing absenteeism and boosting productivity. When employees have access to healthcare, they can recover faster, prevent worsening health issues, and return to work ready to contribute. It’s a win-win situation: employees feel supported, and employers benefit from a more stable and satisfied team. Plus, by complying with ESI regulations, companies avoid potential legal issues or penalties, making it a wise investment.

Implementing ESI might seem like a small step, but it can have a significant impact on long-term business success. Employees who feel secure about their health coverage are more likely to stay with a company, leading to lower turnover and reduced hiring costs. The ESI scheme’s focus on preventive healthcare also means fewer sick days, helping businesses maintain productivity.

ESI can also foster a positive reputation for your business. Companies that prioritize employee well-being often find it easier to build a strong brand image and attract top talent. In today’s job market, employees value workplaces that care about their physical and mental health. By offering ESI, your company sends a clear message that it’s invested in the long-term welfare of its team.

Eligibility Criteria for ESI Registration: Who Needs It?

If you’re thinking about registering for Employee State Insurance (ESI), understanding the eligibility criteria is the first step. ESI is a fantastic scheme that provides employees with medical care, disability benefits, and other social security perks. However, not every employer or employee is automatically covered. There are some key conditions that determine who must register and who can benefit. So, let’s break it down and make sure you know if you’re eligible for this valuable coverage.

First things first: not all businesses are obligated to register for Employee State Insurance. The registration requirement depends on the number of employees and their wages. In India, businesses with 10 or more employees must register for ESI, but this number can vary in some states, where the threshold might be lower. So, if you’re a small business owner with fewer than 10 employees, you’re generally not required to register for ESI, but it’s always a good idea to double-check your local regulations.

When it comes to employee wages, ESI applies to workers earning ₹21,000 or less per month. This wage limit applies to most employees, but if an employee is physically challenged, the wage limit increases to ₹25,000 per month. This means that even if your employees work part-time or are temporary workers, they could still be eligible for ESI benefits if their wages fall below the specified threshold.

Now that we know which employers need to register, let’s look at the employees who can benefit from Employee State Insurance. For workers to qualify for the ESI scheme, they must be employed with a company that has registered under the ESI Act. If your business meets the criteria (10+ employees and a salary within the wage limit), your workers can access various ESI benefits, including health insurance, maternity leave, disability benefits, and even death benefits in certain cases.

Employees earning ₹21,000 (₹25,000 for differently-abled workers) or less per month are eligible for these benefits, and this includes both full-time and part-time workers. So, if you run a business and have workers who fit this description, they are entitled to coverage under the Employee State Insurance scheme. For employers, it’s important to keep track of salary updates and changes to ensure the right employees are enrolled in the scheme.

One thing to note is that the ESI benefits extend not only to the employee but also to their family members, such as spouse, children, and in some cases, parents. This makes ESI a comprehensive solution for families who may need access to medical care or financial support during difficult times.

You might be wondering, “What if my business doesn’t meet the 10-employee threshold?” Well, good news! There’s a voluntary option for employers and employees to opt for ESI coverage. While the scheme is mandatory for businesses that meet the employee and wage criteria, it’s also open to other companies on a voluntary basis. If you’re a small business with fewer than 10 employees but still want to offer ESI benefits, you can opt to join the scheme voluntarily.

Voluntary registration allows businesses of any size to enjoy the advantages of ESI without being forced by law to do so. This can be a great move if you want to provide a safety net for your workers, especially if they’re on lower wages or working in high-risk environments. For employees, this means access to medical care, sickness benefits, and more. While it’s not mandatory, voluntary ESI registration shows that your business cares about the well-being of its workers, which can improve employee loyalty and morale.

ESI is typically aimed at low- to mid-income workers, but what happens if an employee earns slightly more than the wage limit? The rules are pretty clear on this. If an employee’s salary exceeds ₹21,000 per month, they are no longer eligible for ESI benefits, unless they are differently-abled, in which case the wage limit is ₹25,000.

This is where things can get tricky. As an employer, it’s essential to track the salaries of your employees closely. If an employee’s pay goes above the wage limit for the scheme, they will no longer be eligible for coverage, and you’ll need to update your records accordingly. However, it’s important to note that this doesn’t mean you can’t offer other types of insurance coverage for these employees. Many companies choose to offer private health insurance for higher-wage workers who aren’t covered by ESI, so there’s still an option to ensure their well-being.

For employees who fall under the wage limit, being covered by ESI is a huge advantage, as it gives them access to a range of benefits, including health insurance, maternity benefits, and disability support. These benefits make ESI one of the most valuable schemes for workers in India, especially for those in lower-income brackets.

Knowing who is eligible for Employee State Insurance and understanding the criteria is essential for both employers and employees. For employers, it ensures compliance with the law and avoids any penalties or legal issues. It also helps ensure that your workforce is covered in the event of illness or injury, which boosts morale and productivity.

For employees, understanding the eligibility criteria means they can take advantage of this comprehensive benefit scheme, knowing that they will have access to medical care, sickness benefits, and financial support during challenging times. Whether you’re an employer or an employee, understanding how to navigate the ESI registration process and its eligibility criteria is key to making the most of the benefits it offers.

Registration Process: Step-by-Step Guide to Register with Ease

So, you’ve decided to register for Employee State Insurance (ESI) and want to make sure the process goes smoothly. Whether you’re an employer or an employee looking to understand how it all works, you’re in the right place. The good news is that registering for Employee State Insurance is not as complicated as it may seem.

