Understanding the Corporate tax rate in India is essential for every business operating in the country. Whether you are a domestic company, a newly incorporated manufacturing entity, or a foreign enterprise with operations in India, knowing the applicable rates, surcharges, and compliance requirements helps in effective financial planning and regulatory adherence. Corporate taxation in India […]

The Indian Partnership Act 1932 is one of the most important legislations governing partnership businesses in India. It lays down the legal foundation for forming, operating, and dissolving partnership firms while clearly defining the relationship between partners and their obligations toward each other and third parties. For entrepreneurs who prefer a flexible and comparatively simple […]

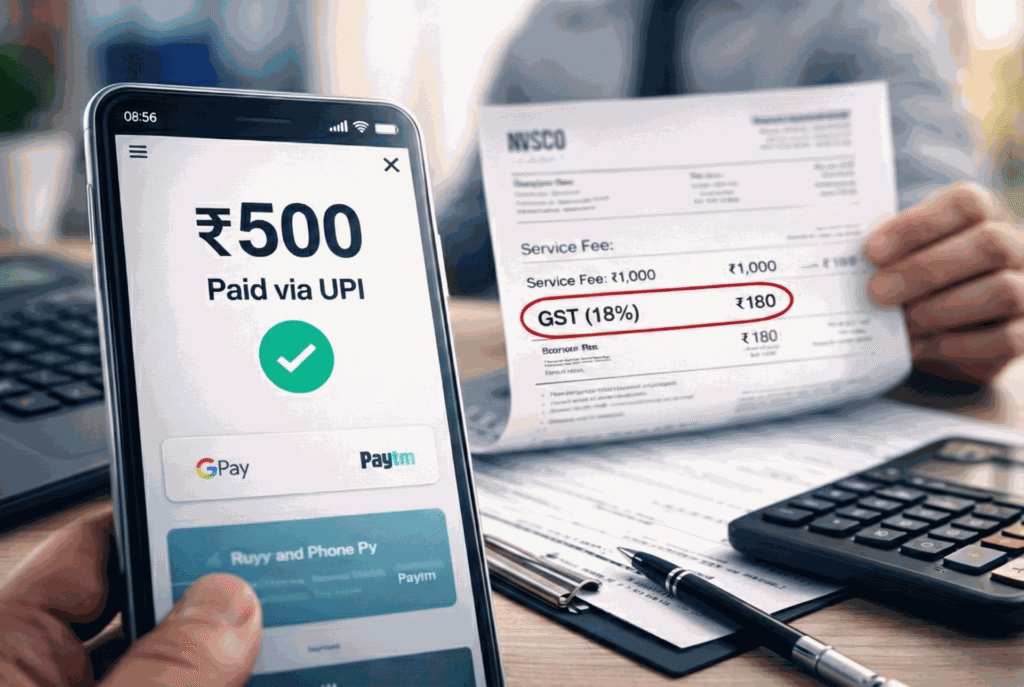

Your customer pays ₹500 via UPI. The money gets into your account. Simple. But then you open your payment gateway dashboard at the end of the month and find a line item asking, “Is there GST on UPI payment?” You were told UPI is free. So what exactly are you paying? This confusion trips up […]

When a business decides to discontinue operations and cancel its GST registration, the compliance journey does not end with cancellation. One of the most critical post-cancellation obligations is filing the GSTR-10 return, commonly referred to as the GSTR-10 final return. This return formally concludes the taxpayer’s responsibilities under GST and ensures that all outstanding liabilities […]

The concept of place of supply under GST is the backbone of India’s Goods and Services Tax framework. Since GST is a destination-based tax, revenue accrues to the state where goods or services are actually consumed, not where they originate. This makes determining the correct place of supply essential for identifying the nature of the […]

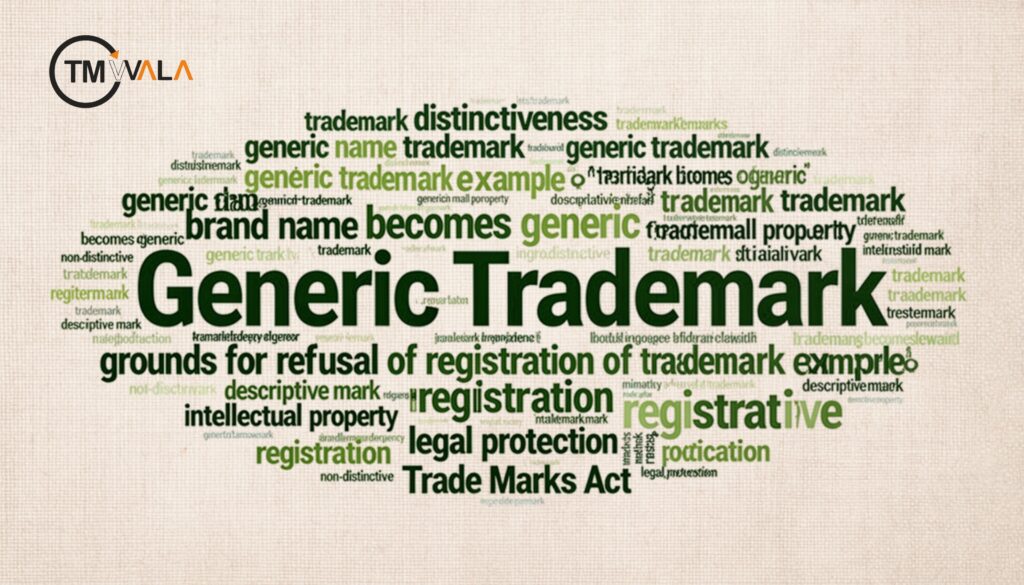

In the dynamic world of intellectual property, trademarks serve as powerful business assets. They protect brand identity, build consumer trust, and distinguish one company’s goods or services from those of competitors. However, not every word or term can function as a trademark. One of the most common and critical barriers to registration is genericness. Understanding […]

In the evolving world of business, scaling up often brings complexity. You might find yourself managing multiple ventures, assets, and liabilities all under one roof. This is where a holding company comes into play. It is a powerful strategy used by the world’s most successful corporate groups to organize their empires, protect their assets, and […]

Commission and brokerage arrangements are an integral part of modern trade and commerce in India. From real estate brokers and insurance agents to export facilitators and marketing representatives, intermediaries play a crucial role in connecting buyers and sellers and enabling smooth business transactions. However, with the implementation of the Goods and Services Tax (GST) regime, […]

Food safety is no longer limited to routine inspections and end-product testing. In today’s regulatory and business environment, food businesses are expected to demonstrate structured control over hazards, transparent processes, and documented compliance. This is where a food safety management system becomes essential. In India, the regulatory framework supporting such systems is robust and continually […]

The Goods and Services Tax (GST) transformed India’s indirect taxation system by replacing multiple state and central taxes with a unified structure. While the GST framework is broadly consistent across the country, its implementation varies in Union Territories due to their distinct administrative setup. This is where UTGST (Union Territory Goods and Services Tax) plays […]

Access to justice is a cornerstone of democratic societies, yet for millions in India, it remains a distant ideal. With over 50 million cases pending across Indian courts and the legal process often being complex, time-consuming, and expensive, there has been a growing shift toward alternative means of dispute resolution. Among these, Online Dispute Resolution […]

Under the GST regime, businesses are generally required to issue a tax invoice when supplying taxable goods or services. However, there are specific situations where a tax invoice cannot be issued. Instead, the seller must issue a bill of supply under GST. This document serves as proof of a tax-free transaction and is particularly relevant […]

Marriage in India has traditionally been viewed as a sacred and lifelong union. However, with changing social dynamics and rising awareness about legal rights, couples today are increasingly exploring legal safeguards before entering marriage. One such safeguard is a prenuptial agreement in India. While common in Western countries, the concept is still evolving within the […]

Every company begins its journey with a legal identity, and this identity is built on two fundamental documents: the Memorandum of Association (MOA) and the Articles of Association (AOA). These documents are not mere registration formalities; they define the company’s purpose, powers, and internal governance framework from day one. For anyone planning to incorporate a […]

What is a GST number? Why does it matter for every business operating in India? Under the Goods and Services Tax (GST) regime, a GST Registration Number, commonly known as GSTIN, acts as the official identity of a registered taxpayer. Whether you are a startup, freelancer, MSME, or a large enterprise, knowing the GST number […]

Everyone believes that winning the lottery or some massive cash prize would completely change their lives. But many don’t realize that a hefty part of their winnings never reaches their pockets because of taxation. In India, however, taxation of lottery winnings and prize money follows a different constitution from the normal income tax regime. This […]

The introduction of Goods and Services Tax (GST) significantly transformed India’s indirect tax system by bringing uniformity and transparency. One of the key compliance mechanisms introduced specifically for the digital economy is TCS under GST. With the rapid growth of online marketplaces and digital platforms, the government needed a way to track transactions carried out […]

The implementation of the Goods and Services Tax (GST) has brought uniformity to indirect taxation in India, while also introducing a structured compliance framework for taxpayers. One of the most important obligations under this framework is the GSTR-3B return. This return acts as a summary declaration of a taxpayer’s GST liability and input tax credit […]

In today’s fast-moving digital product landscape, clarity is everything. Products often fail not because of poor engineering, but due to unclear expectations, misaligned teams, or shifting requirements. This is where a Product Requirements Document (PRD) becomes indispensable. Whether you are building a startup MVP or scaling an enterprise product, a well–written PRD document acts as […]

Tax Deducted at Source (TDS) remains one of the most important compliance mechanisms under the Indian Income Tax Act, 1961. For Financial Year 2025–26 (Assessment Year 2026–27), the government has notified updated and consolidated TDS rates applicable across a wide range of transactions. These rates impact individuals, Hindu Undivided Families (HUFs), firms, domestic companies, and […]