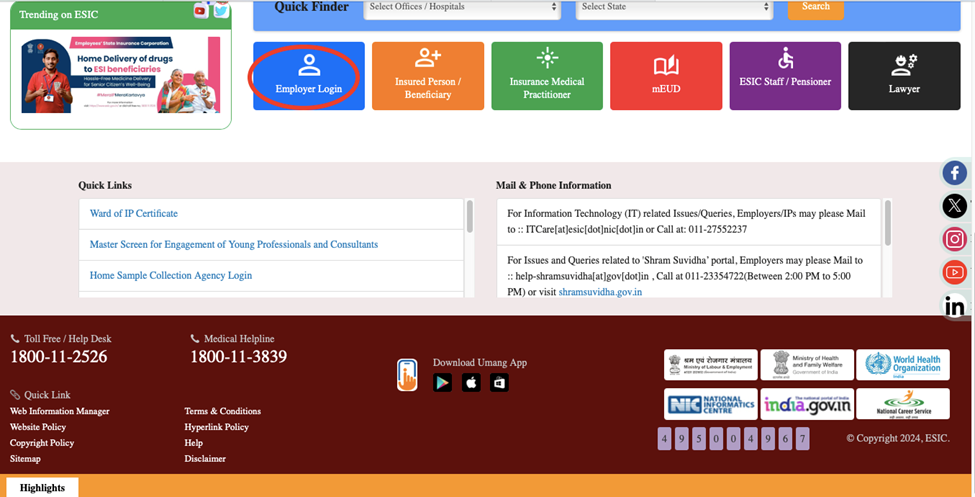

Step 1: In order to register yourself the first step is to visit the official Employee State Insurance Corporation (ESIC) website ESIC Portal.

On the homepage, when you scroll down you will find the option to “Employer log In” option where you have click.

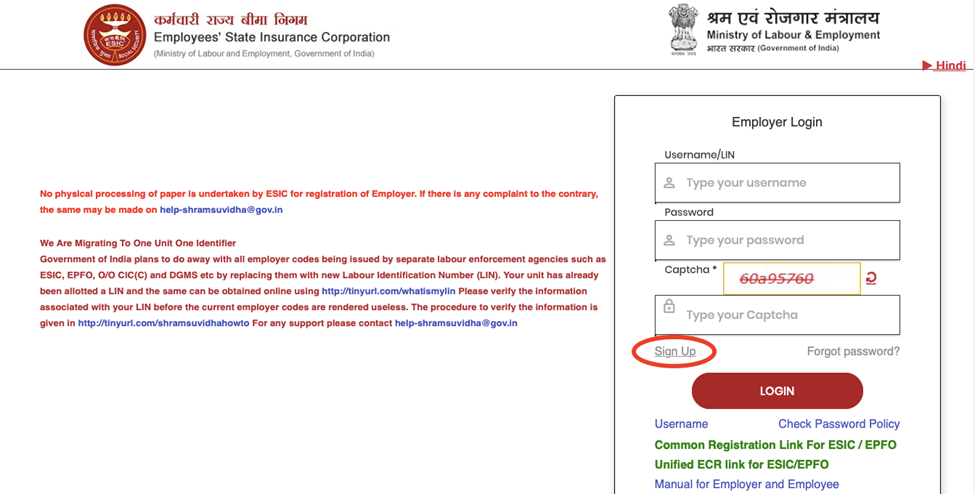

Step 2: After you click on the “Employer log in “you will be redirected to the log in page where you will have to click on the “sign up” button.

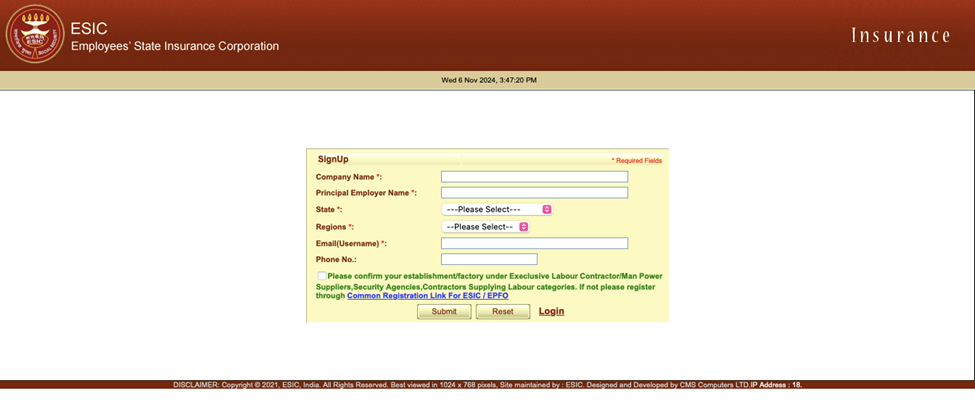

After you click on the button you will be redirected to the page where you will have to complete the sign-up procedure. For completing the process click on the box and click on the” submit” button.

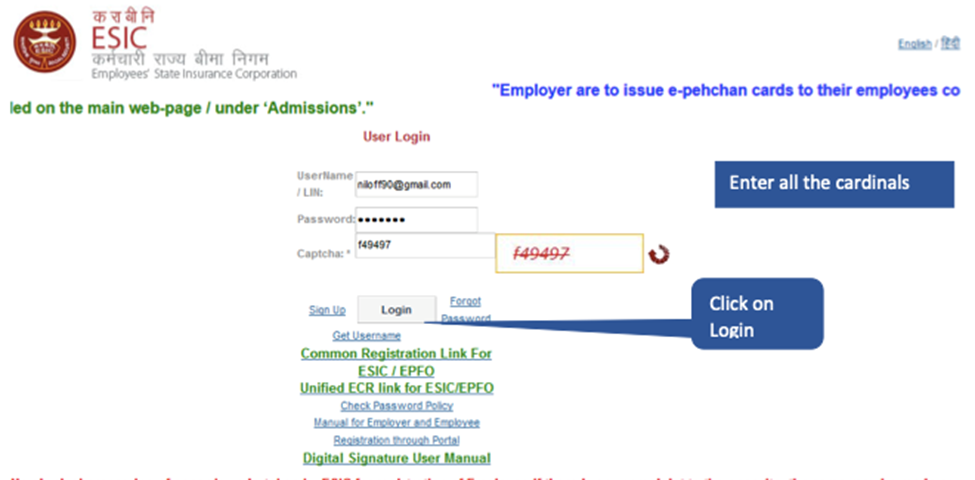

Step 3: Again, go back to portal of the Employee State insurance corporation website. And again go back to the “log in” page and fill in with all your cardinals sent through mail .

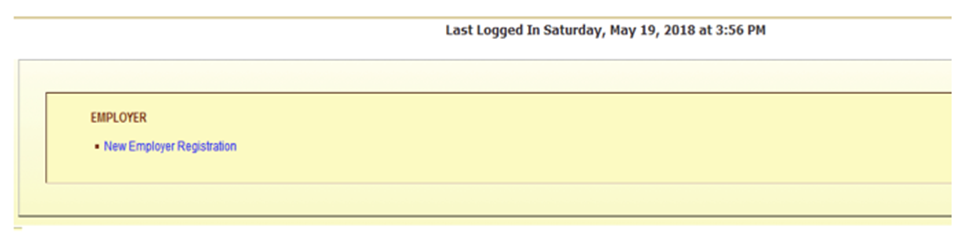

Step 4: Click on the “New Employer Registration”.

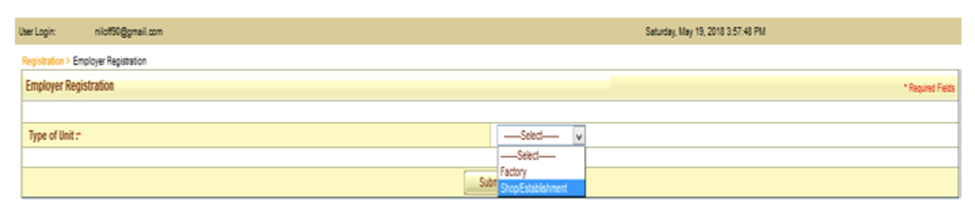

Step 5: Select type of unit and click on “submit” button.

Step 6:

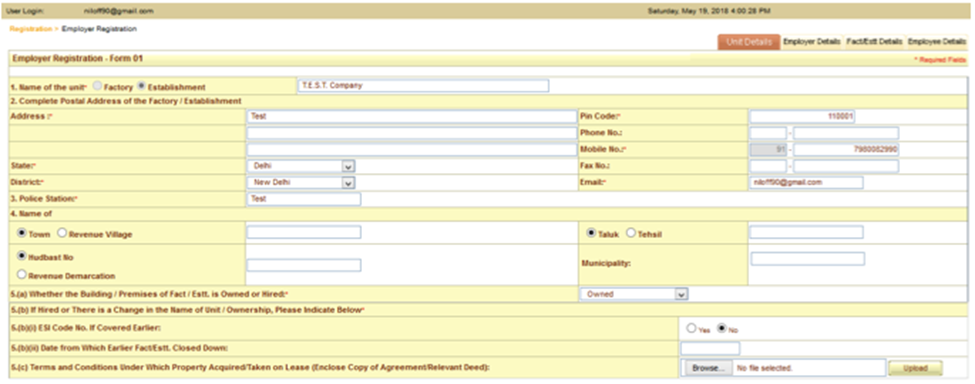

1. Enter the Name of Unit

2. Complete Postal Address of factory/Estt., State, District, pin-code, Email Address.

3. Police Station

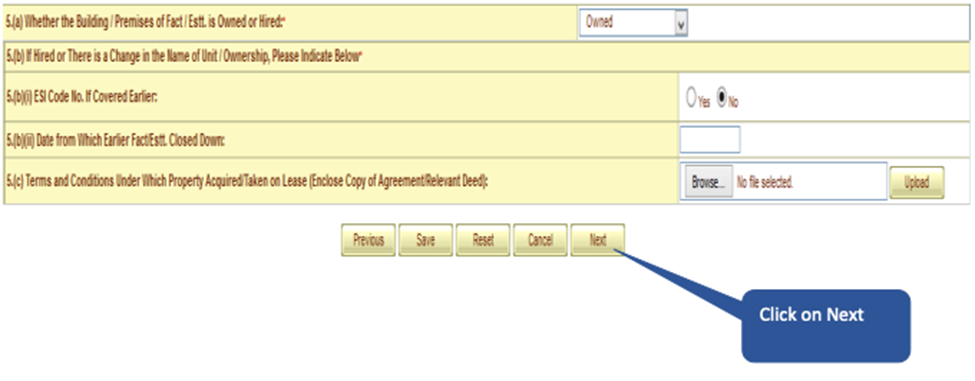

Step 7: select: whether the building/premises of fact/Estt Is owned/ hired

Click next to proceed, Rest to enter details , Cancel to exit and save to save the data.