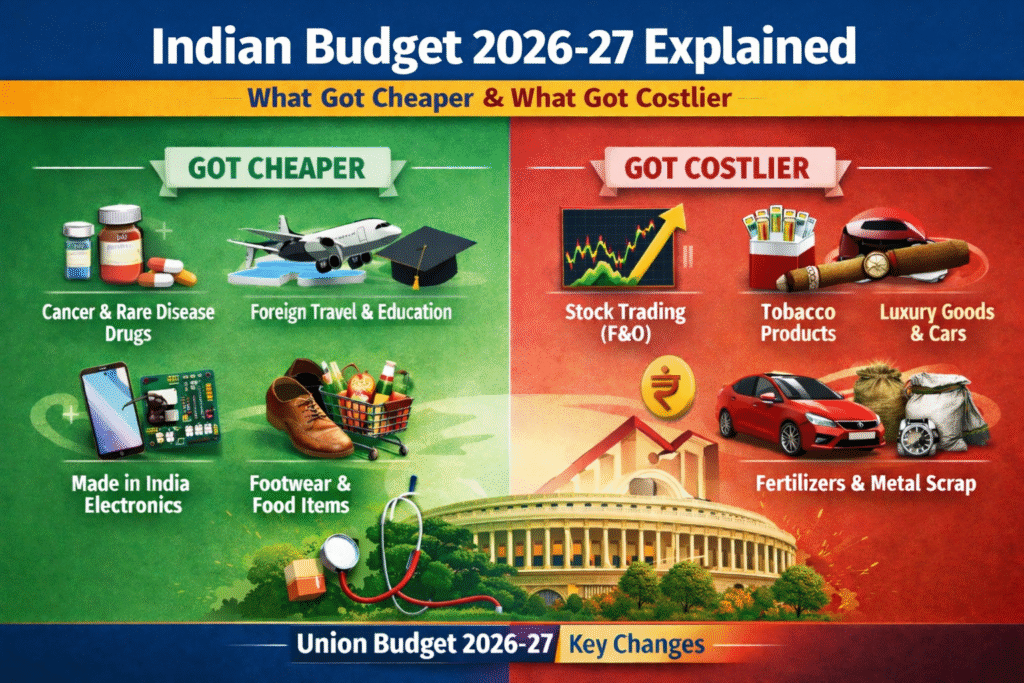

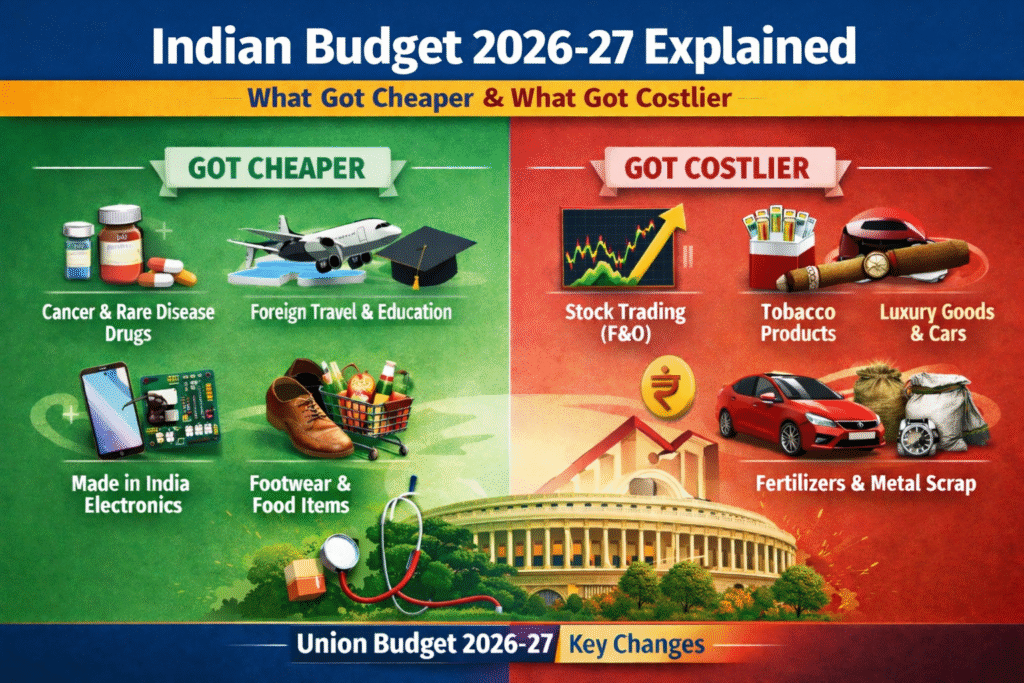

On February 1, 2026, Finance Minister Nirmala Sitharaman presented the Union Budget for the fiscal year 2026-27. If you are wondering how this financial roadmap affects your daily life, you are in the right place. This year’s budget focuses heavily on three pillars: strengthening healthcare, boosting domestic manufacturing, and maintaining fiscal discipline. While income tax […]

Limited Liability Partnerships (LLPs) have emerged as a preferred business structure in India due to their operational flexibility, limited liability protection, and reduced compliance burden compared to companies. However, despite their simplified framework, LLPs are still governed by statutory regulations under the Limited Liability Partnership Act, 2008. One of the most significant compliance aspects for […]

The Goods and Services Tax (GST) framework in India relies heavily on digital processes to ensure transparency, efficiency, and accountability. One of the most important identifiers generated within this system is the ARN number in GST. Whether you are applying for GST registration, submitting an amendment, or responding to a departmental notice, this number acts […]

Buying a home is a dream for many, but it can quickly turn into a nightmare without proper property verification in India. Research shows that over 40% of property disputes arise simply because buyers skip basic legal checks. Whether you are eyeing a trendy apartment or a quiet plot, performing due diligence of property in […]

As India stands at a critical economic juncture, expectations from the Union Budget 2026 are higher than ever. With global funding tightening, geopolitical uncertainty affecting exports, and regulatory compliance becoming increasingly complex, businesses, especially startups and MSMEs, are looking to the upcoming Budget for stability, liquidity, and long-term policy clarity. The upcoming Budget, to be […]

Running a business is never static. Addresses change, partners are added, contact details are updated, and sometimes even the structure of the business evolves. Since GST registration acts as the official identity of a business under Indian tax law, all details reflected on the GST portal must remain accurate and current. The Government of India […]

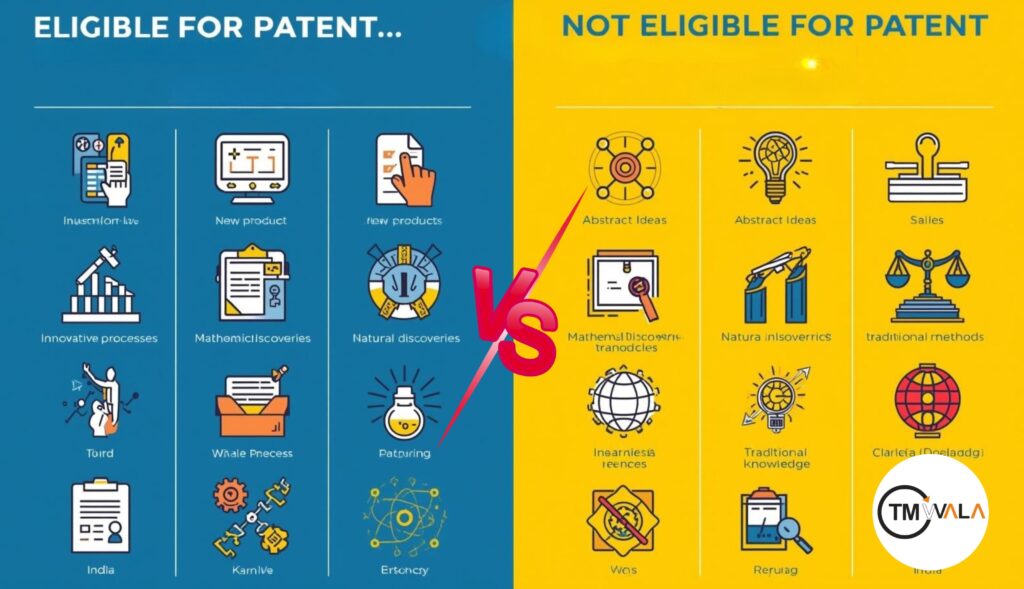

Innovation plays a vital role in economic growth, industrial development, and technological advancement. To encourage innovation, the legal system provides inventors with exclusive rights over their creations through patents. However, not every idea or discovery can be protected. Understanding Patent eligibility in India is essential for inventors, startups, researchers, and businesses aiming to safeguard their […]

Noida has rapidly emerged as a prominent business and technology hub in North India, home to startups, IT companies, designers, content creators, and digital entrepreneurs. With innovation and creativity at the heart of this growing ecosystem, protecting intellectual property has become more important than ever. Copyright registration serves as a vital legal mechanism to safeguard […]

Starting a restaurant, bar, or club in India is an exciting venture. The margins are attractive, and the demand is steady. But before you can pour that first drink, there’s a massive hurdle you need to clear: obtaining a valid liquor license. If you’ve been searching for the liquor license cost in India, you likely […]

The Reverse Charge Mechanism under GST is a key feature of India’s Goods and Services Tax system. Unlike the normal GST process, where the supplier pays tax, RCM under GST shifts the tax payment responsibility to the recipient (buyer). This system is vital for capturing tax from unorganized sectors and ensuring proper taxation of specific […]

In 2026, women entrepreneurs in India are playing a stronger role than ever before in shaping the economy. With improved access to digital tools, flexible work models, and supportive government policies, starting a business has become more achievable for women across urban and semi-urban India. Whether you are a homemaker, a working professional, or a […]

In the Indian corporate ecosystem, companies are broadly classified based on whether their shares are available for public trading on a stock exchange. This distinction plays a vital role in determining how a business raises capital, complies with regulations, and interacts with investors. The discussion around the difference between listed and unlisted companies is particularly […]

Corporate governance in India rests heavily on structured decision-making. One of the most critical pillars of this framework is the validity of meetings held by a company. Among these, the board of directors meeting plays a central role, as it is where strategic, financial, and operational decisions are taken. To ensure such decisions are not […]

Starting a business in India comes with several legal and regulatory responsibilities, and one of the most critical steps for any new entrepreneur is GST registration for a new business. The Goods and Services Tax (GST) is a comprehensive tax system that replaced multiple indirect taxes in India, simplifying tax compliance and ensuring smoother business […]

For entrepreneurs, navigating the financial landscape of a startup can feel like learning a new language. Terms like pre-seed funding, seed funding, SAFE, or convertible note often appear daunting, but understanding them is crucial for the growth and success of your venture. In this article, we break down the essentials of early-stage startup financing, explore […]

Find your trademark classes here: Selecting the correct trademark class is one of the most important steps in the trademark registration process. Even a unique and distinctive brand name can face rejection or future disputes if it is filed under the wrong class. This is where a trademark class finder becomes essential. A trademark class […]

Non–profit organizations play a critical role in addressing social, economic, and environmental challenges across India. From education and healthcare to environmental protection and social justice, NGOs serve as a bridge between communities and resources. To function effectively and lawfully, NGOs must follow a clear organizational structure, select the appropriate legal form, and comply with registration […]

Mobile phones have become indispensable in modern life, supporting communication, digital payments, education, remote work, and business operations. With smartphones now acting as productivity tools rather than mere communication devices, understanding their tax treatment under GST is crucial for individuals, businesses, retailers, and importers alike. Following the GST 2.0 reforms, the Indian government simplified the […]

In today’s highly competitive business environment, trademarks have evolved far beyond traditional word and logo marks. Modern brands are increasingly leveraging distinctive sounds, colors, shapes, motions, smells, and even textures to create a unique identity and deepen consumer engagement. These non-conventional trademarks are emerging as powerful tools for brand differentiation, enabling companies to communicate their […]

1. Phonetic Similarity Pepsico, Inc. v. Jagdamba Foods Pvt.Ltd.IPDATM/210/2023 (popularly known as Lay’s vs Jay’s case) PepsiCo Inc., formed in 1965 through the merger of Frito-Lay Inc. and the Pepsi-Cola Company, traces the Lay’s brand to Herman W. Lay’s potato chip business, begun in 1938. In the context of Indian IP Law, Lay’s has been […]

The judgment delivered by the Hon’ble High Court of Delhi on 24 November 2025 in Hermès International &Anr. v. Macky Lifestyle Private Limited &Anr. marks a significant milestone in Indian trademark jurisprudence. The decision reinforces the robust protection accorded to luxury brands, particularly in relation to non-traditional trademarks such as three-dimensional shape marks. By declaring […]

The diamond and jewellery industry is one of India’s most valuable export-driven sectors, contributing significantly to employment, foreign exchange earnings, and global trade leadership. Given the high value and intricate supply chain involved in diamonds from mining and import to cutting, polishing, and retail taxation, this sector demands clarity and precision. The introduction of the […]

The introduction of electronic invoicing has marked a significant milestone in India’s indirect tax framework. The GST e-invoice system has been implemented to enhance transparency, ensure standardization, and reduce tax evasion. At the core of this system lies the Invoice Reference Number, commonly referred to as IRN. Understanding the concept, generation, and applicability of IRN […]

The rapid rise of artificial intelligence (AI Revolution) is reshaping the landscape of creativity and intellectual property in unprecedented ways. From AI-generated trademarks to automated content creation, businesses and creators are encountering complex legal questions that challenge traditional notions of originality, authorship, and ownership. In India, where intellectual property (IP) law is still evolving to […]

Navigating indirect taxes on technology products can feel complex, especially when rules evolve and classifications change. In India, laptops are essential tools for education, work, and business operations, which makes understanding their tax treatment extremely important. With the introduction of GST 2.0 reforms effective from 22 September 2025, the government streamlined the GST structure into […]

Many businesses are created with long-term plans. Some are launched for future projects. Others are set up to hold assets, intellectual property, or strategic investments. But not every company operates actively every year. This is where dormant company status becomes relevant. If your company is registered but currently inactive, Indian law gives you a legal […]

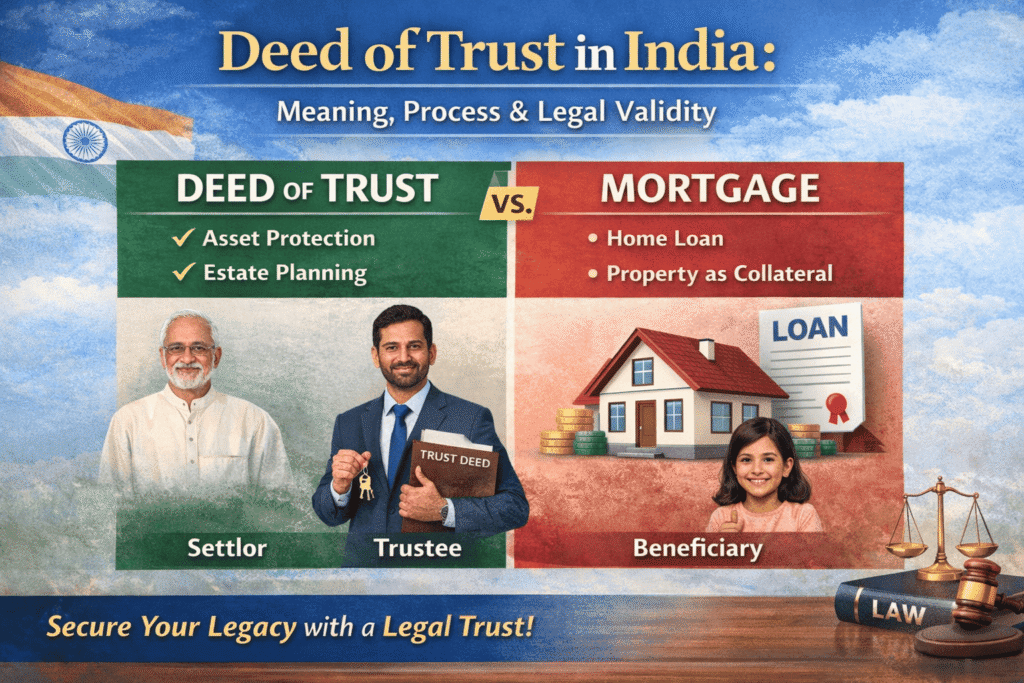

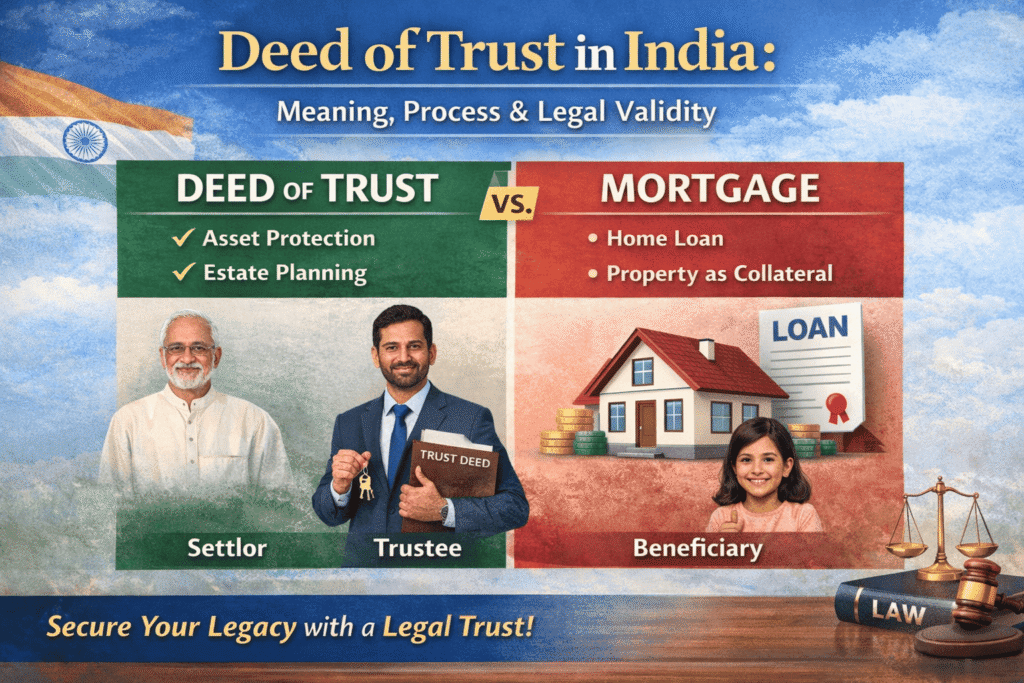

Have you ever wanted to set aside property for a specific purpose, like your children’s education, a charitable cause, or simply to protect family assets, but weren’t sure how to legally secure it? You’re not alone. In India, the legal tool for this is often a Deed of Trust. While the term “Deed of Trust” […]

Shipping goods across India? Dealing with logistics can feel complicated, but getting your documentation right doesn’t have to be. If you are moving goods, the E-Way Bill is your digital passport for smooth transit. It ensures your consignments move without highway hiccups, penalties, or delays. Whether you are a business owner, transporter, or tax professional, […]

If you are a central government employee, the wait is almost over. The 7th Pay Commission cycle is ending. Everyone is asking the same question. When will the new salary structure kick in? The good news is that the wheel has started turning. The Federal Cabinet has formally sanctioned the Terms of Reference (ToR) regarding […]

Televisions remain one of the most commonly purchased electronic items in India, both for household and commercial use. While buyers often focus on features such as display quality, size, and smart functionality, taxation plays a crucial role in determining the final price. Under India’s Goods and Services Tax framework, televisions are taxed at a uniform […]

Litigation is one of the most fundamental pillars of the Indian legal system. It represents the formal mechanism through which legal disputes are brought before courts for adjudication and resolution. From individual civil disputes to complex commercial conflicts and constitutional challenges, litigation plays a central role in enforcing rights, interpreting laws, and maintaining the rule […]

Ownership of immovable property in India is established through legally recognised documentation. Among these documents, the title deed occupies a central position. For buyers, owners, and investors alike, understanding what a title deed is fundamental to confirming lawful ownership, preventing disputes, and ensuring that property transactions are legally enforceable. Despite its importance, the concept of […]

Medical treatment is built on trust, with patients relying on healthcare professionals to act with skill, care, and responsibility. When this trust is breached due to substandard medical care, the consequences can be life-altering for patients and their families. In India, growing awareness of patient rights and legal safeguards has brought medical negligence cases into […]

Understanding the GST rate for food items is essential for households, retailers, manufacturers, restaurants, and food service businesses in India. Food is a daily necessity, and even a small change in tax rates directly impacts consumer prices and business margins. With the introduction of GST 2.0 reforms effective from September 22, 2025, the Goods and […]

Have you ever purchased a product that stopped working shortly after delivery, or paid for a service that was very different from what was promised? Situations like these are more common than we think, and consumers often feel powerless when sellers refuse to respond or take responsibility. Fortunately, the legal framework in India ensures that […]

Criminal law in India functions on the foundational principle of maintaining social order while simultaneously safeguarding individual liberty. The criminal justice system does not aim merely to punish offenders but to ensure that justice is delivered through a fair, transparent, and lawful process. One of the most crucial aspects of this process is securing the […]

Launching a business is one of the most rewarding milestones in an entrepreneur’s journey. The excitement of building something meaningful, creating employment, and generating wealth drives many founders to leap. However, every successful business begins with one critical step, which is incorporation. Incorporation is not merely a legal formality. It also provides your business with […]

In today’s fast-paced digital world, understanding copyright and fair use is more critical than ever. With technology reshaping how content is created, shared, and consumed, creators, users, and legal professionals must clearly grasp these concepts to avoid legal pitfalls while fostering creativity. What is Copyright and Fair Use? Copyright is a legal protection granted to […]

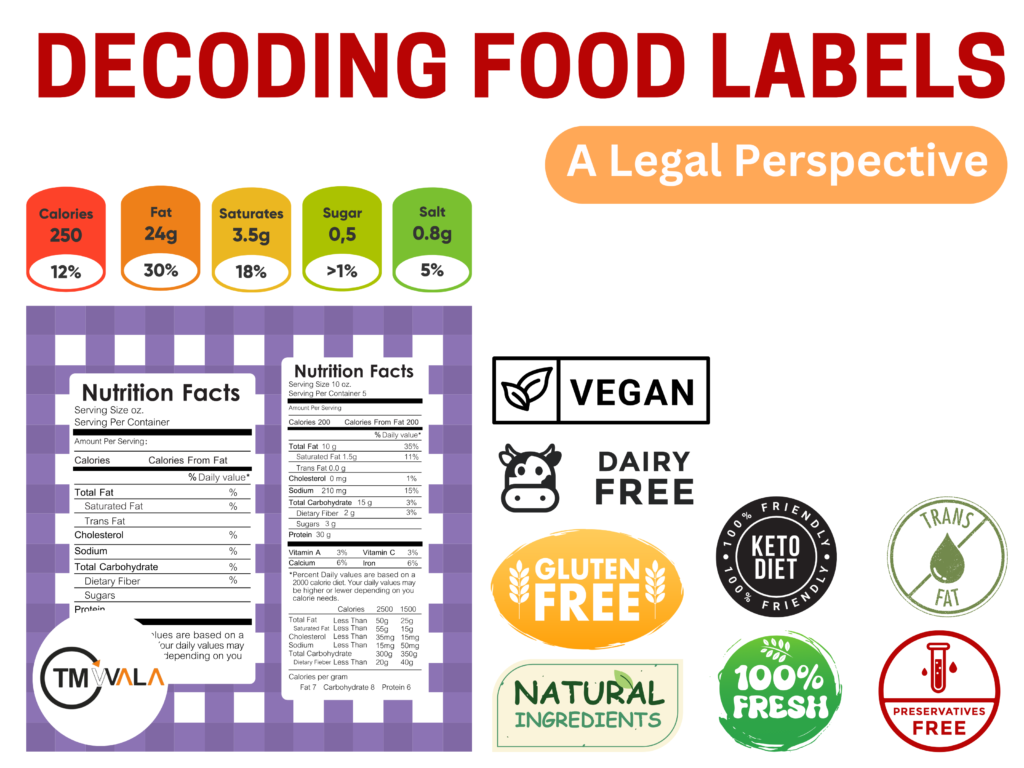

The Food Safety and Standards Authority of India has introduced a comprehensive set of changes that will significantly reshape the way food businesses operate across the country. The FSSAI’s new regulations, officially published on July 10, 2025, are scheduled to take effect from February 1, 2026. These revisions strengthen existing food safety rules and regulations […]

If there’s one thing Indians never stop discussing, it’s food, where to eat, what to order, and how much it costs. And a big part of that cost is the GST on restaurant bill, something most people notice only when the final total looks a little higher than expected. With the GST Council’s 56th meeting […]

When you start a company, two documents act as its foundation, first one is the Memorandum of Association (MOA) and the second one is the Articles of Association (AOA). These are not just formal paperwork; they define how your company is created, what it can do, and how it will operate. In simple terms, if […]

A conveyance deed is one of the most important legal documents in Indian real estate transactions because it establishes the lawful transfer of property ownership from one party to another. Many homebuyers hear terms like sale deed, conveyance deed, and property transfer during the buying process, but do not fully understand how each functions. This […]

For any growing business, one of the earliest and most important decisions is choosing the right office setup. The address you use for your company is more than a formality; it shapes how clients perceive you, determines your compliance obligations, and influences your long-term operational flexibility. Today, businesses are increasingly exploring two major options: virtual […]

Planning for the future can feel complex, but protecting your legacy for your loved ones brings immense peace of mind. In India, a Will Deed in India is a fundamental tool for ensuring your property and assets are transferred exactly as you intend after your passing. It is your final declaration, a clear voice guiding […]

The Companies Act 2013 recognizes several types of companies in India, including One Person Companies, Private Limited Companies, Public Limited Companies, Section 8 Companies, and more. Among these, private and public limited companies are the two most widely chosen structures because they offer limited liability, separate legal identity, and formalized ownership systems. Understanding the difference […]