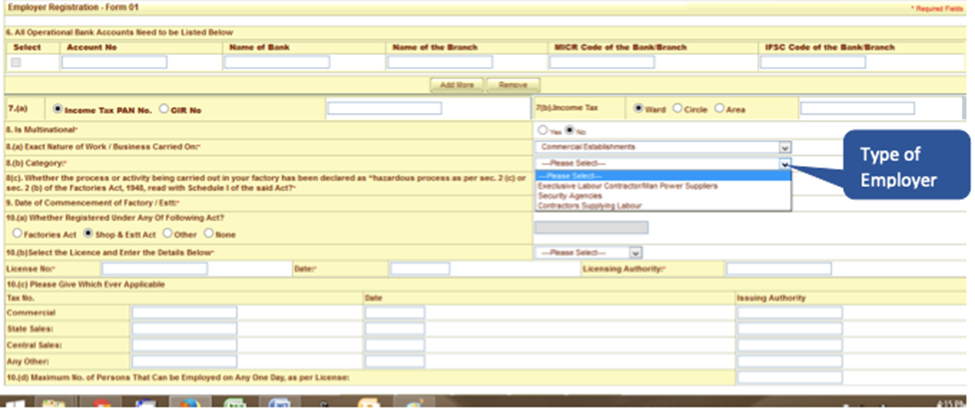

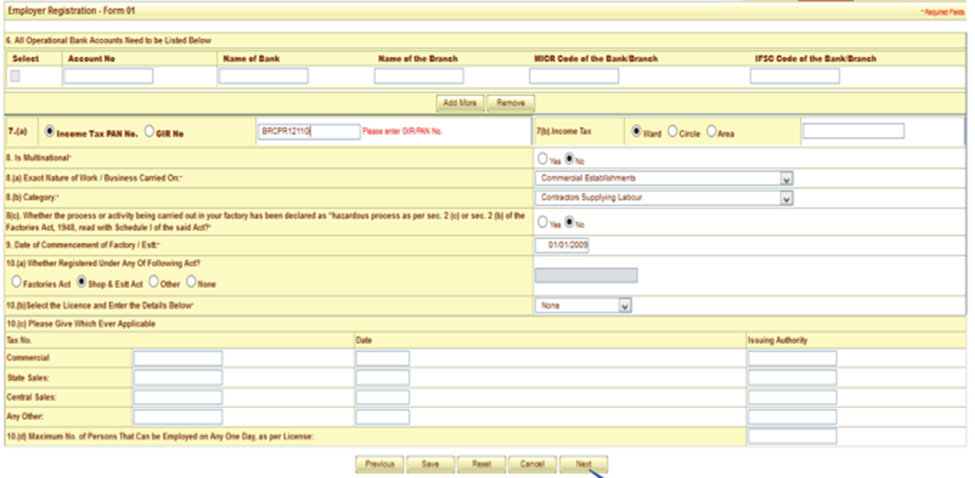

Step 8: Enter the details like” Nature and name of the business”,” PAN” details and etc.

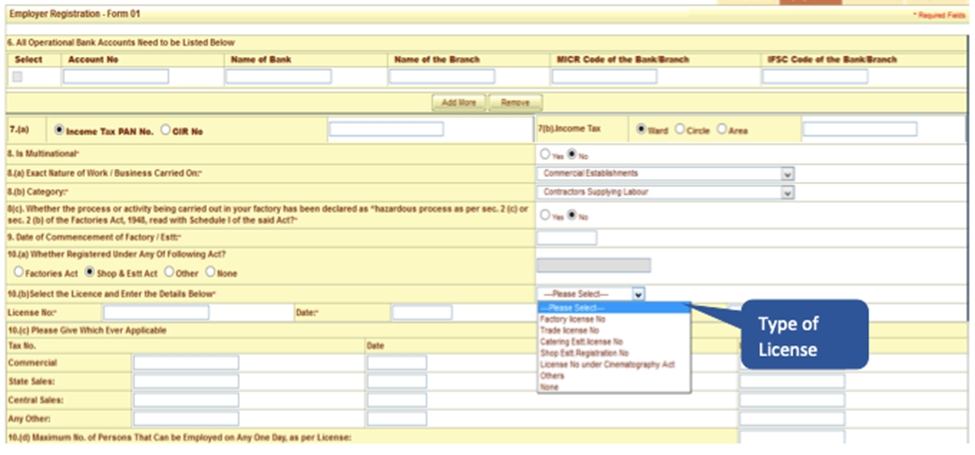

Step 9: Next step is to enter the details like “Date of commencement of the Factory, “License details” (if any).

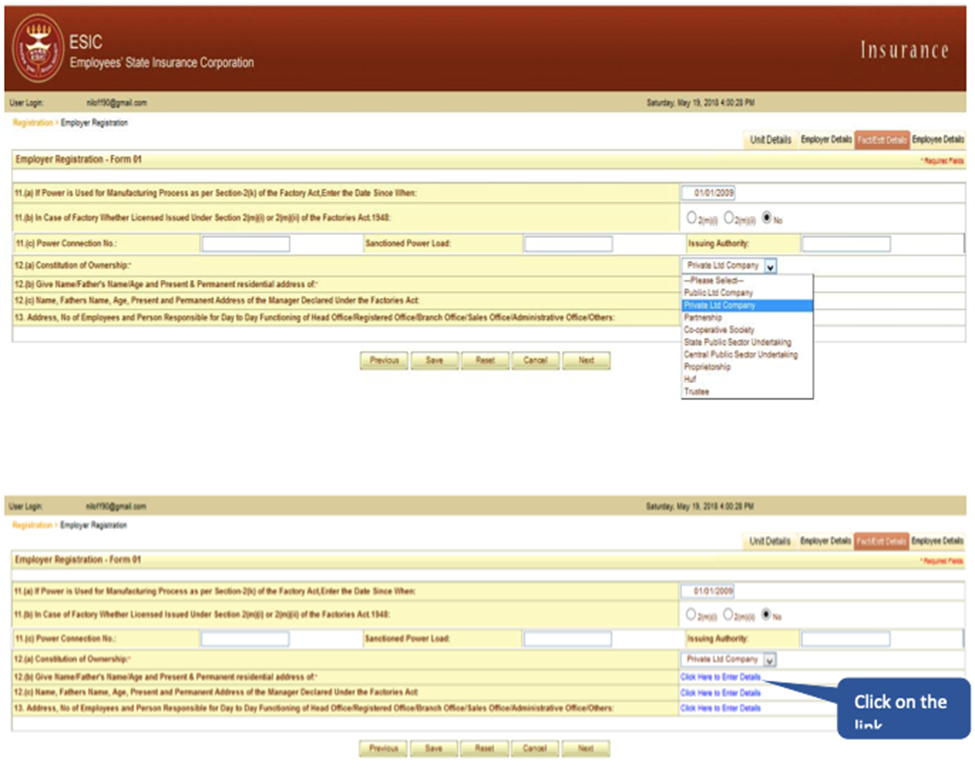

Select “Constitution of owner” and “Details of Owner”.