Depreciation is one of the most crucial concepts in taxation and financial reporting, as it directly impacts taxable income, reported profits, and asset valuation. Depreciation rules in India are outlined in the Income Tax Act, 1961, specifically Section 32, which permits taxpayers engaged in business or a profession to claim depreciation rates on both tangible […]

In India, the legal framework has undergone significant evolution to safeguard the dignity, equality, and empowerment of women. While many of these rights exist in statutes, a lack of awareness often prevents women from fully exercising them. Knowing one’s legal rights is the first step toward protection, independence, and informed decision-making. This article outlines five […]

India’s democracy is built on a powerful foundation, and the foundation is its citizens. Our Constitution grants every Indian a wide range of rights meant to protect dignity, equality, and freedom. Yet many people still hesitate to speak out against injustice, often because they are unaware of what the law actually provides. If you have […]

Closing a company is more than shutting down operations. In corporate law, two legal concepts define this process: winding up and dissolution. These terms are often used interchangeably, but they have distinct meanings, procedures, and legal consequences. Understanding the difference between winding up and dissolution is essential for business owners, corporate professionals, and legal advisors […]

In today’s digital world, social media is no longer just a form of entertainment. It has evolved into a powerful space for business, marketing, and brand-building. For many entrepreneurs, influencers, and content creators who are providing services, a username is not merely an online tag; it is the face of their brand. It is how […]

India is entering a transformative era in labour governance with the Government announcing the new labour code implementation date as 21 November 2025. This marks the full operationalisation of four major labour reforms. The Code on Wages, 2019, The Industrial Relations Code 2020, The Social Security Code 2020, and The Occupational Safety, Health, and Working […]

The business landscape in 2026 is shaped by rapid digital transformation, a shift toward sustainability, and growing reliance on technology-driven solutions. Entrepreneurs today have access to tools, resources, and market opportunities that were virtually unimaginable a decade ago. Whether one plans to start an online venture, a tech-focused enterprise, a creative service, or adopt an […]

The introduction of the Goods and Services Tax (GST) stands as one of the most significant indirect tax reforms in India, aiming to unify the nation under a simplified, transparent, and efficient tax structure. This reform changed how the country perceived and administered indirect taxation, replacing a complex web of central and state taxes. To […]

Depreciation plays a central role in financial reporting and asset management. It ensures that the cost of a fixed asset is allocated systematically over the period it generates economic benefits. Among the various depreciation calculation methods, two approaches dominate global accounting practice: the Straight-Line Method and the Written-down-Value (WDV) Method. Both methods are widely accepted, yet they […]

The GST framework in India has undergone a significant transformation, effective from 22 September 2025. One of the most notable changes concerns the GST Compensation Cess, a levy originally introduced to protect state revenues during the transition to the Goods and Services Tax regime. With the latest policy updates, the cess has been removed for […]

In the Goods and Services Tax (GST) system, accurate reporting and consistency are crucial for efficient tax administration. UQC full form in GST is one of the important tools that facilitate this is the Unique Quantity Code (UQC). UQC is a measuring quantity under the GST system for standard use by all taxpayers. Its application […]

Since the rollout of the Goods and Services Tax (GST), the tax structure for the construction sector has undergone substantial restructuring. Previously, construction activities attracted multiple taxes such as VAT, excise duty, and service tax. With GST in place, these fragmented levies have been consolidated, resulting in a more uniform and transparent framework. However, despite […]

Starting or growing a business requires money. Many new entrepreneurs struggle because they do not know where to begin, which options are trustworthy, or how the process works. The good news is that 2026 presents several strong opportunities for securing funding. You can apply for loans, bring in investors, use government schemes, raise money online, […]

The Central Board of Direct Taxes (CBDT) has once again provided relief to taxpayers and professionals by extending the statutory due dates for filing tax audit reports and Income Tax Returns (ITR) for Assessment Year (AY) 2025–26. This decision was announced through Circular No. 15/2025 dated 29 October 2025 (Visit: https://incometaxindia.gov.in/communications/circular/circular-15-2025.pdf) and a corresponding press […]

India hosts a vast network of non-profit and voluntary organizations working across social welfare, education, development, and public interest domains. For any NGO aiming to operate sustainably in 2025, securing tax-related approvals under the Income Tax Act is crucial. Two of the most significant certifications are 12A registration and 80G registration, both of which offer […]

Beginning November 1, 2025, India will introduce a major improvement to the GST enrolment framework as part of the wider GST 2.0 reforms. A new GST registration auto-approval system will allow most applicants to receive their registration within three working days, significantly reducing the usual waiting period. This initiative, endorsed by the GST Council, aims […]

In a global market increasingly shaped by environmental expectations, organizations face mounting pressure to operate responsibly and reduce their ecological footprint. Among the most effective frameworks supporting this transition is the ISO 14001 environmental management system, a globally recognized standard designed to help businesses manage environmental responsibilities systematically. The benefits of ISO 14001 certification extend […]

In the modern digital Era, safeguarding electronic information has become an essential requirement. Whether it involves online communication, financial transactions, or the exchange of digital documents, ensuring authenticity and security is crucial. Digital signature certificates serve as a foundational tool in establishing trust, preventing tampering, and confirming the identity of individuals or entities involved in […]

As businesses evolve, their brand identity often grows as well. A shift in vision, diversification of services, mergers, or rebranding strategies may lead a company to change its registered name. Understanding how to change a company name in India is essential for ensuring a seamless transition without disrupting day-to-day operations or creating compliance issues. The […]

Consumers today are more informed and empowered than ever before. Yet, there are times when a product or service fails to meet expectations, or a business engages in unfair trade practices. To safeguard consumers’ interests, the Government of India has established consumer courts under the Consumer Protection Act, 2019. These forums provide an accessible and […]

Starting a food business from home in India is one of the most rewarding ways to turn your passion for cooking into a profitable venture. With the growing demand for hygienic, tasty, and homemade food options, many aspiring entrepreneurs are exploring food business ideas they can run from home. Whether you dream of selling baked […]

Marriage is a significant milestone in life, but in India, traditional religious marriages can sometimes involve complex rituals, customs, or social expectations. Court marriage is often chosen by couples who wish to avoid societal pressures, legal ambiguities, or restrictions based on caste and religion. It offers a neutral, civil, and fully legitimate way to formalize […]

The opposition stage is a critical part of the trademark registration process, allowing third parties to challenge the registration of a mark that may conflict with their existing rights. Once an opposition is filed, a structured legal procedure begins, governed by specific timelines and provisions under Rule 47 of the Trade Marks Rules, 2017. Among […]

When a trademark application is under registration and an opposition is filed, the applicant has the opportunity to respond to the opponent’s claims by filing a counterstatement. After the counterstatement is submitted, the opponent provides evidence in support of the opposition. Once this evidence is received, the applicant must submit additional evidence to strengthen their […]

When a trademark application is under registration and an opposition is filed, a separate legal procedure begins. As per Section 21 of the Trade Marks Act, 1999, read with Rule 45 of the Trade Marks Rules, 2017, the applicant must file a counterstatement in response to the opposition filed. In the counterstatement, the applicant addresses […]

In today’s competitive marketplace, a trademark serves as the identity of a brand, a visual and legal representation of its reputation, quality, and trust. Registering a trademark is not merely a procedural step but a strategic move to safeguard intellectual property. However, during the filing process or even after registration, applicants sometimes realize there are […]

INTRODUCTION A trademark is more than just a logo or symbol; it is the identity of a business that distinguishes its goods and services from those of competitors. It represents the reputation, quality, and trust a brand has built with its customers. However, the legal protection granted to a registered trademark is not perpetual. Under […]

INTRODUCTION Delhi, the capital city of India, has evolved into one of the country’s most dynamic startup ecosystems. Once known primarily for its political influence and academic institutions, Delhi is now a thriving base for startup in delhi across sectors like fintech, healthtech, edtech, e-commerce, B2B SaaS, and digital media. With over 13,000 startups operating […]

INTRODUCTION Mumbai, known as the City of Dreams, is not just India’s financial capital but also one of its fastest-growing startup ecosystems. Home to over 9,000 startups, Mumbai ranks India’s third-largest startup hub, playing a vital role in shaping the nation’s entrepreneurial and innovation landscape. With access to investors, skilled professionals, and world-class infrastructure, Mumbai […]

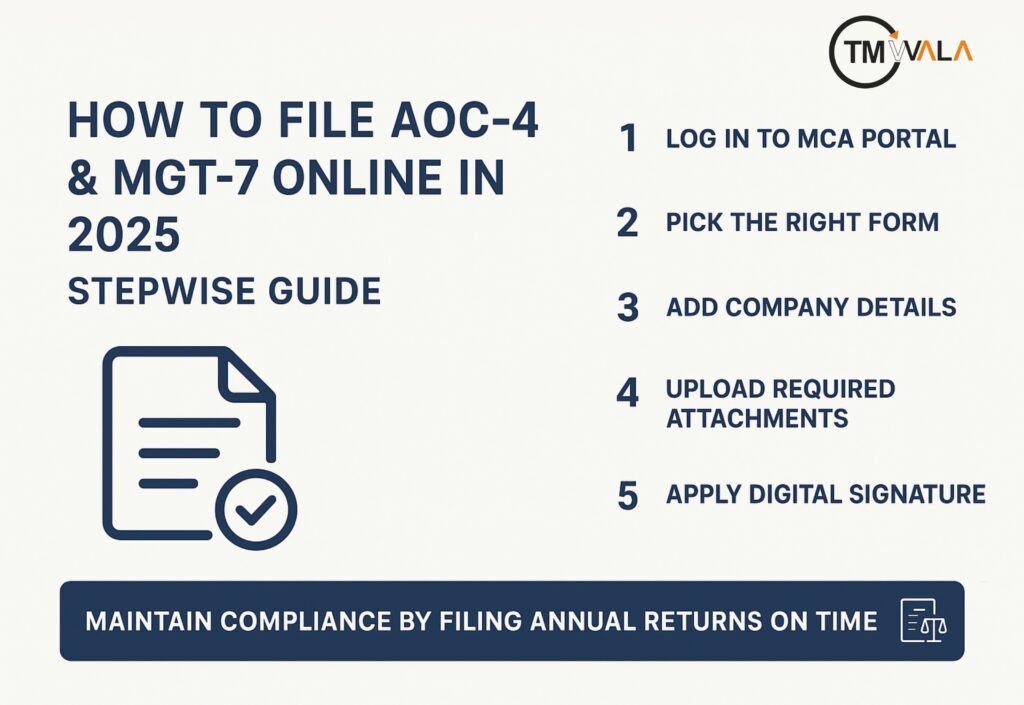

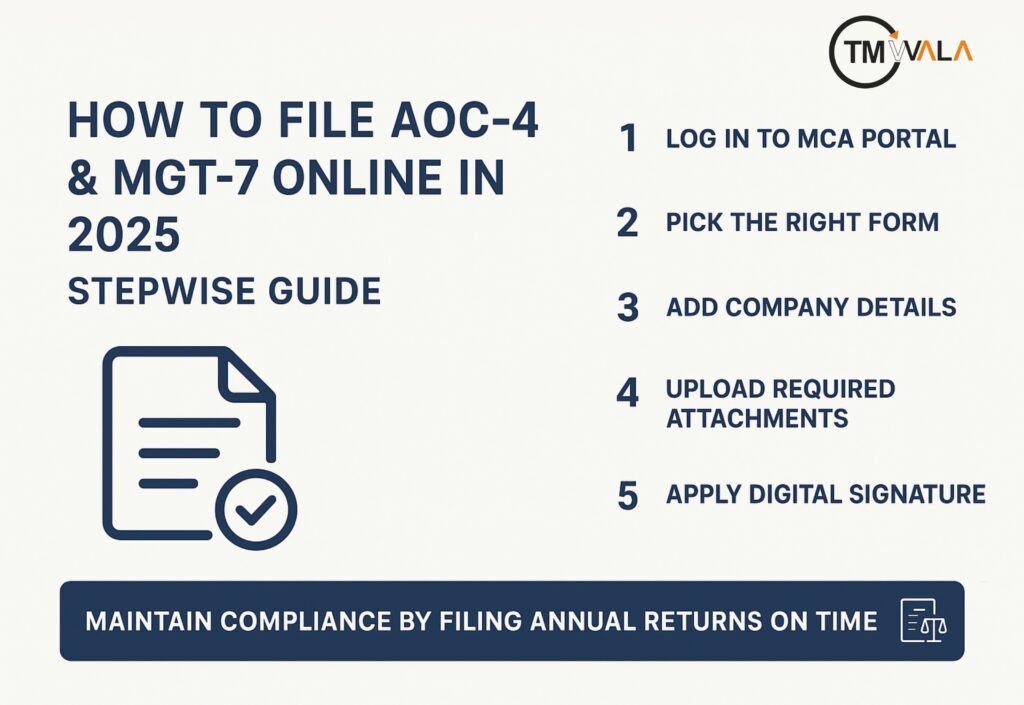

Filing annual compliance forms with the Ministry of Corporate Affairs (MCA) is one of the most crucial responsibilities for every registered company in India. Two of the most important forms under the Companies Act, 2013, are AOC-4 and MGT-7. These filings ensure transparency in financial reporting, governance, and compliance with statutory requirements. In this comprehensive […]