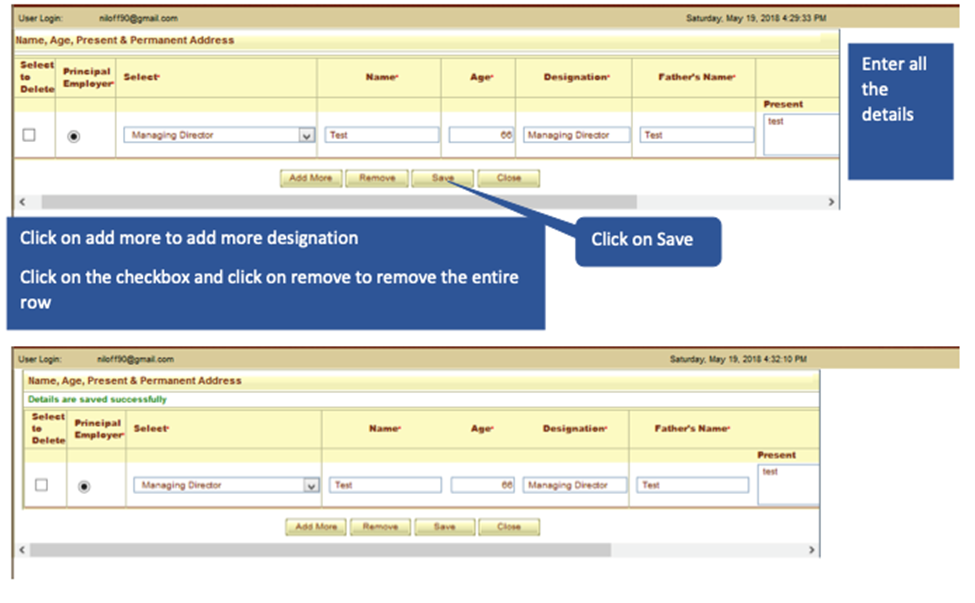

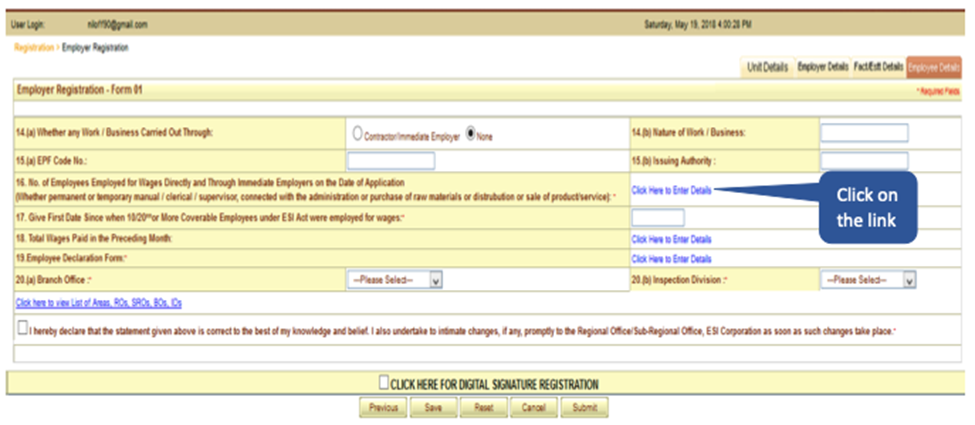

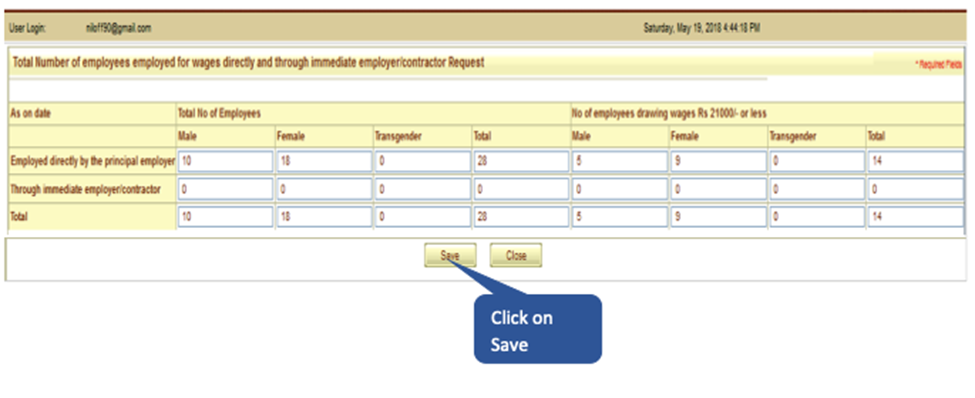

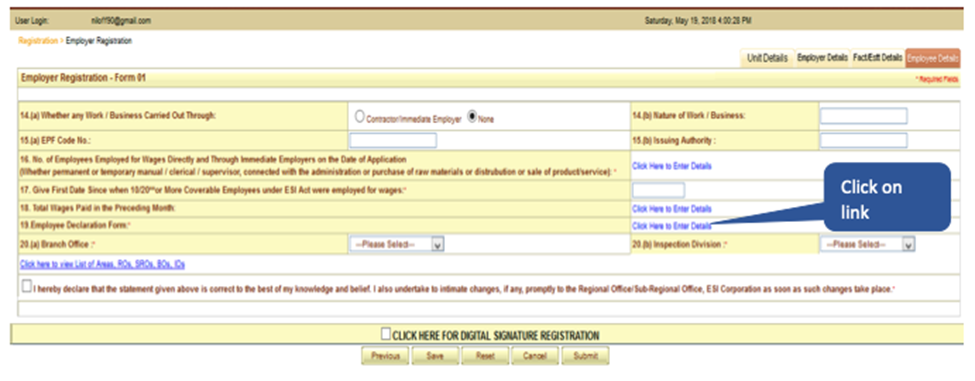

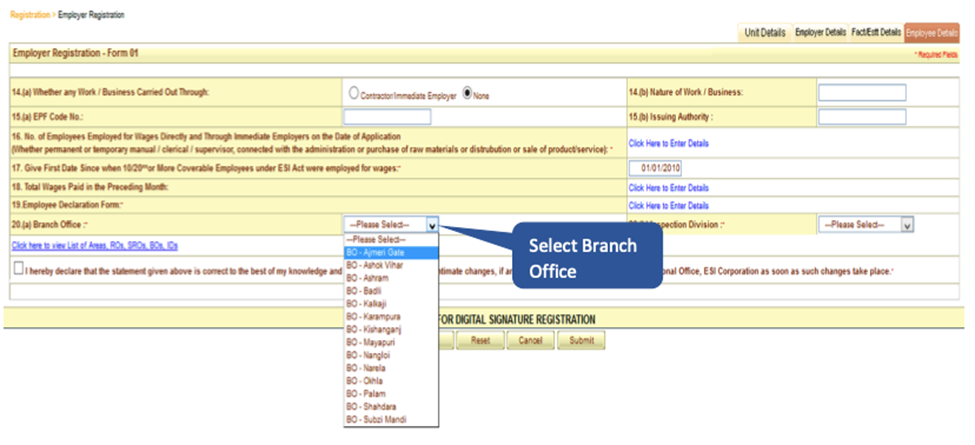

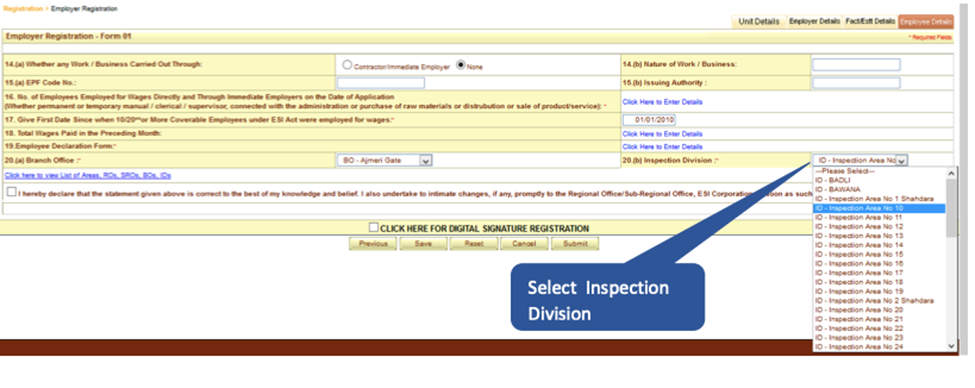

Step 10: Click on the “Sr. 16” to ” enter the details of the No. Of employees working”.

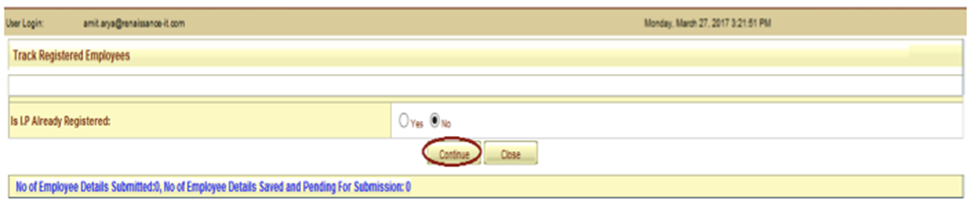