INTRODUCTION In today’s competitive business world, a brand is much more than just a name or logo; it represents trust, reputation, and the promise of quality to customers. Protecting this identity is vital, as unauthorized use of your brand by others can lead to confusion among consumers, damage to your goodwill, and financial losses. This […]

INTRODUCTION Every private limited company in India must comply with the provisions of the Companies Act, 2013 provisions and other applicable laws. Failure to meet these legal requirements can result in penalties, fines, or other legal consequences. To prevent such issues, it is important to follow a mandatory compliance checklist and ensure that all filings, […]

In India’s rapidly evolving business ecosystem, choosing the right structure for your enterprise is crucial. For entrepreneurs looking to protect their assets, attract investments, and grow sustainably, the private limited company emerges as one of the most preferred business models. It offers credibility, flexibility, and long-term advantages, especially when compared to sole proprietorships, partnerships, or […]

INTRODUCTION In India, companies are governed by the Companies Act, 2013, and one of the key components of corporate compliance is the Corporate Identification Number (CIN). This number is essential for establishing a company’s identity in the eyes of regulatory authorities, financial institutions, stakeholders, and the government. This article covers everything you need to know […]

INTRODUCTION As we move into 2025, the business landscape is changing rapidly. Technological innovation, changing consumer behaviour, and global shifts are paving the way for entrepreneurs to explore new business ideas. Whether you’re an aspiring entrepreneur, a working professional considering a shift, or a homemaker looking to start something from home, 2025 offers exciting possibilities. […]

Comfort, style, and a dash of individuality come to the mind when one think of home. It seems like an industry that is never out of style. So Nestroots’s Shark Tank arrival and carving a name for itself in India’s thriving direct-to-consumer market seemed obvious. And they did so by concentrating on the junction of […]

If you’ve scrolled Instagram’s fashion reels in the past few years, chances are you’ve stumbled across Snitch. Founded by Siddharth Dungarwal, Snitch started its life in B2B apparel, supplying garments to retailers and local chains. But somewhere along the way, the brand vision shifted: make stylish Indian menswear in a D2C (direct to consumer) format, […]

Sometimes the simplest of childhood memories can spark a million-dollar business. That’s exactly what happened with Ravi and Anuja Kabra, the husband-wife duo behind Skippi Ice Pops. If you grew up in India in the 80s, 90s, or even early 2000s, you probably remember those colourful ice pops sold outside schools, in playgrounds, or by […]

When you think “healthy bakery,” you might imagine a small home kitchen, a few jars of almond butter, or someone trying out sweets with oats instead of sugar. But The Cinnamon Kitchen (TCK) is more than that. It’s a brand born from personal struggle, rapid growth, and sharp business sense, all of which require more […]

When you hear the word trademark, you probably think of logos, brand names, or some catchy slogans. From Nike’s swoosh, McDonald’s golden arches, or Coca-Cola’s script. But in today’s celebrity-driven economy, trademarks go beyond companies. They’re personal. Celebrities are trademarking their nicknames, voices, signatures, and even their children’s names. Some of these actions are clear […]

INTRODUCTION Globally, artificial intelligence is one of the fastest-changing sectors, increasing productivity and opening up previously unheard possibilities in fields like manufacturing, healthcare, finance, and education. Such innovation necessitates the use of intellectual property rights, especially patents, to safeguard these technological developments. Given the nature of AI ideas and the existing constraints of Indian patent […]

What if you could open your fridge and pull out a perfectly crafted cocktail? No fuss of a bartender, muddler, measuring, or mess? That’s exactly the experience InACan set out to create. The story begins with Sameer Mirajkar and Viraj Rajendra Sawant, two friends who wanted to break down the barrier between everyday life and […]

Let’s be honest. It can be quite frightening when HR says, “Just sign here, here, and here,” while dragging a heavy pile of documents across the table. Before you give up and simply sign the document, your brain searches the lengthy legal text for terms like “salary” and “notice period.” Everybody has been there. In […]

When you see gleaming hair extensions in photos, slick Instagram videos, and celebrity-style marketing, it’s easy to be dazzled. Behind all that, though, there is strategy: securing trademark protection, negotiating deals, using contracts, and satisfying investor due diligence. This article dives into Nish Hair and its founder, Parul Gulati, what’s publicly known about its IP, […]

You’re driving through a mid-sized Indian city, maybe it’s Jaipur, maybe it’s Coimbatore. Amidst the familiar local shops, a bright, familiar logo catches your eye: a Domino’s Pizza, a Starbucks, or a Bata showroom. The experience is comforting because you know exactly what to expect. The product, the service, the decor, it’s all consistent. In […]

INTRODUCTION A Limited Liability Partnership (LLP) is a unique business structure that combines the operational flexibility of a partnership with the limited liability benefits of a private limited company. It is recognized as a separate legal entity under Indian law and is governed by the Limited Liability Partnership Act, 2008. LLPs are commonly preferred by […]

INTRODUCTION The Employees’ Provident Fund Organisation (EPFO) is a statutory body under the Ministry of Labour and Employment, Government of India. It administers the provident fund scheme in India, introduced under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Designed to provide long-term financial security to employees after retirement, the Employee Provident Fund (EPF) […]

You know the scene. It’s a familiar story in India’s entrepreneurial landscape. Two friends, fuelled by chai and a big idea, decide to go into business together. One is the tech wizard; the other is the people person. There’s excitement, there’s trust, and there’s a verbal agreement sealed with a handshake. “We’ll figure it out […]

Picture it. You have a potential game-changing concept for a smartphone app that can change the face of grocery shopping in your local area. You’re energetic and keen to move forward. You are about to meet with potential investors and outsource a developer. But suddenly, a fear dawns on you: you must present this concept […]

In India, a popular business proverb is that one and one make eleven. It’s the notion that the correct alliance can build something much stronger than the sum of its parts. It’s the exact definition of a Joint Venture. It’s not a takeover or a merger; it’s a strategic shake, a vow to traverse a […]

Think about the business world today. You most likely envision handshake agreements, business transactions, and the realization of ambitious plans. But let’s be honest: In today’s complex world, a handshake or a person’s word may be important, but it’s often insufficient. Modern commerce is driven by the powerful commercial contract, which is less showy but […]

INTRODUCTION The Supreme Court’s 2025 decision in Cryogas Equipment Private Limited v. Inox India Limited marks a pivotal moment in Indian intellectual property (IP) jurisprudence, addressing the longstanding tension between copyright protection for artistic works and design protection for industrial products. The case arose from a dispute over engineering drawings for cryogenic storage tanks, where […]

INTRODUCTION India’s commitment to a transparent, digital-first taxation ecosystem took a significant leap forward in April 2025 with the official rollout of the Invoice Management System GST. Months into its implementation, the IMS is already redefining how businesses across sectors manage GST invoices, claim Input Tax Credit (ITC), and ensure real-time compliance. Designed as a […]

INTRODUCTION The Ministry of Corporate Affairs (MCA) has introduced a crucial regulatory update that redefines how companies in India must comply with statutory auditor appointment requirements. With Notification G.S.R. 359(E) dated May 30, 2025, the Companies (Audit and Auditors) Amendment Rules, 2025 will come into effect on July 14, 2025, marking a significant shift in […]

INTRODUCTION In today’s fast-paced startup ecosystem, having a great idea is only the beginning. The real edge lies in how well you can protect that idea and turn it into a sustainable business advantage. For young entrepreneurs, especially those building technology-driven solutions or innovative products, patent registration is one of the most powerful tools available. […]

INTRODUCTION WIPO’s 2024 World Intellectual Property Indicators Report Spotlights India’s Unprecedented Rise in Innovation India is fast emerging as a global innovation powerhouse, a transformation firmly reflected in the World Intellectual Property Organization’s (WIPO) World Intellectual Property Indicators (WIPI) 2024 report. The country has reached a new milestone in its intellectual property (IP) journey, demonstrating […]

INTRODUCTION In an era where global semiconductor design chains involve multiple players, from IP vendors to system-on-chip integrators and third-party manufacturers, hardware intellectual property (IP) piracy has become an alarming issue. Unauthorized copying, false ownership claims, and insertion of malicious logic into hardware are serious concerns not only for companies but also for the safety […]

INTRODUCTION In a groundbreaking move set to redefine intellectual property (IP) management in India, Union Minister of Commerce & Industry, Shri Piyush Goyal, officially unveiled the Artificial Intelligence (AI) and Machine Learning (ML)based Trademark Search Technology along with the AI tools for trademarks in India, like IP SAARTHI AI CHATBOT, on 18th September 2024 in New […]

Establishing a hospital in India is a social responsibility and a business venture. Hospitals offer medical treatment, emergency care, and preventive health services, and hence they are a vital part of the infrastructure. Although the concept of opening a hospital appears to be noble and fulfilling, it is associated with a significant set of legal […]

INTRODUCTION In the world of fashion, textiles, industrial products, and even digital design, creativity and functionality often go hand in hand. But what happens when your design is not just art, it becomes a product? For Indian designers, understanding the legal distinction between copyright protection and design registration is not just important; it’s essential for […]