Step 11: Enter the details of the total no. Of employees and click on the employee declaration form. Click on the button of ’YES’ if you have the IP already registered and ’NO’ if IP is not registered.

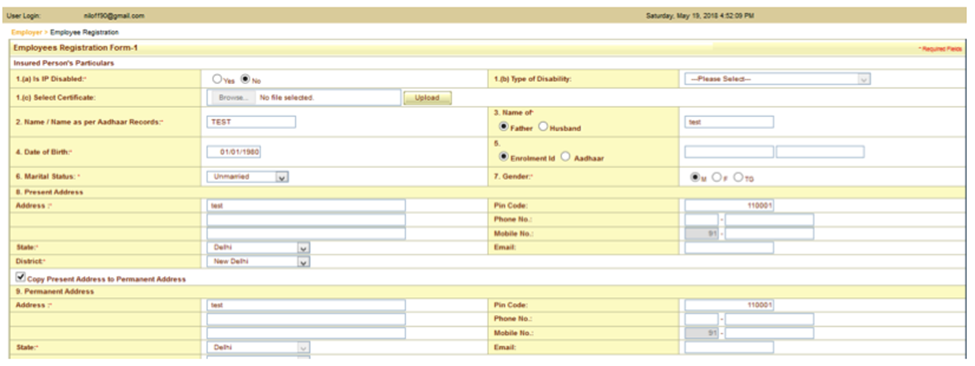

Step 12: Enter all the details like ’Name of IP’ & ’Name of IP’s Father’ ’address’, ’DOB’, ’Gender’ and ’marital status’.