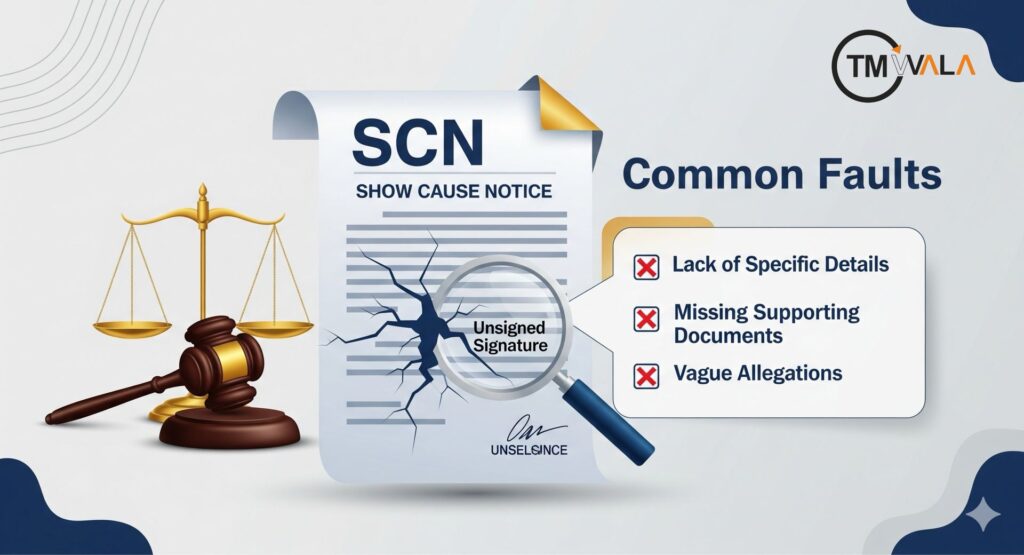

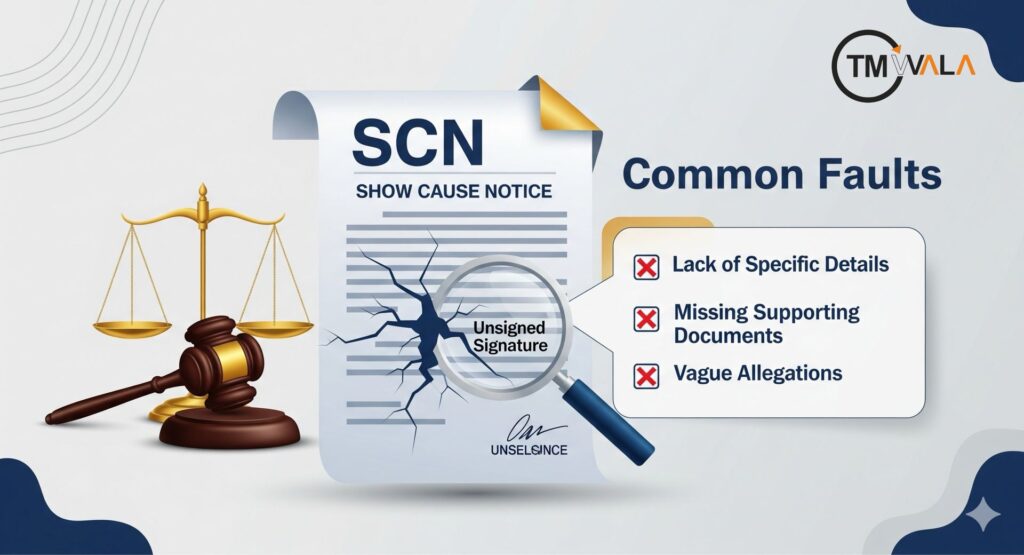

A Show Cause Notice (SCN) is the foundation of any adjudication process under the Goods and Services Tax (GST). It is the very first step where the department alleges short-payment, non-payment, wrongful availment of Input Tax Credit (ITC), or other violations, and calls upon the taxpayer to explain why tax, interest, or penalty should not […]

INTRODUCTION In a major step toward simplifying India’s taxation landscape, the GST Council, under the leadership of Finance Minister Nirmala Sitharaman, has introduced a revamped structure of the Goods and Services Tax, popularly termed GST 2.0. Effective September 22, this overhaul significantly rationalises tax slabs and aims to strike a delicate balance between economic stimulation […]

Starting a company in India is exciting. There is the drive of creating something new, the excitement of acquiring your first clients, and perhaps even the hope of bringing in investors, all present. But hidden underneath all that excitement is the unglamorous world of legal compliance. In this article, based on start-ups, we will make you aware […]

INTRODUCTION Hyderabad, also known as the City of Pearls, has rapidly transformed into a dynamic startup hub in India. With a blend of modern infrastructure, government-backed initiatives like T-Hub, and a growing investor ecosystem, the city presents a fertile ground for budding entrepreneurs. Unlike the over-saturated startup scenes of other metros, Hyderabad offers a balanced […]

One of the biggest promises of the GST regime from 2017 in India was the concept of “seamless flow of input tax credit” (ITC). It simply means that businesses could claim credit for the taxes they already paid on their purchases or inputs, and use that credit to offset the tax payable on their sales […]

INTRODUCTION India has emerged as a globally significant market, drawing increasing interest from foreign investors and multinational corporations. With a rapidly evolving business environment and robust legal infrastructure, the country offers a variety of pathways for foreign entities to establish their presence. However, it is very important to know how to register a foreign company […]

Navigating the Goods and Services Tax (GST) system can be intimidating, particularly when you receive an impending Show Cause Notice (SCN) on your portal. So, understandably, the right to a personal hearing is one of your most significant rights as a taxpayer during this process. Personal hearings are more than just formalities; they are your […]

INTRODUCTION Income tax return filing for professionals and business owners is more than a legal obligation; it’s a key part of responsible financial planning. For individuals and Hindu Undivided Families (HUFs) with income from business or profession, filing IT return through the appropriate form ensures compliance, avoids penalties, and simplifies financial documentation for future needs. […]

INTRODUCTION In a bold move toward tax modernization, the Government of India has successfully enacted a historic reform. After being passed by the Lok Sabha on August 11, 2025, and subsequently cleared by the Rajya Sabha, the President of India gave his assent to the revised Income Tax Bill on August 21, 2025. The law […]

INTRODUCTION The Government of India is taking a significant step forward in ensuring quality assurance in the precious metals sector. Following the success of mandatory hallmarking in gold, a new revolution came with the BIS notification on silver hallmarking. It mandates hallmarking for silver jewellery and will be implemented from September 1, 2025. This decision, […]

INTRODUCTION Goods and Services Tax (GST) compliance is a critical aspect of running a business in India. While it aims to streamline the taxation system, its practical implementation has posed challenges for businesses of all sizes. Multiple monthly filings, complex return structures, and system-driven validations often result in errors, especially for small and medium enterprises […]

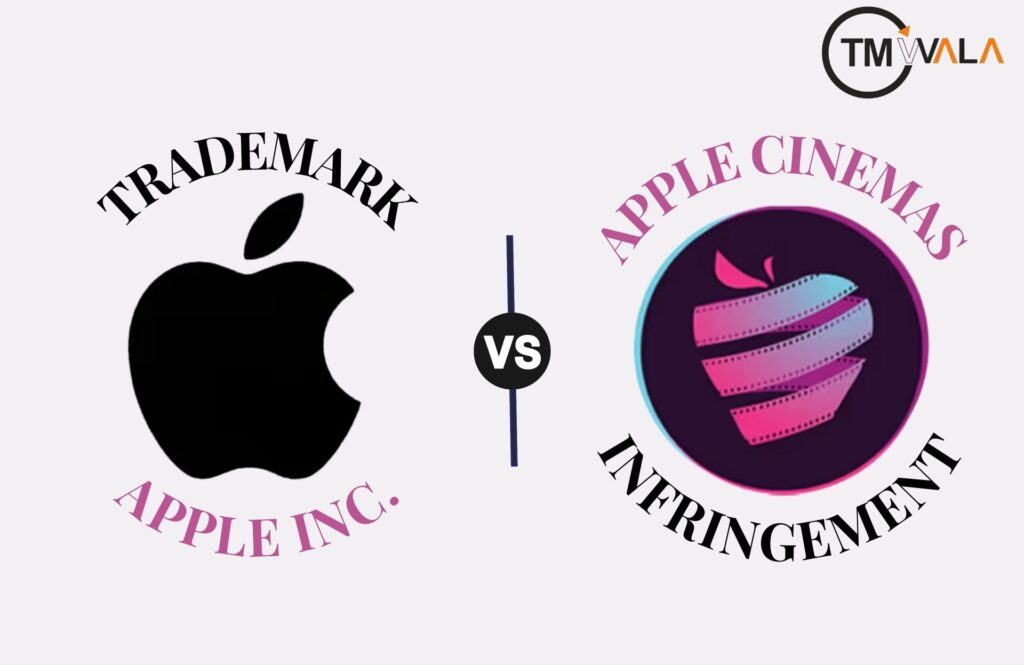

INTRODUCTION A high-profile legal battle is unfolding in Massachusetts, as Apple Inc. has filed a lawsuit against Apple Cinemas, a relatively small yet ambitious movie theatre chain. The Apple trademark lawsuit was filed on August 1, 2025, in the District Court of Massachusetts. In the lawsuit, Apple Inc. accuses Apple Cinemas and its parent company, […]

INTRODUCTION Bangalore, often referred to as the Silicon Valley of India. It is the country’s undisputed startup capital. With a thriving entrepreneurial ecosystem, abundant funding opportunities, and access to a rich talent pool, the city has become the preferred launchpad for emerging startups. However, the journey of building a successful startup in Bangalore involves more […]

If you’ve ever dreamed of launching your own packaged food brand in India, whether it’s granola, ready-to-eat curries, protein bars, or artisanal snacks, you’re not alone. The market is booming. From D2C (direct-to-consumer) brands riding on Instagram to homegrown start-ups getting funded on Shark Tank India, packaged food has never been hotter. But here’s the […]

Establishing a pharmaceutical business in India involves more than just the lofty goal of enhancing healthcare. It is more than just capitalising on a quickly expanding market. It’s also about navigating a complex regulatory landscape that ensures medicines and health products are safe, effective, and trustworthy. Therefore, knowing the license criteria is the first important […]

One of the most well-liked business models in India right now is selling on Amazon. Everyone seemed to be taking advantage of India’s increasing e-commerce market, from major firms going online to students pursuing side projects. On the surface, it appears simple to register, submit your goods, and begin shipping. The catch is that you […]

![ANNUAL COMPLIANCE CHECKLIST FOR INDIAN STARTUPS & MSMES [2025 EDITION] 142 2025 compliance checklist for Indian startups and MSMEs.](https://tmwala.com/wp-content/uploads/2025/08/Copy-of-Copy-of-Colorful-Minimalist-Linear-Steps-Circular-Diagram-9-1024x680.jpg)

INTRODUCTION Growth and sales alone don’t guarantee the successful operation of a Micro, Small, or Medium Enterprise (MSME) and a startup in India. Staying compliant with government regulations is equally crucial. As the Indian regulatory landscape continues to evolve, businesses need to understand and execute the legal, financial, and operational responsibilities that come with running […]

You’ve got the idea—the kind that keeps you awake at night, scribbling wireframes on napkins or sketching algorithms on whiteboards. But here’s the thing every founder quickly learns: ideas don’t pay rent. Transforming your concept into a working prototype and then into a product that customers pay for takes money, and in India, early-stage funding is […]

INTRODUCTION Picture this: standing in an empty stretch of land, with kids playing in the playground, teachers guiding inquisitive minds, and parents feeling pleased that they chose your school. It’s a beautiful dream, and you’re ready to make it real. But here’s the truth no one tells you at the start: just before the first […]

INTRODUCTION In the dynamic landscape of India’s entrepreneurial ecosystem, incorporating your business as a legal entity is the first critical step toward building a sustainable startup. This process not only provides your business with legitimacy under Indian law but also establishes a structured framework for operations, fundraising, and market recognition. With continuous digital integration and […]

INTRODUCTION In today’s fast-evolving digital landscape, the protection of personal data is no longer a luxury; it’s a legal, ethical, and competitive necessity. India has taken a major step in this direction through the Digital Personal Data Protection Act, 2023 (DPDP Act) and the accompanying Draft DPDP Rules, 2025. These comprehensive frameworks place India firmly […]

If you’ve ever dreamed of turning your passion for skincare, haircare, or makeup into a full-fledged business, India is an exciting place to be right now. The country’s cosmetic industry is booming as natural and homemade formulations are trending, social media is creating overnight beauty stars, and consumer awareness is at an all-time high. But […]

Starting a manufacturing business is like planting a tree. You choose the right soil (location), get the right tools (machinery), hire the right gardeners (team), and dream about the fruits (profits). But here’s the thing: In India, before you plant that first seed, you need to get your paperwork right. And this is where factory […]

Gold and India share a special bond that isn’t just cultural but deeply financial, too. For centuries, from family heirlooms to auspicious festivals, gold has always symbolized safety, stability, and wealth. But over time, the way we invest in it is changing, and the Reserve Bank of India’s Sovereign Gold Bonds (SGBs) offer a modern, […]

INTRODUCTION Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy. To promote entrepreneurship, encourage self-employment, and reduce dependency on formal employment sectors, the Government of India has launched several targeted schemes. These initiatives aim to provide financial support, collateral-free loans, grants, and technical assistance to MSMEs at various stages of their […]

INTRODUCTION The Goods and Services Tax (GST) system, introduced in India in 2017, was a historic shift in the country’s tax structure. It replaced a complex array of state and central taxes with a unified indirect tax system, aiming to streamline compliance and establish a common national market. Businesses across sectors are now required to […]