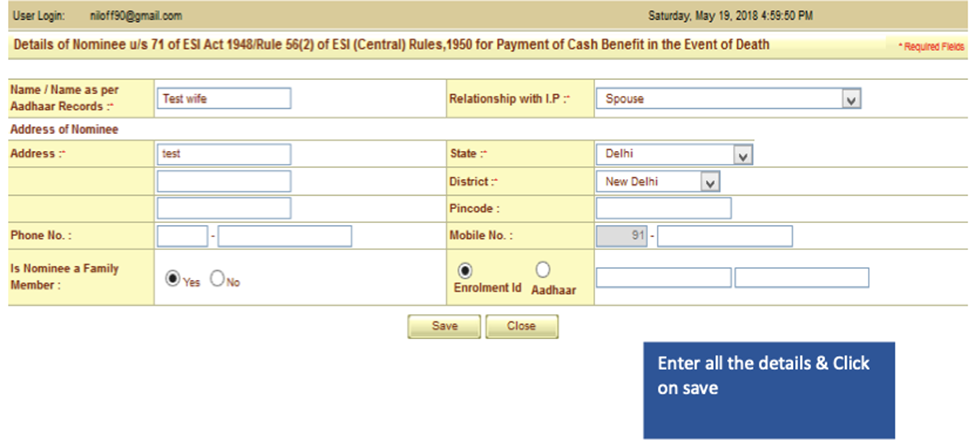

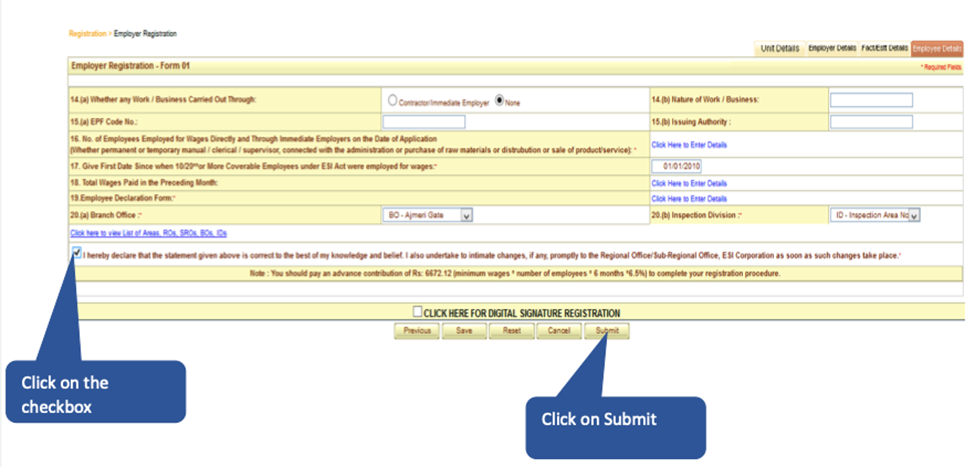

And then fill in the Permanent address and Date of joining, Nominee details and filling details- Check the declaration and submit.

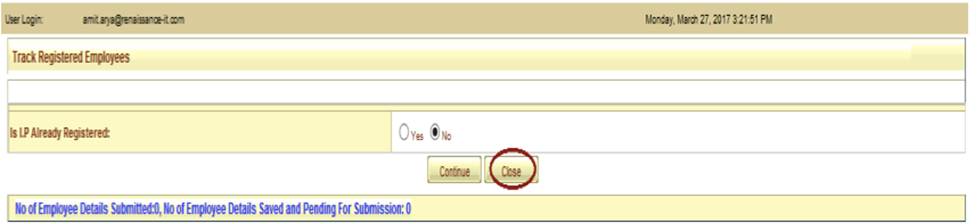

Step 12: After sucessfully filling the details of minimum 10 (for factory)/ 20 (for establishment) IPs click on the ’close’ button.

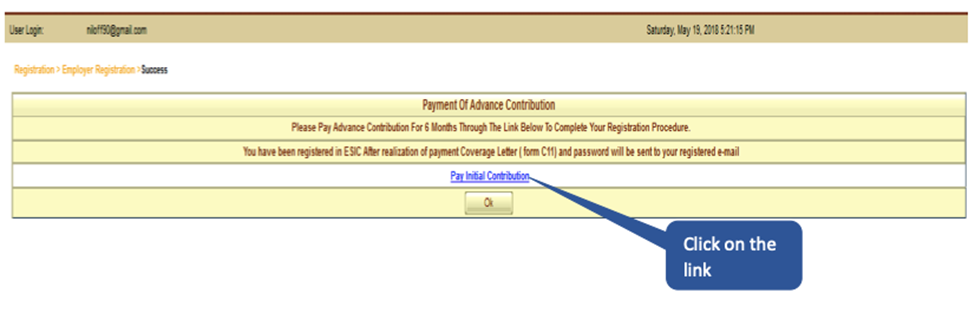

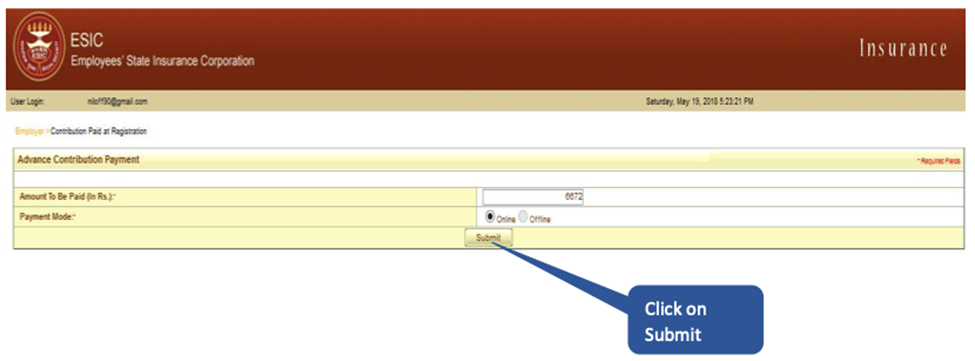

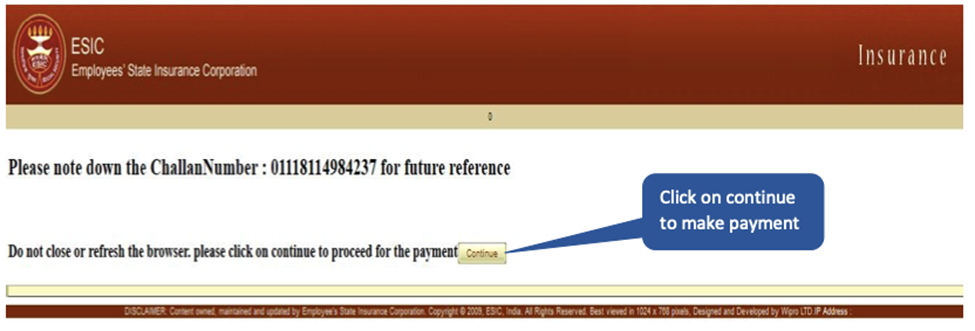

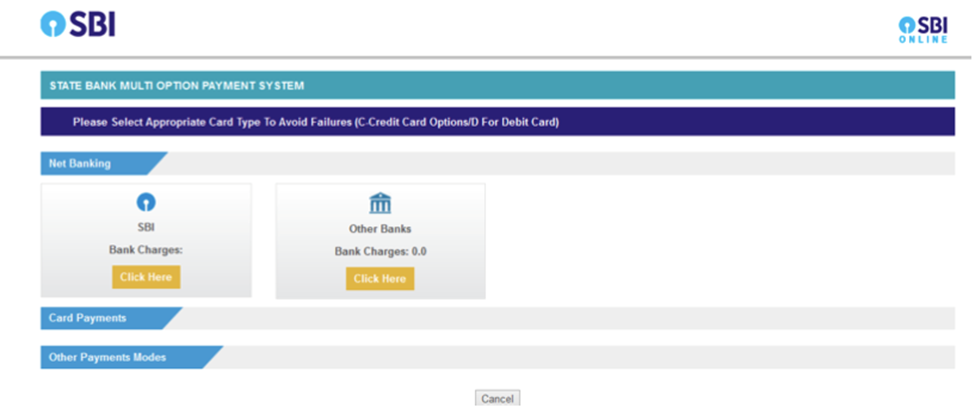

Step 14: Complete the process with making the payment.