INTRODUCTION The concept of a well-known trademark plays a crucial role in modern trademark law, offering protection that extends beyond specific goods or services. The Delhi High Court has formally recognized the well-known Nutella trademark, giving it protection under Trademark law, a major event in Ferrero trademark news. This judgment marks a milestone in Nutella […]

INTRODUCTION McPatel filed a trademark application (TMA No. 6354343) under Class 30, which McDonald’s Corporation opposed. This case can potentially become a landmark in Indian intellectual property law. Currently being heard in Ahmedabad, it pits one of the world’s most iconic fast-food chains against a regional Indian food company in a dispute over the use […]

Imagine it’s your wedding day, everyone’s dancing, laughing, and enjoying the moment. Suddenly, a group of people enters, stops the music, and demands a hefty fine. They claim you’re using copyrighted music without a license. This scenario, though shocking, is becoming increasingly common at weddings and events. These individuals usually represent private agencies like PPL […]

INTRODUCTION The Bombay High Court has made a historic ruling in one of India’s longest-running intellectual property cases, prohibiting Allied Blenders and Distillers Pvt. Ltd. (ABD) from launching or marketing its goods throughout the country under the trademarks “MANSION HOUSE” and “SAVOY CLUB” until the outcome of the current trial. The order, dated July 16, […]

INTRODUCTION As India experiences rapid digitalization, increased entrepreneurship, and stronger participation in the global economy, its intellectual property (IP) framework must evolve in step. Trademarks, among the most recognized elements of IP rights, are critical in helping businesses establish identity, secure market position, and protect consumer trust. In this context, Trademark rules in India are […]

A disability certificate is a crucial official document issued by the Government of India to persons with disabilities. It serves as proof of the disability and unlocks various benefits and protections under the law. For many individuals with disabilities, this certificate is not just a paper but a gateway to dignity, empowerment, and equal opportunity. […]

INTRODUCTION GSTR 9C is a crucial compliance form under the Goods and Services Tax (GST) regime in India. It is a reconciliation statement filed annually by taxpayers whose turnover exceeds a specified limit. This form reconciles the details declared in GSTR-9 (Annual Return) with the audited financial statements of the taxpayer for the relevant financial […]

INTRODUCTION The healthcare sector relies heavily on medical textiles, which serve vital functions ranging from hygiene and protection to wound care and surgical applications. Products such as baby diapers, surgical face masks, eye pads, sanitary napkins, shoe covers, adhesive plasters, and compression bandages are essential for treatment and patient care, infection control, and hygiene maintenance. […]

INTRODUCTION Political parties are the lifeline of any democracy. They not only contest elections but also shape national discourse, influence public policy, and serve as a channel for citizen engagement. In India’s vibrant democratic setup, marked by a multi-party system, political party registration is the foundational step that formalizes an organization’s intent to participate in […]

INTRODUCTION In an age where much of our communication is fleetingreduced to quick messages or social media postskeeping a personal diary remains one of the most intimate and enduring forms of self-expression. Whether handwritten or digital, your diary is a record of your inner life: thoughts, feelings, personal stories, and reflections. But as private as […]

INTRODUCTION Intellectual Property (IP) is the backbone of innovation in nearly every industry, and architecture is no exception. IP rights refer to the legal rights that protect creations of the mind, including inventions, artistic works, symbols, names, and designs used in commerce. In the world of architecture, IP ensures that architects and firms can secure […]

INTRODUCTION In India, trademark rights operate on the principle of “first to use” rather than “first to file.” This means that the rights to a trademark are granted to the party who can prove prior use in the market, regardless of who applies first. This fundamental rule has become particularly significant in recent cases involving […]

INTRODUCTION Foreign Direct Investment (FDI) in India plays a vital role in driving economic growth, fostering innovation, and creating employment. With India positioning itself as a global investment hub, the government continues to refine its FDI rules to ensure national security, promote domestic enterprise, and maintain transparency. To successfully navigate the Indian market, foreign investors […]

INTRODUCTION Indian startup ecosystem has witnessed significant growth over the past decade. In response to this innovation and startup activity surge, the Government of India launched the Startup India scheme in 2016. This flagship initiative aims to build a robust ecosystem for nurturing innovation, driving sustainable economic growth, and generating large-scale employment opportunities. At the […]

INTRODUCTION Before starting the process of trademark registration, one must identify which trademark class their goods and services belong to. As per the NICE classification, the goods and services are divided into various categories, which are recognized globally. Therefore, registering your trademark in the right class will give you exclusive rights to your mark and […]

INTRODUCTION The GST Compensation Cess is crucial as it helps ensure fair revenue distribution among Indian states after the launch of GST. It is a special kind of tax imposed on specific goods and services, especially those related to luxury. The amount collected is used to compensate states for any revenue loss caused by GST […]

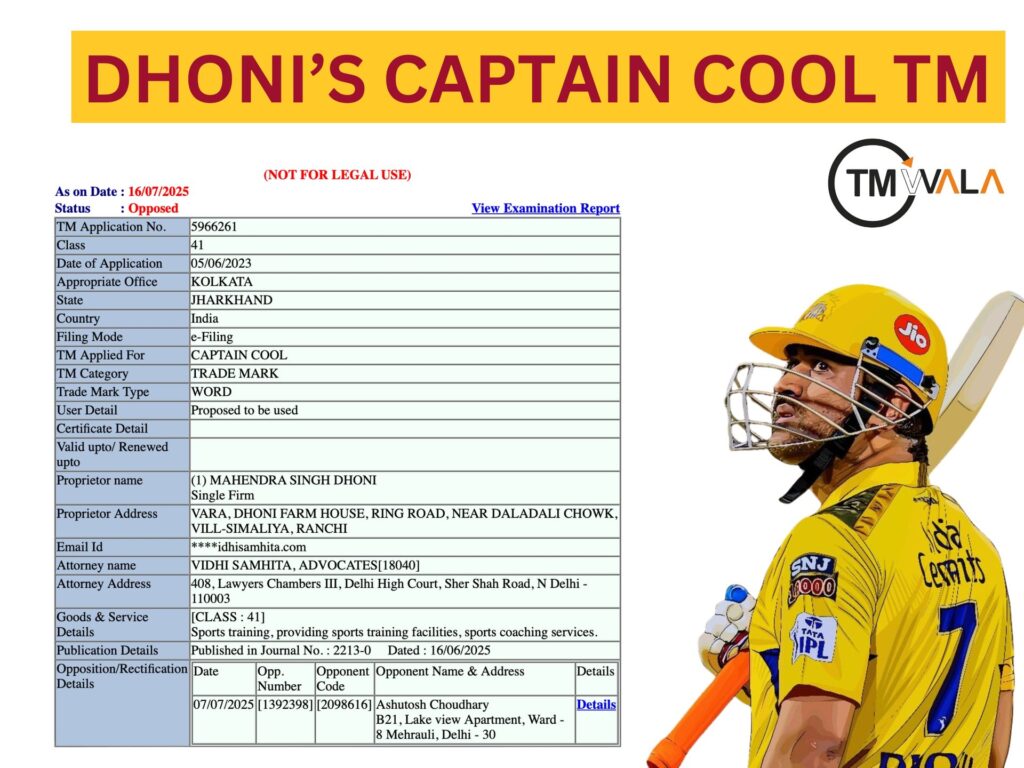

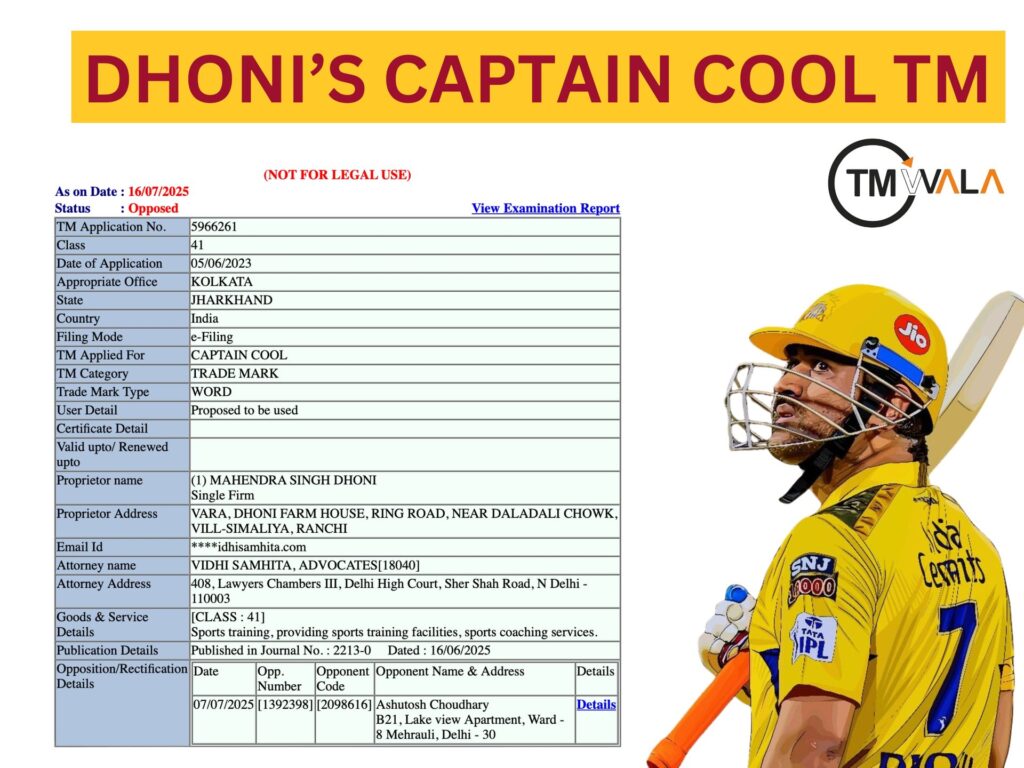

Introduction: When Legacy Meets Law Mahendra Singh Dhoni has always been more than just a cricketer. For millions, he’s a symbol of composure, strategy, and leadership. Over the years, one title has stuck with him with particular fondness: Captain Cool. This nickname, echoing his calm persona under pressure, is now at the centre of a […]

In recent times, the global fashion industry has increasingly drawn inspiration from traditional art forms and indigenous craftsmanship. However, this blending of modern aesthetics with cultural heritage does not always result in appreciation; it often raises concerns about appropriation, exploitation, and disregard for intellectual property rights. A prime example of this is the 2025 controversy […]

Earning more than 10 lakh per annum in India can put you in one of the highest tax slabs, and you end up paying a huge amount of your hard-earned salary to the government in the form of tax. So, to avoid such a situation, one must know about tax efficiency, not just as a […]

INTRODUCTION In the age where AI has become the author of every other new content, protecting the rights of real-life authors has become crucial not just as a legal obligation but also a critical component of sustaining innovation and originality. As the internet became handy for people worldwide, they started consuming and producing content at […]

INTRODUCTION In India’s rapidly growing market, trademark strategy is essential for protecting a brand’s identity as trademarks are essential for building trust and securing business reputation. This article explores famous trademark cases in India, highlighting landmark disputes involving major brands like Flipkart, Zepto, and boAt that illustrate key legal principles in trademark enforcement. It also […]

INTRODUCTION The famous Writer Mr. William Shakespeare once said, “What’s in a name?” While poetic in literature, in business and branding, the answer is quite a lot. A name, especially when associated with quality, innovation, or heritage, can become one of a business’s most valuable assets. Think of names like Tata, Mahindra, Raymond, or even […]

Introduction A trademark is a distinct sign, symbol, word, logo, or combination thereof that identifies and distinguishes the goods or services of one enterprise from those of others. In India, trademarks’ legal protection and regulation are governed by the Trademarks Act of 1999 and the Trademarks Rules of 2017. According to Section 25(1) of the […]

INTRODUCTION The transforming economy of India has brought intellectual property to the forefront of economic development. With the growing number of new startups and technology-driven enterprises, the role of intangible assets like trademarks, trade dress, copyright, and patents has become crucial. The exclusive IP rights of IP owners have become economic tools for them, that […]

INTRODUCTION Imagine you’re a content creator who has put your heart and soul into the art you have made. Finally, people start recognizing it, but suddenly, somebody else posts your work claiming it is theirs, and they are earning a profit from it. How would you feel? Sadly, this is the reality for many small […]

INTRODUCTION The past decade has marked a significant evolution in the Indian startup ecosystem, which now stands as the third largest in the world. With over 100,000 startups and more than 100 unicorns, Indian startups are increasingly competing on the global stage. In their early stages, many founders chose to incorporate offshoremainly in jurisdictions like […]

INTRODUCTION The GST return filing rule changes from July 2025 bring significant shifts in compliance requirements for businesses across India. Major updates include the GSTR-3B Auto-lock, strict 3-year GST return filing limit, late GST return penalty 2025and classification of time-barred GST returns. The introduction of e-way bill 2.0 ensures smoother logistics, while broader GST return […]

INTRODUCTION A key accounting concept that enables companies to spread out the expense of physical assets over their useful lives is depreciation. It shows how assets deteriorate, wear down, or become obsolete over time. The article mentions the depreciation rates for 2024–2025. The depreciation rate as per the Income Tax Act varies based on the […]

INTRODUCTION For all Food Business Operators (FBOs) licensed by the Food Safety and Standards Authority of India (FSSAI), filing the FSSAI yearly return is a necessary compliance obligation. To avoid fines and preserve regulatory compliance, it is essential to timely file the FSSAI returns, Form D1 FSSAI for general food enterprises and Form D2 FSSAI […]

INTRODUCTION A trade agreement known as an Early Harvest Agreement (EHA) enables two nations to address important trade issues and liberalize tariffs on a limited range of commodities and services. As a measure to boost confidence, it aids in creating momentum and trust in larger trade talks. The EHA is regarded as a crucial first […]

Introduction Form GSTR-9 is the annual return under GST law that must be filed by registered taxpayers who operate as regular taxpayers, including SEZ units and SEZ developers. It consolidates the details of outward and inward supplies, input tax credit, tax paid, and other related activities for a financial year. This return acts as a […]

INTRODUCTION A brand’s identity, reputation, and consumer trust are all represented by its trademarks, which are essential assets. Transferring ownership of these trademarks may become necessary if companies expand, merge, reorganize, or change their business plans. The legal transfer of a trademark’s rights from one party (the assignor) to another (the assignee) is called trademark […]

Introduction India’s intellectual property landscape has undergone unprecedented changes in recent years, characterized by a significant increase in patent applications reflecting the evolving innovation ecosystem in the country. This phenomenon represents not only a statistical increase but also a fundamental change in India’s approach to intellectual property protection and technological progress. Understanding Patents A patent […]

Case 10: Kaira District Cooperative Milk Producers Union Ltd. & Anr. v. Bio Logic and Psychotropics India Pvt. Ltd. & Anr. Citation: 2024 LiveLaw (Del) 1035Court: Delhi High CourtDate Decided: 10 September 2024Judge: Justice Mini Pushkarna Background Kaira District Cooperative Milk Producers Union Ltd., widely known as Amul, is a prominent dairy cooperative in India, […]

Case 9: Emami Limited v. Hindustan Unilever Limited Citation: 2024 SCC OnLine Cal 3579Court: Calcutta High CourtDate Decided: 9 April 2024Judge: Justice Ravi Krishan Kapur Background Emami Limited, a prominent Indian FMCG company, launched its men’s skincare product “Fair and Handsome” in 2005. Over the years, Emami invested significantly in building the brand’s identity, emphasizing […]

Case 8: Moti Mahal Delux Management Services Pvt. Ltd. & Ors. v. SRMJ Business Promoters Pvt. Ltd. & Anr. Citation: CS(COMM) 1115/2024Court: Delhi High CourtDate Decided: 12 December 2024Judge: Justice Mini Pushkarna Background Moti Mahal Delux Management Services Pvt. Ltd. (“Moti Mahal”), a renowned restaurant chain with a legacy dating back to 1920, owns several […]

Case 7: Inter IKEA Systems BV v. IKey Home Studio LLP & Anr. Citation: 2024 SCC OnLine Del 3147Court: Delhi High CourtDate Decided: 18 December 2024Judge: Justice Mini Pushkarna Background Inter IKEA Systems BV, the proprietor of the globally recognized “IKEA” trademark, discovered that an Indian entity, IKey Home Studio LLP, was operating under the […]

Case 6: Mankind Pharma Ltd. v. Sepkind Pharma Pvt. Ltd. & Ors. Citation: 2024 SCC OnLine Del 3143Court: Delhi High CourtDate Decided: 23 December 2024Judge: Justice Mini Pushkarna Background Mankind Pharma Ltd. (“Mankind”), a leading pharmaceutical company in India, has been using the trademark “MANKIND” since 1986 and holds multiple registrations under the Trademarks Act, […]

Case 5: Mount Everest Breweries Ltd. v. MP Beer Products Ltd. & Ors. Citation: 2024 SCC OnLine MP 7367Court: Madhya Pradesh High CourtDate Decided: 12 November 2024Bench: Justice Sanjeev Sachdeva and Justice Pranay Verma Background Beer bottles are at the center of a dispute in which Mount Everest Breweries Ltd. (MEBL), the manufacturer of the […]

Case 4: Independent News Service Pvt. Ltd. & Rajat Sharma v. Ravindra Kumar Choudhary & Ors. Citation: 2024 SCC OnLine Del 3142Court: Delhi High CourtDate Decided: 30 May 2024Judge: Justice Anish Dayal Background Independent News Service Pvt. Ltd. (INS), the proprietor of the 24-hour Hindi news channel “India TV,” and its Chairman and Editor-in-Chief, Rajat […]

Case 3: Relaxo Footwears Ltd. v. XS Brands Consultancy Pvt. Ltd. & Ors. Citation: 2024 SCC OnLine Del 3141Court: Delhi High CourtDate Decided: 13 May 2024Judge: Justice Anish Dayal Background Relaxo Footwears Ltd., a prominent Indian footwear manufacturer, has been using the “SPARX” brand since 1976. The company developed a distinctive “X” device mark derived […]

Case 2: Pfizer Products Inc. v. Renovision Exports (P) Ltd. Citation: 2024 SCC OnLine Del 3140Court: Delhi High CourtDate Decided: 1 May 2024Judge: Justice Sanjeev Narula Background Pfizer Products Inc., a globally recognized pharmaceutical company, holds the registered trademark “VIAGRA” for its sildenafil citrate-based medication used to treat erectile dysfunction. The trademark “VIAGRA” has been […]

INTRODUCTION The realm of trademark law in India has witnessed dynamic evolution in recent years, with courts playing an increasingly assertive role in safeguarding brand identity, consumer trust, and commercial goodwill. In the upcoming paragraphs, we’ll know about the trademark dispute between Bulgari S.P.A and Prerna Rajpal The Amaris Flagship. The period between 2024 and […]

Are you a start-up founder, entrepreneur or a businesswoman or man looking for Startup themed T-Shirts in India? Then look no further. TMWala is here with a list of Top Startup T-Shirts every entrepreneur in India should own in 2025. This is the place where Fashion meets hustle. These Startup T-shirts are unique, funny, relatable, […]

“From the treasury comes the power of the government, and the Earth, whose ornament is the treasury, is acquired by means of the Treasury and Army.” -Kautilya (Arthasastra) INTRODUCTION TO GST 1.1 Background and Evolution of Indirect Taxes in India Prior to the advent of the Goods and Services Tax (GST), India’s indirect tax regime […]

Filing Provident Fund (PF) returns is a critical compliance requirement for employers in India, governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Understanding how to file a PF return ensures timely and accurate reporting of employee contributions to the Employees’ Provident Fund Organisation (EPFO), thereby safeguarding the interests of both employers and […]

INTRODUCTION Intellectual property (IP) lawyer frequently come across companies that are having significant difficulties as a result of their early failure to implement crucial IP protections. Many entrepreneurs approach the experts with concerns after discovering, often too late, that they have made serious errors pertaining to their intellectual property. The experts can sometimes help them […]

Introduction Intellectual Property Rights (IPR) enforcement has emerged as a critical determinant in shaping international trade relations in the contemporary global economy. The intersection of IPR protection and trade policy creates complex dynamics that influence bilateral and multilateral commercial relationships, particularly during periods of geopolitical tension. This article examines the intricate relationship between IPR enforcement […]

Introduction The rapid emergence of Artificial Intelligence (AI) technologies has transformed creative industries, raising fundamental questions about copyright law’s scope and applicability. AI systems are increasingly capable of generating literary, artistic, musical, and software works autonomously, challenging traditional notions of authorship, originality, and ownership. This article critically examines the concept and importance of copyright protection […]

Intellectual Property (IP) refers to the original creations of the human mind, such as inventions, artworks, literature, designs, and unique symbols, names, or images used in trade or business. Laws such as patents, copyrights, and trademarks protect these creations, allowing individuals and companies to gain recognition or financial rewards for their innovation and effort. The […]

INTRODUCTION A Private Limited Company (Pvt Ltd) is a well-liked business form that is perfect for entrepreneurs since it provides restricted liability, a distinct legal identity, and increased credibility. Even while creating a Pvt Ltd company in India requires a number of processes, including selecting a company name, acquiring the required digital signatures and director […]

INTRODUCTION Copyright registration in India is essential for protecting the artistic creations of writers, singers, filmmakers, software developers, and artists. Because of India’s membership to the Berne Convention, copyright registration is not required by Indian law. yet, there are substantial legal and practical benefits to doing so. Through customs registration, it helps stop the import […]

INTRODUCTION One of the most important post-incorporation compliances is private limited company annual return filing. Every company, except a One Person Company, must hold an AGM annually and present its audited financial statements, which must then be filed with the Registrar of Companies (ROC). This process is referred to as filing of annual returns. The […]

Intellectual Property Rights (IPR) refer to the legal protections granted to the intangible creations of the human mindsuch as inventions, literary and artistic works, designs, and symbols used in commerce. The World Intellectual Property Organization (WIPO) defines intellectual property (IP) as “creations of the mind,” which encompasses mechanisms like patents, copyrights, trademarks, and trade secrets […]

In India, GST registration for a Private Limited Company is important if its revenue surpasses ₹40 lakhs for goods and ₹20 lakhs for services, or if it does e-commerce or interstate transactions. The Aadhaar and PAN cards of each director, corporate photos, the Certificate of Incorporation, the Letter of Authorization, and evidence of the primary […]

A trademark is a distinctive word, symbol, sign, or combination thereof that distinguishes the goods or services of one enterprise from those of others in the marketplace. It functions as a distinctive mark or a unique identifier for a business’s products or services, giving customers a simple means of identifying and differentiating brands. Trademarks are […]

INTRODUCTION Trademark withdrawal is a crucial aspect of the Trademarks Act, 1999, which serves as the cornerstone of trademark law in India, ensuring the protection of intellectual property rights. A trademark refers to any word, phrase, symbol, design, or combination thereof used to identify and distinguish the goods or services from one another. According to […]

A Trademark Agent is a qualified practitioner who assists both individuals and businesses with registration of trademarks along with its protection and compliance. They serve as an intermediary between applicants of trademarks and the Trade Marks Registry, providing legal and procedural assistance to the applicants to protect the intellectual property rights. Here is an article that […]

INTRODUCTION Preserving a brand’s or company’s distinguishing qualities is essential to remaining relevant in this era. In India, anyone can file for trademark registration, including individuals, start-ups, small and medium-sized businesses, and large corporations. India has five trademark offices in total, and all the states of India falls under their jurisdiction. The main duties of […]

Trademark registration in India is a mandatory process for gaining exclusive rights over a symbol, logo, or brand name in order to safeguard it against unauthorized use. Whether you are an individual business owner, a startup, or a business organization, learning the process for trademark registration in India is important to protect your brand identity. […]