Employer will receive the System generated Registration Letter (C-11) on registered email id once challan get realized from the bank, The C-11 is a computer-generated letter and does not require any signature and can be used as a valid proof of registration of the unit under ESI Act.

The Employee State Insurance Corporation (ESIC) scheme is a must-know for any employer in India. If you’re new to this topic or looking to brush up on your knowledge, you’re in the right place. Navigating ESI compliance might seem tricky, but with the right tips and a little guidance, it can be smooth sailing. In this section, we break down key points that will help you understand ESI compliance better and unlock its benefits for your business and employees.

The first step in ensuring ESI compliance is knowing who needs to be covered. The ESI scheme applies to establishments with 10 or more employees earning a monthly salary of up to ₹21,000. As an employer, it’s your responsibility to check eligibility and register your company with the Employee State Insurance Corporation as soon as you meet the criteria. Missing the registration deadline can result in fines, so don’t put it off. Registration is easier than you might think and can now be done online, saving you time and effort.

You need to know the contribution rate for ESI to ensure compliance. Employers contribute 3.25% of the employee’s wages, while employees contribute 0.75%. This is a small investment for a big impact on employee welfare. Accurate and timely deductions are crucial, as late payments or incorrect deductions can lead to penalties from the Employee State Insurance Corporation. Regular audits of your payroll system can help you stay compliant and avoid any surprises. Keep your records organized and up-to-date to make the process hassle-free.

Filing ESI returns is an important part of your compliance duties. As an employer, you must file ESI returns every six months—by May 11th and November 11th. This is a legal requirement, so mark these dates on your calendar. Filing late or incorrectly can result in hefty fines and unwanted complications. The good news? The Employee State Insurance Corporation offers an easy-to-use online portal that makes return filing straightforward. Remember, timely submissions not only ensure compliance but also show your commitment to employee welfare.

Don’t just stop at compliance; make sure your employees understand the benefits they receive through ESI coverage. This scheme provides medical care, maternity benefits, disability compensation, and more, all managed by the Employee State Insurance Corporation. Regularly educating your staff about their entitlements boosts morale and helps them appreciate the deductions made from their wages. Consider sending out a simple guide or hosting a quick training session to explain the benefits. It’s a small effort that can make a big difference in how your employees perceive the scheme.

The Employee State Insurance Corporation conducts periodic inspections to ensure compliance. As an employer, you need to maintain accurate records, including payroll details, ESI contributions, and employee information. This might seem tedious, but proper documentation can save you a lot of trouble during audits. Invest in a reliable payroll software or assign a dedicated team member to keep track of these records. Being prepared means fewer disruptions and a smoother process during inspections. It also reflects well on your business, showing your commitment to legal compliance and employee welfare.

ESI policies and contribution rates can change, and staying informed is key to compliance. The Employee State Insurance Corporation regularly updates its guidelines, and missing these changes can result in compliance issues. Make it a habit to check for updates on their official website or subscribe to newsletters for timely information. You can also join industry forums or groups where employers share insights and updates. This way, you won’t miss any important notifications and can adapt your processes quickly.

Offering ESI benefits is not just about compliance—it’s a valuable perk that can enhance employee retention. Knowing their healthcare needs are covered by the Employee State Insurance Corporation makes employees feel secure and valued. Use this as a selling point when recruiting new talent and in discussions with current employees. It’s a great way to show that you care about their well-being beyond the workplace. In a competitive job market, this can give you a definite edge in attracting and retaining top talent.

If you’re struggling to keep up with ESI compliance, don’t hesitate to get professional help. Consulting with a payroll expert or legal advisor can save you time and prevent costly mistakes. The rules set by the Employee State Insurance Corporation can be complex, especially for new businesses. An expert can guide you through the regulations, ensure you’re following the correct processes, and help you implement an efficient system. It’s an investment that pays off in the long run by keeping your business compliant and reducing stress.

When you comply with the regulations of the Employee State Insurance Corporation, it’s not just about following the law—it’s about creating a healthy, secure workplace. ESI benefits are designed to protect your employees in times of need, reducing their financial burdens and giving them peace of mind. In return, you get a more motivated, loyal workforce that knows their employer values their well-being. It’s a win-win situation that fosters trust and long-term success for your business.

With these tips, you’re now better equipped to handle ESI compliance smoothly. Embrace it as part of your commitment to your team, and watch your business thrive as a result.

For more information contact TMWala today!

Get started instantly

"*" indicates required fields

TMWala

Your one stop shop for all your business registration and compliance needs.

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for MSME/Individual/Sole Proprietorships) Best-Selling, Economical & Easy

₹1,500.00 Original price was: ₹1,500.00.₹999.00Current price is: ₹999.00.

Trademark Application @ ₹999* (Basic Discounted Plan for Non-MSMEs/Large Entities) Best-Selling, Economical, Quick and Easy

Choose your Entity Type

Individual/ MSME/ Sole Proprietorships

Non-MSME/ Large Entities

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹4500/-

₹3,500.00 Original price was: ₹3,500.00.₹1,999.00Current price is: ₹1,999.00.

Government Fees

₹9000/-

Choose your Entity Type

Non-MSME/ Large Entitie

Individual/ MSME/ Sole Proprietorships

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for Non-MSMEs/Large Entities) Comprehensive

Government Fees

₹9000/-

₹9,000.00 Original price was: ₹9,000.00.₹3,999.00Current price is: ₹3,999.00.

Trademark Application @ ₹3999* (Premium Discounted Plan for MSME/Individual/Sole Proprietorships) Comprehensive

Government Fees

₹4500/-

"*" indicates required fields